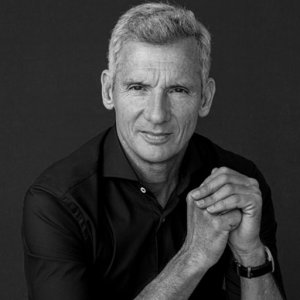

ACY Securities taps high-profile Chief Economist Clifford Bennett

From the 2000s onwards, Clifford Bennett established himself as a leader in macro-economic and financial markets thought, having written the famous “The White Crane Report”.

ACY Securities has appointed Clifford Bennett as its new Chief Economist, where he will be offering real-time global economic insights for a high-performance trading edge.

Macroeconomic analysis and forecasting are broken down into practical, bite-size market pieces that are easy to comprehend and put into trading practice.

Clifford Bennett wears 35 years of economics and market trading experience under his belt. From naval officer to senior economist in investment banking, advising the world’s largest corporations, political leaders and billionaire investors, he has covered every geopolitical and financial market moment since the mid-80s.

Having started as a Senior Currency Analyst at Macquarie Bank in 1984, based in Sydney, Mr. Bennett worked in Singapore for six years at BNP Paribas, covering Asia.

Completing his institutional career as Senior FX Strategist Asia for BNP Paribas, just as being promoted to Head of Eastern Europe and African Research in London, Clifford returned to Australia for family reasons and started his “look out the window” commonsense economics consulting business.

From the 2000s onwards, Clifford Bennett established himself as a leader in macro-economic and financial markets thought, having written the famous “The White Crane Report” aimed at countering “the fictional bearish end of world nonsense most banks, brokers, and the media, were pushing for the first five years of one of the most rewarding bull markets in history” in the post-2008 financial crisis.

He has also authored brushTURKEY and Warrior Trading. Bloomberg New York labeled him, “the world’s most accurate currency forecaster”. He has appeared numerous times in the global print and television media, such as the Financial Times, CNBC, Bloomberg, ABC and AFR.

Mr. Bennett has been delivering his services to leading business figures around the world, clients in 27 countries and becoming a regular international key note speaker at global economic conferences from Rome to Miami.

On the appointment with ACY Securities, Mr. Bennett said on LinkedIn: “Very excited to become a member of the outstanding team at ACY Securities! Everyone come and join us and become a client and enjoy research and vision unmatched in the Australian market place. Moving strongly across the region and globally!”

Earlier this year, ACY Securities picked Ashley Jessen as its new Chief Operating Officer. He first joined the company as Head of Marketing. In a time where image and brand positioning are key factors in a successful financial services business, it comes as no surprise to see the marketing expert occupying the COO post.

According to Jessen, what he found most impressive with the firm since he joined in 2019, is “their focus on developing cutting-edge FinTech products to build more engagement among traders around the world”.

It was in 2019 that ACY Securities rebranded from ACY Capital following the acquisition of Synergy FX, which took place in H2 2018. In the follow-up to the rebranding, the retail CFD broker rolled out a new MT5 trading platform, securities trading, a new client portal, and a new MAM System.