Ally Financial reports net income of $241m in Q2 2020

Lower net financing revenue, higher provision for credit losses, higher noninterest expense and higher income tax expense affected Ally’s earnings in the second quarter of 2020.

US financial services provider Ally Financial Inc (NYSE:ALLY) today published its financial results for the second quarter of 2020, with net income sharply down from the equivalent period a year earlier.

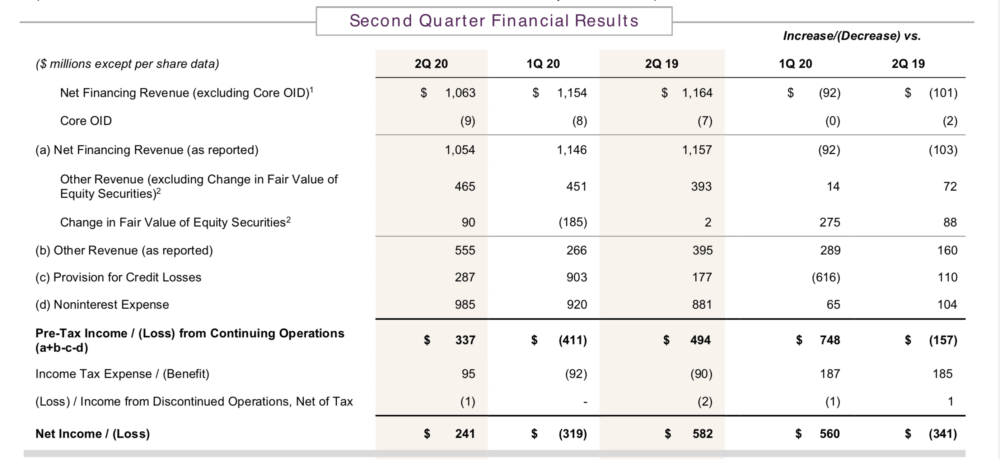

Net income attributable to common shareholders amounted to $241 million in the second quarter of 2020, compared to net income attributable to common shareholders of $582 million in the second quarter of 2019, as lower net financing revenue, higher provision for credit losses, higher noninterest expense and higher income tax expense more than offset higher other revenue.

Income tax expense was $185 million higher year-over-year, primarily as a result of a discrete tax benefit of $201 million from valuation allowance release on foreign tax credit carryforwards in the prior year quarter.

Net financing revenue was $1.05 billion, down $103 million year over year, driven by lower commercial auto balance and portfolio yield, losses on off-lease vehicles, higher mortgage premium amortization and higher consolidated liquidity levels, partially offset by higher retail portfolio yield.

Other revenue increased $160 million year-over-year to $555 million, including a $90 million increase in the fair value of equity securities in the quarter compared to a $2 million increase in the fair value of equity securities in the prior-year quarter. Other revenue, excluding the change in fair value of equity securities, increased $72 million year-over-year to $465 million, primarily thanks to higher realized investment gains.

Net interest margin (“NIM”) of 2.40%, including Core OIDB of 2 bps, decreased 26 bps year-over-year. Excluding Core OIDB, NIM was 2.42%, down 25 bps versus the prior year period, due to elevated liquidity levels, losses on off-lease vehicles and mortgage premium amortization.

Provision for credit losses increased $110 million year-over-year to $287 million due to COVID-19 reserve build driven by macroeconomic variables.

Noninterest expense increased $104 million year-over-year, primarily driven by a $50 million goodwill impairment at Ally Invest, higher weather- related losses, technology spend supporting business initiatives and the addition of Ally Lending in the fourth quarter of 2019.

Ally Chief Executive Officer Jeffrey Brown commented on the performance in the second quarter of 2020:

“Ally Bank had the strongest quarterly retail deposit growth ever, adding $9.7 billion of balances, while adding 94 thousand new customers. Our resilient and adaptable auto finance business saw meaningful improvement toward the end of the quarter, delivering $7.2 billion of consumer originations, and maintaining estimated retail auto originated yields1 above 7% for the ninth consecutive quarter, a tremendous accomplishment given the low interest rate environment”.

“During the second quarter, we proactively suspended share repurchases through the end of 2020 given the evolving macroeconomic picture. We believe this was in the best interests of our stakeholders as we preserve capital and ensure we remain able to serve as a source of strength for our customers. Moving forward, we will continue to rigorously assess capital deployment actions, with an ongoing focus on growing and diversifying our businesses while thoughtfully returning capital to shareholders”, Mr Brown added.

Ally’s Board of Directors approved a $0.19 per share common dividend for the third quarter of 2020.