Ally Invest, rebranded from TradeKing, sees accounts, cash balances grow Y/Y in Q2 2017

Ally Invest has contributed to the rise of “Corporate and other” revenues of Ally Financial in the second quarter of 2017.

In early May this year, US financial services provider Ally Financial Inc (NYSE:ALLY) rebranded brokerage TradeKing, which it acquired in June 2016 in a $275 million deal. As a result of the change, TradeKing became Ally Invest, and Ally Financial got a chance to markedly expand its product offering.

Today, Ally Financial reported its financial results for the second quarter of 2017, with our attention focused on any information the Group may provide on Ally Invest.

Ally Invest’s results are integrated in “Other” revenues. Other revenue increased $14 million year-over-year on the back of “favorable gains on asset sales and contributions from the Corporate Finance and Ally Invest businesses”, according to the earnings report.

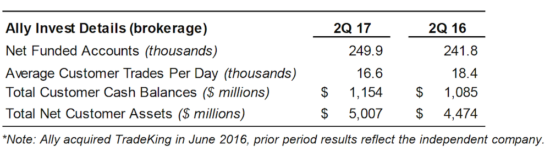

The number of net funded accounts grew to 249,900 in the second quarter of 2017, compared to 241,800 in the equivalent period in 2016. Total customer cash balances and net customer assets also showed a rise in annual terms, whereas the average customer trades per day staged a drop to 16,600 against 18,400 a year earlier.

Following the rebranding, TradeKing’s securities products and services are now offered through Ally Invest Securities LLC. Advisory products and services are offered now through Ally Invest Advisors, Inc.

Forex products and services are offered through Ally Invest Forex LLC, an introducing broker to GAIN Capital Group. These Forex accounts are held and maintained at GAIN. Traders retain access to the ForexTrader and MT4 platforms, as well as research & analysis tools.

Futures trading services are provided by Ally Invest Futures LLC.

MBTrading, which was acquired by TradeKing in August 2015, now has a redesigned website displaying the following message: “Ally Invest Now Owns MB Trading. We’ve recently acquired MB Trading, and we’re working to combine our products and services. In the meantime, you can still open an MB Trading account”.

In June, in a move seen as the last step in TradeKing’s integration into Ally, TradeKing’s Trader Network was closed, with traders offered to make use of Ally’s community instead.