As a measure to align with Québec securities legislation, Refinitiv has submitted an application to the AMF seeking exemptive relief from being recognized as an exchange. This step is an effort to rectify its regulatory compliance status.

Search Query: #refinitiv

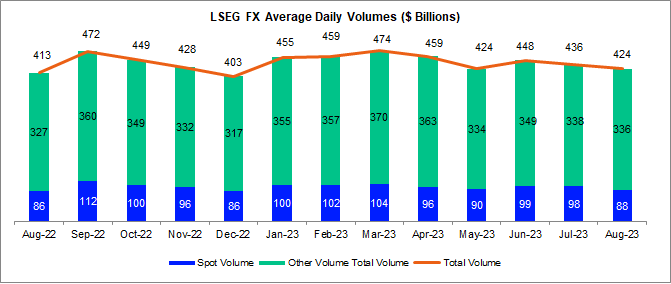

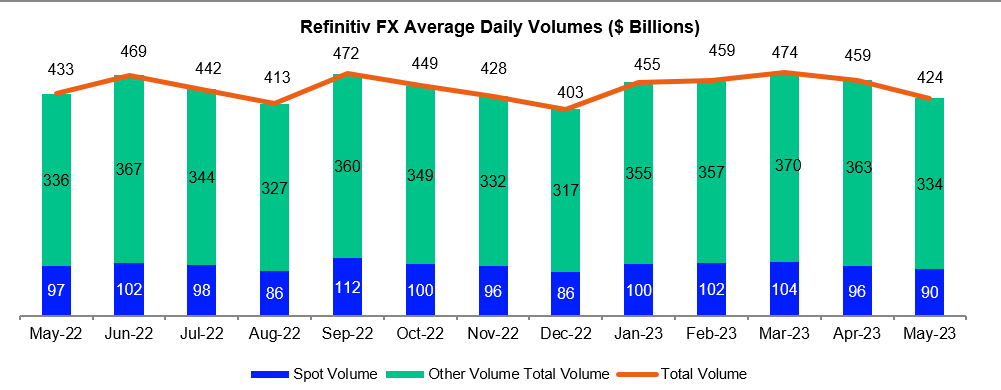

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $424 billion last month on the company’s main FX trading services.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $436 billion last month on the company’s main FX trading services.

