Ally Financial incurs net loss of $319m in Q1 2020

The loss was blamed on higher provision for loan losses due to reserve build driven by forecasted changes associated with the COVID-19 pandemic as well as the decline in the fair value of equity securities.

US financial services provider Ally Financial Inc (NYSE:ALLY) today reported its financial results for the first quarter of 2020.

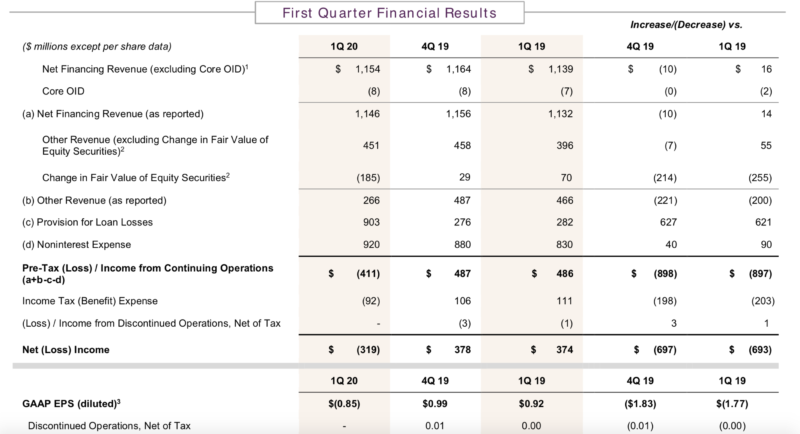

Net loss attributable to common shareholders was $319 million in the first quarter of 2020, compared to net income attributable to common shareholders of $374 million in the first quarter of 2019. The loss reflected higher provision for loan losses due to reserve build driven by forecasted macroeconomic changes associated with the COVID-19 pandemic as well as the decline in the fair value of equity securities given the overall decline in equity markets in March.

Ally saw net financing revenue improve to $1.15 billion, up $14 million from the year-ago quarter, driven by higher retail auto portfolio yield and balance as well as liability mix shift, partially offset by lower commercial auto balance and portfolio yield. Net financing revenue was $10 million lower quarter-over-quarter, largely due to lower retail auto portfolio yield.

Other revenue decreased $200 million year-over-year, with the decrease attributed to a $185 million decline in the fair value of equity securities in the quarter compared to a $70 million increase in the fair value of equity securities in the prior-year quarter. Other revenue, excluding the change in fair value of equity securities, increased $55 million year-over-year, due primarily to higher realized investment gains.

Net interest margin (NIM) for the first quarter of 2020 was 2.66%, including Core OIDB of 2 bps, down 1 bp year-over-year. Excluding Core OIDB, NIM was 2.68%, down 1 bp versus the prior-year period, and up 2 bps versus the prior quarter.

Provision for loan losses increased $621 million year-over-year to $903 million due to reserve build, mostly reflecting forecasted macroeconomic changes associated with the COVID-19 pandemic.

Noninterest expense increased $90 million year-over-year, as a result of technology spend supporting business initiatives, higher insurance expenses directly linked to higher earned premiums and the addition of Ally Lending in the fourth quarter of 2019.

Ally paid a $0.19 per share quarterly common dividend and completed $104 million of share repurchases in the first quarter, including shares withheld to cover income taxes owed by participants related to share-based incentive plans. On March 17, 2020, Ally announced that it was suspending share repurchases through the second quarter of 2020 in support of the Federal Reserve’s effort to mitigate the impact of the COVID-19 pandemic on the U.S. economy and the financial system. Ally’s Board of Directors approved a $0.19 per share common dividend for the second quarter of 2020.