ACFX still owes a fortune: Asian introducers have vast balances in their trading accounts and cannot withdraw – FinanceFeeds investigation

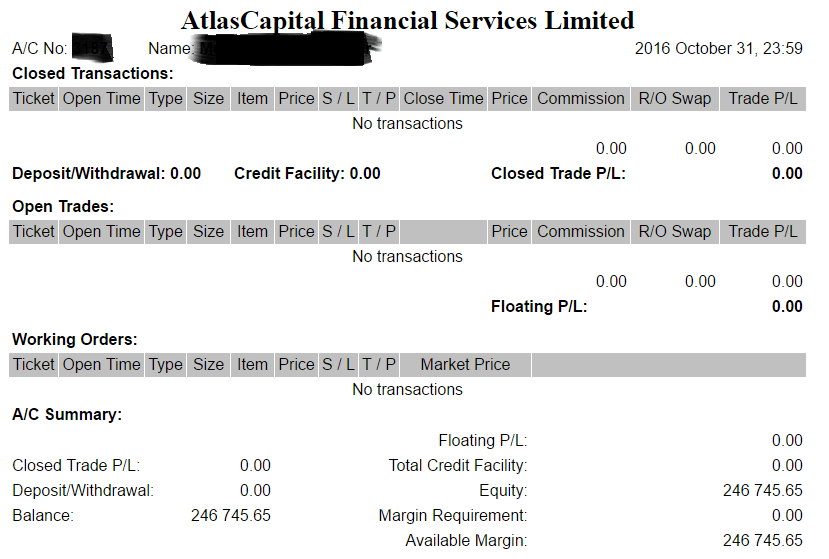

Cyprus based retail FX brokerage ACFX continues to owe withdrawals to customers, with the APAC region being one of the greatest affected. Today, an introducing broker from Malaysia showed us a statement with $246,755 in the account, however he is unable to withdraw. We take a look at the full sequence of events.

The woes for customers, strategic partners and introducing brokers of moribund retail FX brokerage ACFX continue as the firm remains blighted by withdrawal issues.

Withdrawal issues being a polite and politically correct means of stating that they are unable to get their money, or their clients money back, nor withdraw their commissions for introducing business.

Today, FinanceFeeds spoke to a large introducing broker in Kuala Lumpur, Malaysia, whose trading account shows a balance of $246,755 yet all attempts to withdraw this capital have been met with a large brick wall ever since the firm’s CySec license was suspended on April 7 this year.

Corporate and retail clients of the firm in regions across the world, ranging from the Asia Pacific to Eastern Europe have positive balances but are unable to access their funds.

The circumstances surrounding ACFX’s license suspension have been somewhat unusual. FinanceFeeds spoke to several members of former ACFX staff and customers who had explained that until April 7, they were able to operate as normal, staff having no issues with the firm, and customers able to trade normally, withdraw their profits and their IB commission where relevant.

Subsequent to the license removal, however, the entire management team except for CEO Petar Gazivoda left the company.

In speaking to this particular introducing broker in Malaysia, a full account statement was produced to FinanceFeeds showing the balance, and inability to withdraw. FinanceFeeds contacted ACFX CEO Petar Gazivoda for comment, however no reply was proffered.

Earlier this year, FinanceFeeds made an investigation into the exodus of senior staff members when the firm owes money to its clients. In asking for comment from ACFX, FinanceFeeds approached Przemyslaw Czerka, the company’s former Sales Manager, who replied “Glad to receive your message. However I won’t be able to comment at this moment as the company is still working with CySEC on this matter. Thank you and keep in touch. Best Regards, Przemyslaw.”

Former employees have come forward and explained to FinanceFeeds that there are not many members of staff remaining at the company, and that “The whole management team have now left, not just the Chief Marketing Officer.”

Another former employee explained “The management left a while ago, and regular staff have not been kept in the loop even before the suspension of the license by CySec. It is probably only Petar (CEO) who could say something relevant.”

Further research shows the parent bank of ACFX Atlas Banka in some financial strife in Montenegro. One of the reasons that the company appeared safe was the bank backbone the brokerage had.

Subsequent to the exodus of senior staff, FinanceFeeds learned that many of the former management of ACFX had been hired by LCG (formerly London Capital Group) which is a publicly listed company regulated by the FCA in Britain.

Despite the senior management having moved on to LCG, ACFX continues to owe withdrawals to a substantial number of customers, and a large group of Chinese traders have now come forward to explain that their requests for withdrawals have gone unanswered and no monies have been received.

Sources close to the matter in mainland China have explained to FinanceFeeds that approximately 100 traders are awaiting their withdrawals, with requests dating back to the middle of March this year.

