In this age of censorship lunacy, your online presence and PR will never be the same again

We lift the lid on an odious policy by a major PR provider. It is imperative that all FX and CFD firms read this carefully.

The first step was to remove liberties and livelihoods, and the second step is censorship.

This is the method by which illiberal powers that be erode free enterprise and control the minds of the entrepreneurial.

Back in March, a number of members of society (myself excluded – Ed) actually believed in the initiative by world governments that locking the world down was somehow in the best interests of the unsuspecting and uninitiated global population.

Here we are, eight months later, almost the time in which it takes for a human being to come into the world, and the attempts to curtail business, personal activity, social activity, and – well – normal behavior are still in full swing.

Naturally, as an inquisitive and intelligent species, hundreds of millions of people are now beginning to understand that control to this extent is unpalatable at best, and has questionable motives at worst, so in order to maintain it, governments are now stepping up their propaganda efforts.

However, it is not just governments that are doing so, but privately owned media and PR entities, which are resorting to censorship on a very extensive scale in order to ensure that they toe the party line.

The FX and CFD industry has done well during the past few months, and our collective commitment to innovation, hard working diligence and ingenuity has led the electronic trading sector to prosperity, especially given the efficiency of modern trading platforms and their respective brokerages, in providing easy and good quality access to global currency, stock and equities markets during the times at which many people are working from home, or have to search for another form of income at a time during which many have lost their jobs and new jobs aren’t plentiful.

Additionally, the extra volatility caused by this year’s extremely unusual circumstances has stirred tremendous interest among retail traders, so existing client bases of brokerages have traded at high volumes, and in some cases record volumes.

Of course, this is all great news for the FX industry, however whilst activity is up, and many FX firms have spoken to FinanceFeeds over the past few months stating that they have never been busier. My colleagues here in Canary Wharf are working flat out from early morning until late at night to cope with the extra business that is being processed.

Yes, it is boom time for the FX industry, but very much a disaster for pretty much every other industry sector worldwide, with no end in sight.

What, it is feasible to ask, does a firm do in order to capitalize on the demand for FX trading and gain more customers?

The usual method is to channel some of the profit into marketing in order to bring on board new clients whilst there is good revenue. This way, the marketing spend can be increased, and new types of client demographic onboarded without making any dent in expected income.

Similarly, it is also prudent to approach new channels, and develop new asset classes or products for new audiences in order to appeal to a different sector of society, thus making your brokerage more sustainable in future.

These are sensible, normal methods of expanding a business during a time of good revenue generation.

The question is, how? Traditionally, being an online business sector, FX and CFD companies, along with their relative technology vendors, liquidity providers and platform integration firms would meet at conferences, an extremely popular point in the annual calendar of all FX firms pioneered almost ten years ago by Finance Magnates (known at that time as Forex Magnates) and followed by many other entities since.

These industry conferences have been viewed by the entire industry globally from Tier 1 banks to global exchanges like CME Group, all the way through all brokerages and payment firms, platform companies as absolutely essential, and have brought every component of the entire industry together so that they all now know each other personally, whereas formerly they were separate online entities.

However, these events are no longer allowed which is a travesty.

Thus, electronic trading firms, which need to get their presence known, need to step up their digital remit once again, because it is an online world only now.

How? I hear you ask. Well, the traditional PR method has now fallen into the hands of the censors.

Not only are all social media and business news sites censored in case any content doesn’t toe the new pro-lockdown, pro-Covid line, but PR sites that brokerages actually pay a lot of money for are now censoring content.

PRNewsWire, owned by Cision, which is a well known and widely read PR aggregation site used by all industry sectors and is hugely popular with companies across all aspects of the FX industry, has issued a notice on its site detailing its ‘policy’ if it can be called that.

