Applying big data to risk management: Big Data is the ‘Game-Changer’ a comprehensive insight – Part 2

Part 2 of our Applying Big Data to Risk Management series. Click here for the full series. This is a guest research article by Kieron Yorke, Director of Financial Sales Services at SinusIridum Risk management faces new demands and challenges. In response to the crisis, regulators are requiring more detailed data and increasingly sophisticated reports. Banks are expected […]

Part 2 of our Applying Big Data to Risk Management series. Click here for the full series.

This is a guest research article by Kieron Yorke, Director of Financial Sales Services at SinusIridum

Risk management faces new demands and challenges. In response to the crisis, regulators are requiring more detailed data and increasingly sophisticated reports. Banks are expected to conduct regular and comprehensive bottom-up stress tests for a number of scenarios across all asset classes.

Recent, highly publicised ‘rogue trader’ and money- laundering scandals have prompted further industry calls for improved risk monitoring and modelling.

Big Data technologies present fresh opportunities to address these challenges. Vast, comprehensive and near real-time data has the potential to improve monitoring of risk (while reducing noise-to-signal ratios), risk coverage, and the stability and predictive power of risk models.

In a number of key domains – particularly operational and compliance risk – Big Data technologies will allow the development of models that will support everyday Risk Officer decision-making. Able to process enormous amounts of data in fast timeframes, the technologies can also accommodate new requirements for scenario stress tests at the trade, counter-party and portfolio levels.

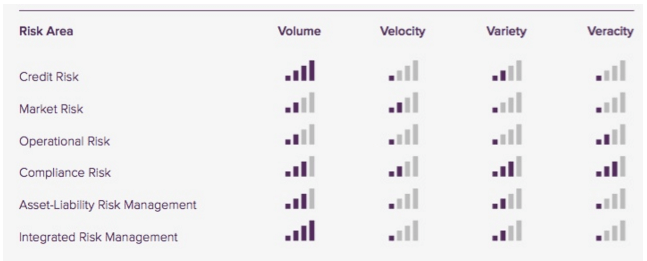

The majority of benefits – and challenges – offered by Big Data stem from its massive volume and variety (Fig 1 Below). However, different risk domains stand to benefit from Big Data technologies in diverse ways.

Big Data can be targeted to an organisation’s particular needs – whether they are for greater volume, variety, velocity or veracity – and strategically applied to enhance different risk domains.

Post-crisis, financial institutions are now expected to have thorough knowledge of their clients. Increasingly, forward-thinking banks – for example – will harness Big Data to develop more robust predictive indicators in the credit risk domain.

New data sources – including social media and marketing databases – can be used to gain greater visibility into customer behaviour. These sources can reveal startling information: a costly divorce, an expensive purchase, a gambling problem.

Drawn from data lakes, this information can augment traditional data sources including financial, socio-demographic, internal payments and externals loss data. Together, the datasets can produce a highly robust, comprehensive risk indicator.

Rather than waiting to review loan clients’ financial reports to discover loan-servicing problems, firms can utilise Big Data technologies to detect early warning signals by observing clients’ on-going behaviours, and act in time.