After shelving plans to move to Hong Kong, HSBC accused of ‘doing down the Pound’ as bank turns pro-EU

Whilst popular opinion among Britain’s businesses and financial institutions looks very favorably at a ‘Brexit’ – the acronym for a British exit from its membership of the European Union, the metaphorical finger has been pointed at HSBC for what has been perceived as the bank’s ‘doing down the Pound.’ HSBC Holdings plc (LON:HSBA), which declared […]

Whilst popular opinion among Britain’s businesses and financial institutions looks very favorably at a ‘Brexit’ – the acronym for a British exit from its membership of the European Union, the metaphorical finger has been pointed at HSBC for what has been perceived as the bank’s ‘doing down the Pound.’

HSBC Holdings plc (LON:HSBA), which declared recently that it would keep its head office in London, putting and end to the board-level consideration as to whether to move its operations to Hong Kong as a result of positive third-quarter results which were up 32%.

The fourth quarter demonstrated a downturn in fortunes, in line with many other interbank FX dealers which have made substantial losses over the course of the last year, the end result for HSBC having been a very lackluster 2015 indeed.

Today, the bank has made a public claim that an exit from the European Union by Britain would be ‘disastrous for the economy’ and that the ‘Pound could sink to its lowest level since the 1980s.’

Whilst many firms in the industry have remained apolitical but have demonstrated a preference toward Britain’s independence from the EU, some of London’s most prominent figures have made their perspectives clear, an example being CMC Markets founder & CEO Peter Cruddas, a former Conservative Party treasurer, who donated £1 million to the ‘Brexit’ campaign, Vote Leave.

The Pound languishes at 1.39 to the dollar, which is its lowest value in the post-financial crisis era, however it could be worth considering that confidence is low not because of fear of exit from the EU, but rather the economic burden and restrictive business factors that could ensue if Britain remains part of the flagging European Union.

During the later months of last year, Japanese electronic trading giant MONEX Group issued a report stating that the USD would be the currency of 2016, a prediction that appears to be indeed correct because the USD is isolated from the geopolitical uncertainty in Europe, therefore is a good base from which to trade the volatile euro and pound.

CEO of the Vote Leave campaign Matthew Elliot yesterday made his opinion clear with regard to pro-euro sentiment such as that voiced by HSBC. “Those who wish to remain in the EU at all costs should stop doing down the pound” he said.

Neil Woodford CBE, one of the country’s most successful fund managers spoke out yesterday by expressing his opinion to the BBC that “ECB chief Mario Draghi is printing money and trying to do his bit, but the macro headwinds are intense and unemployment remains high. It is these problems that a UK exit could shine a brighter light on.”

Mr. Woodford, whose company Woodford Investment Management has over £14 billion in assets under management, stated that “There is no economic case either for the UK to stay in or to leave the EU, and any argument based on economics has no merit.”

Analysts at HSBC have stated that the pound could fall by another 20% after Brexit, taking it to around $1.11 which would take it down to its lowest valuation in 31 years.

In a report by HSBC Chief UK Economist Simon Wells, it was stated that “Following a vote to leave, we think uncertainty could grip the UK economy, triggering a potential slowdown and a collapse in sterling.”

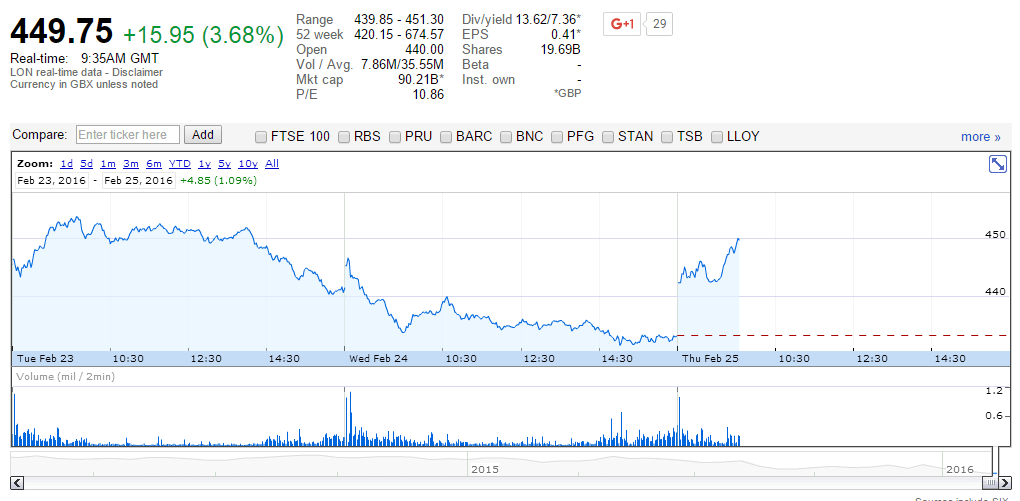

Interestingly, the combination of the bank’s dip in fortunes, accusations of nepotism in Asia, and now its pro-EU stance, HSBC’s share price has increased by a remarkable 3.41% today, representing a spike after a prolonged downturn in the value of company stock.

HSBC has the largest market share for corporate clients in the global interbank FX sector, edging into pole position for the first time in the 39 years during which Citi has dominated. The company’s low results during 2015 caused it to reinstate a pay freeze last week, in which senior executives will not receive increases in remuneration for the entirety of 2016.