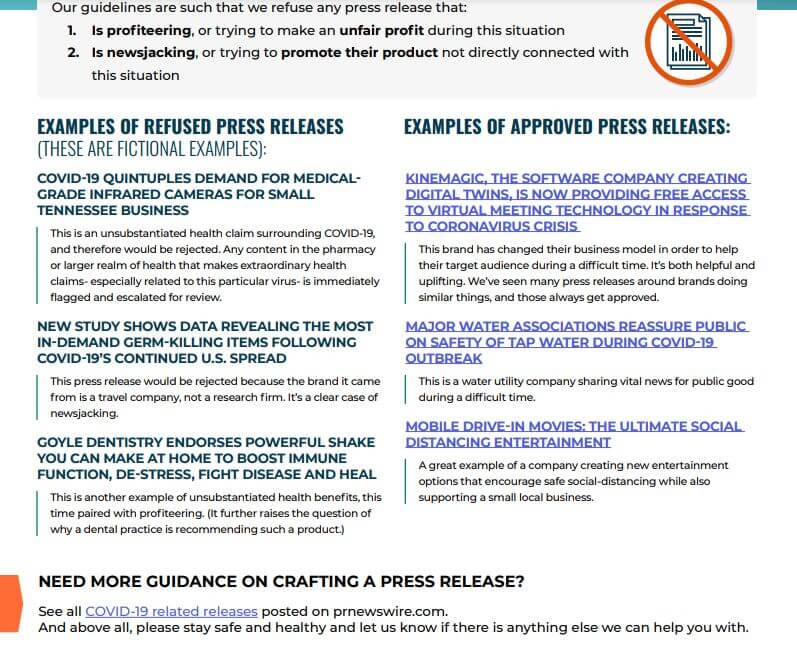

Under the ominous title of “How to Ensure Your COVID-19 Press Release Gets Published”, it says “Crafting an engaging press release that stands out is challenging in the best of times, not to mention during a time of great uncertainty with a news cycle that changes by the minute. Releases need to be extra-sensitive and thoughtful in the time of COVID-19, and we at Cision wanted to lend some guidance to help ensure that any COVID-19 related press release meets the PR Newswire guidelines.”

There is a document available for download which details all of this in full, however here are the important points:

If this is to be taken seriously, it gives a clear impression that any PRs submitted to the internet and indexed in search engines via the PRNewsWire site will not be published if they have titles such as “Our brokerage experiences great increases in revenue during Covid” for example, as that comes under their absurd rule of “newsjacking” which really means not following the narrative of the totalitarians in government.

Another example would be perhaps “Multi-asset brokerage offers access to derivatives for extra income during Covid/pandemic/situation (or whatever anyone wants to call it these days)” as this would be attempting to “attempting to make an unfair profit from this situation” – even they are using the marketing spin we have all heard from governments in calling it a ‘situation’. I would call it the waste product which emanates from the alimentary canal of the male of the bovine species.

For brokers or media entities wishing to promote their online webinars to clients, or business-to-business online seminars, that’s out too. “Join our Zoom in which panels will discuss how to move your brokerage forward in the times of Coronavirus” which is a very popular panel discussion on every single Zoom conference I have attended lately – and I have attended a lot – is out of the question according to PRNewsWire’s criteria.

You cannot talk about volatility due to big pharma stock rises, you cannot promote services aimed to help people wishing to trade during these times and you cannot publish quarterly results which attribute any rises in revenue or volatility to the current ‘situation’ if we really must call it that.

The more you read into the ‘rules’ set out by this censorship, the less you can write about your company’s innovations, new products and adaptability to the new method of doing business that we have all been forced into by anti-business, pro-lockdown, censorship-happy authorities in Western nations.

PRNewsWire charges an absolute fortune for even the smallest of PR. It is not in my personal remit to advise anyone to part with money to place PR on any media site, I believe in freedom and free enterprise. The more the merrier.

However, if this is how the good customers of a site which is supposed to provide a service to help them promote their products are treated, it may be time to look elsewhere…. until they are censored too.

FinanceFeeds maintains an absolute commitment to freedom of information, to uncovering important matters of public and commercial interest within the electronic trading industry, to assisting all areas of the FX industry to provide detailed editorial to reach their potential commercial or retail clients and absolutely promise that we will never implement censorship of any kind.

That way, transparency is upheld, business can be conducted without barriers, and the most important news and developments within our industry are documented for the greater good of all its participants.

Open dialog and open publication is vital to online industries such as ours.