Amid massive losses and plunging share prices, Deutsche Bank CEO and German finance minister say “Don’t panic!”

German banking institution Deutsche Bank AG (FRA:DBK) has suffered tremendous losses over recent months, a matter that has now become a focus of attention at central government level. Back in October 2015, FinanceFeeds first reported way ahead of the mainstream media that the interbank FX giant had estimated a third quarter loss of £4.4 billion, […]

German banking institution Deutsche Bank AG (FRA:DBK) has suffered tremendous losses over recent months, a matter that has now become a focus of attention at central government level.

Back in October 2015, FinanceFeeds first reported way ahead of the mainstream media that the interbank FX giant had estimated a third quarter loss of £4.4 billion, with sentiment from within the FX industry, especially surrounding the circumstance in which the loss of approximately 5.8 billion Euro was contrary to the forecast of 1 billion Euro profit.

Deutsche Bank is the second largest interbank FX dealer in the world with 14.54% of global market share in 2015.

Now, just four months on, the true gravity of this situation is coming home to roost as Germany’s finance minister Wolfgang Schaeuble has publicly declared his perspective on Deutsche Bank’s current situation.

“No, I have no concerns about Deutsche Bank,” Mr. Schaeuble told Bloomberg Television in Paris after a meeting of French and German finance chiefs today.

Whilst making this statement which attempts to boost confidence, Mr. Schaeuble did not provide any figures or forecast with regard to how Deutsche Bank is likely to recover from its plummeting position, nor was any information regarding rising investor concern over the bank’s finances and collapsing share prices proffered.

Deutsche Bank’s CEO John Cryan has issed a memo to employees as a further attempt to boost confidence, stating that the bank is “rock solid” and has a “strong” capital and risk position, and iterated that the bank “took advantages of its capacity and commitment to pay coupons to investors.”

Such statements, made at such senior level resemble those made by certain now-defunct retail FX firms at the time of the Swiss National Bank’s removal of the 1.20 peg on January 15 last year. Some of the firms that declared strong capital positions in the aftermath of that particular black swan event indeed did not survive the losses that they were exposed to, despite votes of confidence by senior officials within said firms.

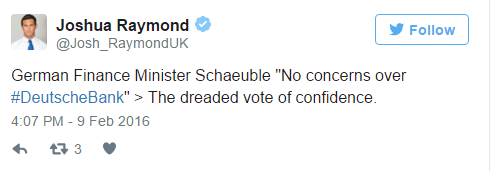

These statement made by Germany’s finance minister and Deutsche Bank’s CEo have caught the attention of certain professionals within the FX industry.

Today, former City Index Marketing Director Joshua Raymond, who recently moved to XTB to become CMO tweeted the following:

Back in October, Paul Orford, VP Business Development at TopFX explained to FinanceFeeds:

“One piece of news that has quietly slipped under the radar of the mainstream media has been the late night announcement that has left analysts aghast. Deutsche Bank, which is Germanys largest lender are reporting staggering potential losses of 6 BN Euro for the 3rd quarter”

“Insiders within the company have blamed huge impairment charges of around 5.8BN Euro for the unexpected loses they are looking to incur. Having gone from a forecasts of 1 BN Euro profit, this is seen as another piece of catastrophic news for Germany following the Volkswagen crisis” he continued.

“Having already having to set aside around 1.2 BN Euro to cover the Libor scandal, with further investigations to come in Switzerland for suspected price fixing in the precious metals market, it has not been a great year for the bank” – Paul Orford

Mr. Orford concluded by asking “With news like this, where does that leave the other banks? What are their balance sheets like? As we all understand from the previous crash the main problem was and still is contagion. If one of the global behemoths which are deemed ‘too big to fail’ banks goes down or becomes distressed, will we see crisis v2.0 on the horizon?”

Today, with share prices down a further 1.1% to 13.49 EUR, it appears that the fiscal woes are coming home to roost.