One particular trader, who is also an introducing broker, explained today to FinanceFeeds “As an example, one of my accounts at ACFX has a balance of $ 12,100 and I put my withdrawal request in for this account on March 28, 2016 however absolutely no confirmation of its receipt has been sent, and there is no withdrawal.”

A further client of ACFX in China said “I know that all of the ACFX customers that I am aware of on the mainland have not received any withdrawals from ACFX. Many of my clients have explained this to me, and there are groups with several ACFX customers that have several pending withdrawal requests.”

Indeed, a litany of complaints surrounding this matter now adorn public forums, indicating that the tardiness with regard to withdrawals is no longer limited to Chinese introducing brokers and their clients, but is now widespread across many region in which ACFX conducted its business.

FinanceFeeds contacted several clients who allege that they have been affected by this, as well as made investigations into the operational structure at ACFX by contacting existing and former employees of the company.

One particular trader that we spoke to is an experienced trader who holds accounts with several brokerages in various regions, including Australia, Cyprus, UK and Belize and explained to FinanceFeeds that he has never had any issues until now.

“Things got slow with withdrawals when I won large amounts (some hundreds of thousands USD) off another Cyprus broker in August 2015, then again in January 2016. This coincided with China Black Monday and the oil price drop plus commodity currency drops. There were reports of this happening on greater scale with much bigger traders than me” said the trader

“Anyway all along I had an account manager at ACFX, Rasha Gad. It was apparently a surprise to all when on 7th April ACFX’s license got suspended by Cysec. The first thing I know is that all my trades turned “Close Only” on the Metatrader trading platform, as I was trying to roll over some of my positions at that time. I generally rolled over positions every day, but I did not use ACFX account to scalp – with very rare exceptions” he explained.

“My balance, once I had everything closed was almost $84,000, which was a significant proportion of my trading capital (and personal wealth)”

FinanceFeeds conducted some research and found the withdrawal delays in China were due to so-called instances of ‘riskless arbitrage’ which had started in approximately March. Further research showed delays in withdrawals from time to time in August 2015.

Another trader explained “My account with ACFX had been losing as I needed to to hedge various exposures in Australian Dollars and New Zealand Dollars and Turkish Lira from other investments. I also traded Euro, Swiss Francs, Yen, US Dollar and various crosses between all the mentioned currencies, long and short. I also traded just under a contract of Spot WTI Oil. I was not hedged here, it was an outright long. My account had been designated swap free since early to mid 2015.”

On July 9, FinanceFeeds received further reports from traders, one particular client of ACFX stating “I am client of ACFX, with a large sum in an account with them that I cannot withdraw, as my withdraw request is falling on deaf ears, along with thousands of others I’d say. I have written to Cysec with no response other than they are still investigating the situation.”

After the suspension of the license by CySec, members of staff were under the impression that the limiting of withdrawals could be attributed the the company wanting to resolve its regulatory matter, however this is still ongoing.

A client of the firm explained “I have emailed the ACFX back office twice to ask to process my withdrawal on top of sending the request through for withdrawal through the ACFX back office portal on about the 9th of April.”

Further research shows the parent bank of ACFX Atlas Banka in some financial strife in Montenegro. One of the reasons that the company appeared safe was the bank backbone the brokerage had.

“ACFX was a good broker before the sudden suspension” said one client. “Their conditions were pretty good in that I could obtain a swap free account – positions were able to be held 1 week before a commission of 15 USD per contract per day was applied.”

“The spreads were pretty average but their rebate structures were quite generous and they paid promptly. It appears as though their marketing department (which is the part responsible for rebate payouts and bonus payouts) were the first to resign or be terminated” explained this particular client.

According to further research, one of the account managers at the firm thinks that the company paid out millions to the Chinese clients that had found the oil arbitrage trade I mentioned above. “It was such an obvious flaw that I am so surprised that they did not pick it until too late. it means also their cfd dealing desk was very unskilled and grossly underestimated the skill of traders internationally” said a client involved in this matter.

FinanceFeeds spoke to CySec about this matter, with a representative at the regulator preferring not to comment as this still subject to an ongoing regulatory investigation by CySec.

A report in Eastern Europe also recently concluded that “A British entity is taking over the company. On the subject of recent news surrounding ACFX in Cyprus, which for several years was controlled by Mr. Knezevic, and currently risks the permanent removal of its license to be able to operate in Cyprus, began a few months ago negotiations with the more eminent of legal entities about taking over the company and overall operations.”

“The deal was reached recently with the strategic partner from Great Britain who is already in the process of performing due dilligence” continued the report.

The report stated that ACFX had been party to an interview with Cypriot regulator CYSEC following the approval for the investor to continue with the process of the takeover of the company, as well as resolve all the problems that the company faced and that led to the suspension of the license.

“The future strategic partner will form a special team that will deal with resolving the created situation” announced Atlas Group.”