Alpari starts accepting payments via UK-registered Al Accept Solutions, controlled by Dashin

Al Accept Solutions has four Alpari entities amid its initial shareholders and Andrey Dashin as a sole person with significant control.

The dynamics of the Forex industry and its ability to reshape itself no matter what have always been impressive. Another piece of proof comes from the UK, where a number of Alpari entities have set up a business involved in processing of client payments – the business was established about nine months after retail FX broker Alpari UK Limited filed for special administration. Effective March 23, 2017, Alpari has changed several of its documents so that acceptance of payments made by company clients is possible via UK-based Al Accept Solutions Limited.

Two of Alpari Group’s entities – Alpari Limited (St Vincent and the Grenadines) and Alpari Limited (Belize) have amended their client agreements by adding the following clause:

“Acceptance of payments by clients of the Company by means of international card payment systems can also be carried out by official partners of the Company, information about which is provided in the Regulations for Non-trading Operations and in myAlpari”.

Under the amended Regulations for Non-Trading Operations, the following article is added:

“Acceptance of payments by clients of the Company through myAlpari by means of international card payment systems are carried out by official partners of the Company”.

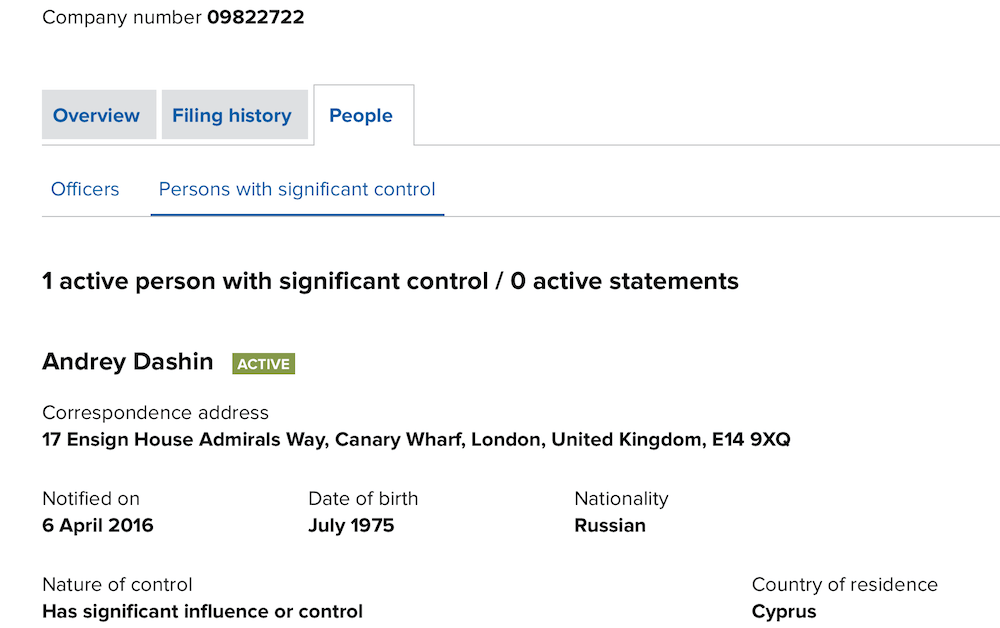

A note explains that these official partners include: Al Accept Solutions, with registered address at 17 Ensign House, Admirals Way, Canary Wharf, London, UK.

The UK Companies House service shows that Al Accept Solutions Limited was incorporated on October 13, 2015 and currently has the following address: 17 Ensign House, Admirals Way, Canary Wharf, London, United Kingdom, E14 9XQ. The nature of the business is 96090 – Other service activities not elsewhere classified.

The document of the incorporation of Al Accept Solutions is dated October 2015, which means the company was set up some 9 months after the “Black Swan” events of January 2015 that led to the demise of retail FX broker Alpari UK Limited.

The list of initial shareholders of Al Accept Solutions include:

- Alpari International Limited (Mauritius);

- Alpari Limited (St Vincent and the Grenadines);

- Alpari Limited (Belize);

- Alpari Ltd (Bermuda).

More interestingly, the company has one person with significant control (PSC) – Andrey Dashin, as per Confirmation Statement made in October 2016.

Al Accept Solutions has two current officers: Vistra Registrats (UK) Limited and Roberto D’Ambrosio. The latter is director at Al Accept Solutions and director at Alpari Research & Analysis Limited (09822850). The nature of business of Alpari Research & Analysis Limited is officially described as “market research and public opinion polling”, whereas the company has the same address as Al Accept Solutions.

FinanceFeeds has underlined numerous times the importance of payment services processors for FX companies. Of course, the regulatory oversight of PSPs is crucial. For that matter, it is worth recalling how in October last year, the UK Financial Conduct Authority (FCA) raised eyebrows by announcing that PacNet Services Ltd and UK Counting House Ltd, two firms within the PacNet Group, are authorized by the UK authorities. This announcement flew in the face of US regulatory findings that PacNet Group is a criminal organization.