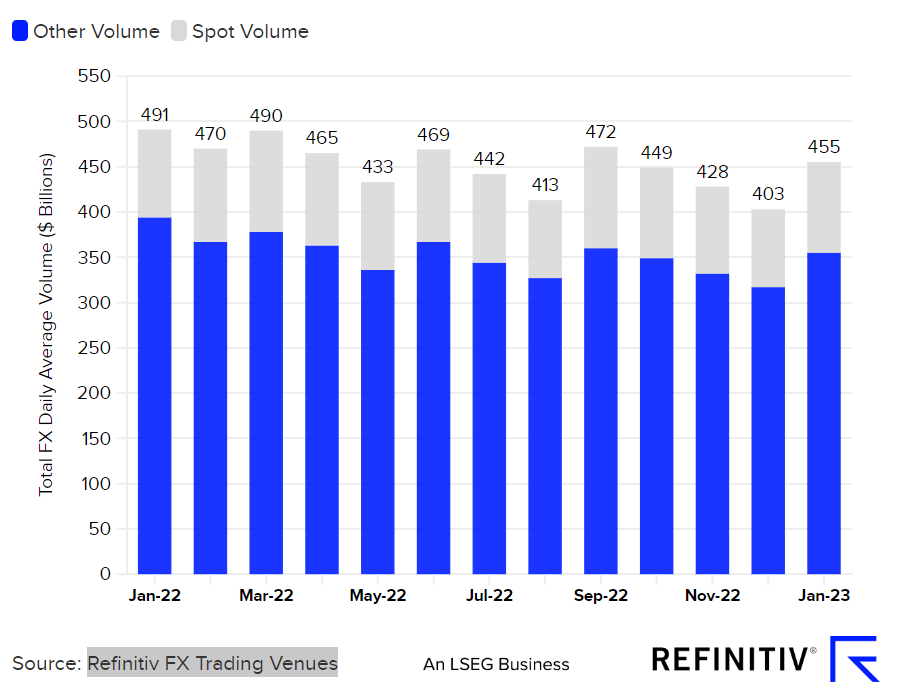

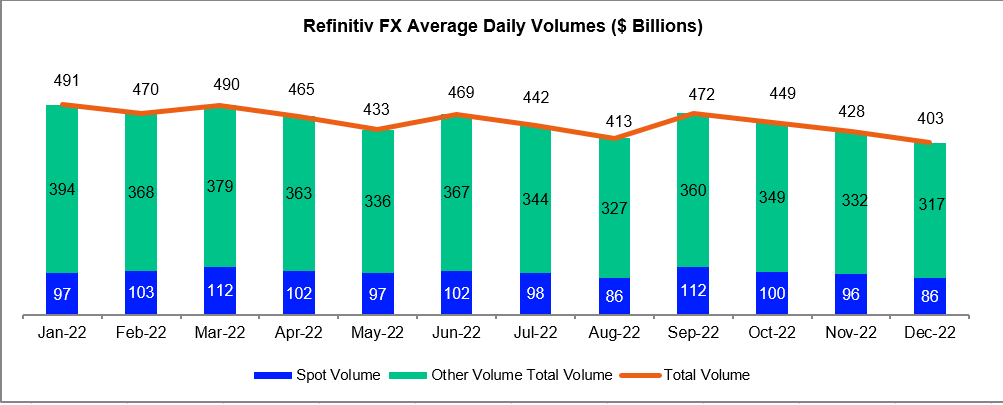

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $448 billion in June on the company’s main FX trading services. June’s ADV figure was the highest in twelve months.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $424 billion last month on the company’s main FX trading services.

“Leveraging our expertise in digital asset data and research-backed methodologies, our collaboration represents a unique value proposition that brings trusted and transparent price discovery to market participants.”

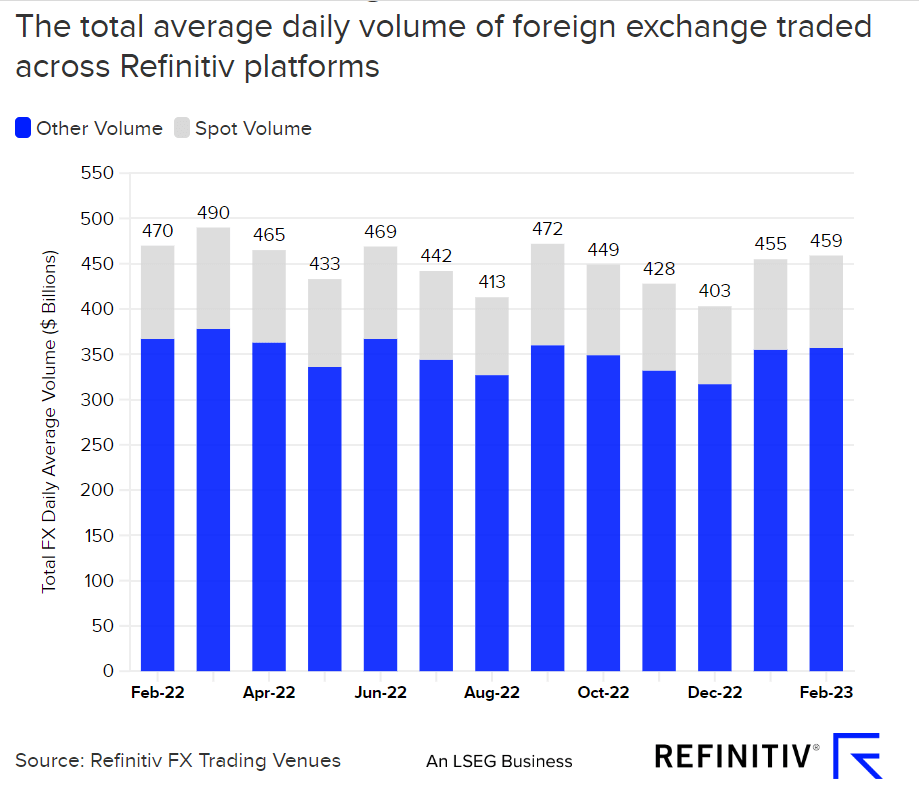

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $459 billion in April on the company’s main FX trading services.

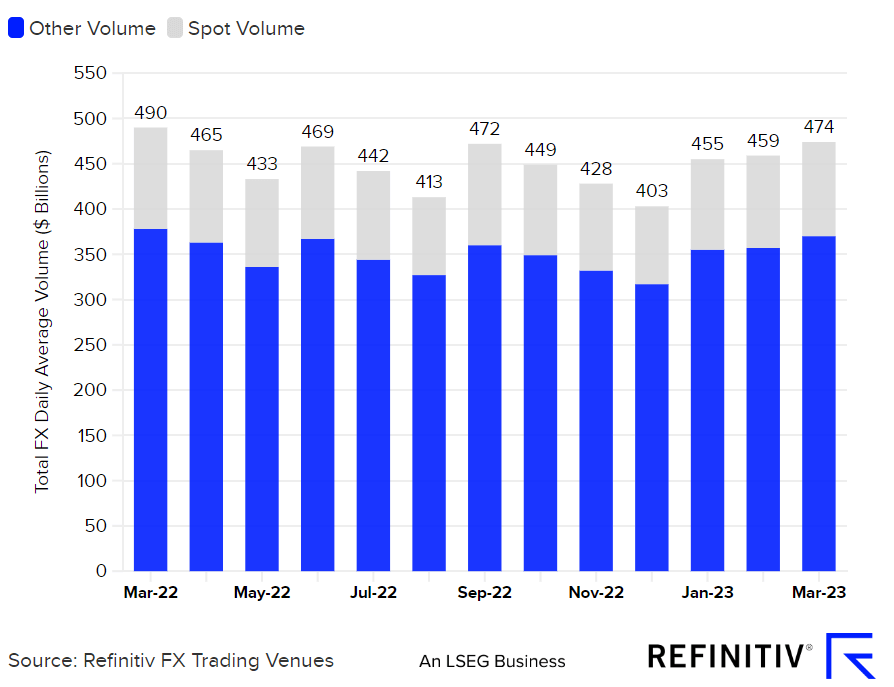

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $474 billion in March on the company’s main FX trading services. March’s ADV figure was the highest in twelve months.

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $459 billion in February on the company’s main FX trading services.

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $455 billion in January on the company’s main FX trading services.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $403 billion last month on the company’s main FX trading services.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $428 billion last month on the company’s main FX trading services.

“LSEG serves thousands of asset managers who will have to report on SFDR, and accuracy will be key – especially in the environment of high regulatory scrutiny surrounding ESG and sustainability.”

“Traders will have comprehensive ESG data at their fingertips, at no cost, at the precise moment they need to make an investment decision”.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $472 billion last month on the company’s main FX trading services.

Refinitiv has launched a digital onboarding solution to help businesses streamline their approach to onboarding customers.

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $413 billion last month on the company’s main FX trading services.

FXHedgePool is now accelerating its multi-product strategy starting with an FX Spot matching service for the WM/R benchmark. The firm believes it will reduce market impact, tracking error, cost transparency and operational inefficiencies for the buy-side, while sell-side providers can reduce exposures and monetize underutilized credit lines.

FXCubic, a trading technology provider for institutional and retail brokers, has integrated Refinitiv Elektron as a service into their ecosystem.