As Tradable launches TradingView charting app, CEO Jannick Malling exclusively details its raison d’etre

The charting and analytical tools that are available to traders are becoming increasingly advanced as retail FX traders become ever more discerning. From ergonomics to functionality, the way that retail trading platforms provide instrumental data to end users is now as competitive as the platform market itself. Application-based trading platform development company Tradable has today […]

The charting and analytical tools that are available to traders are becoming increasingly advanced as retail FX traders become ever more discerning.

From ergonomics to functionality, the way that retail trading platforms provide instrumental data to end users is now as competitive as the platform market itself.

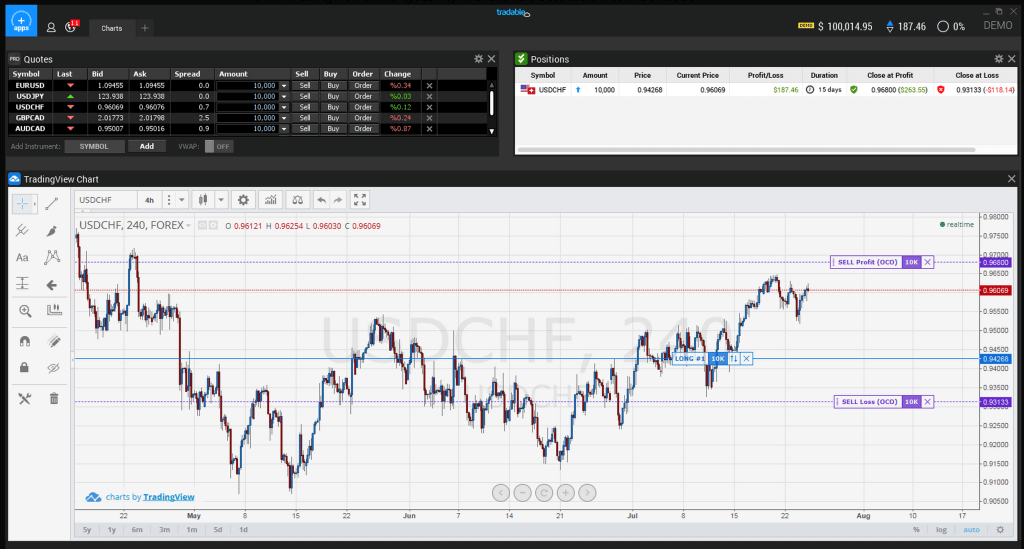

Application-based trading platform development company Tradable has today launched its own system which allows traders to manage trades directly.

Launched today under the name of TradingView, it enhances the cause of the way that traders interact with the market.

Stan Bokov, Co-Founder and COO, TradingView made a commercial statement today on the launch of the new charting application

Tradable is an innovative company which aims to radically improve the trading experience. It enables traders to build their own dashboard based on apps, which they find most useful and we are delighted to be a part of that.

FinanceFeeds exclusively spoke to Jannick Malling, CEO of Tradable today in order to further investigate the rationale behind TradingView.

How will the in-house designed TradingView app integrate with opensource apps designed by users that are intended to provide high-level charting facilities?

The app is integrated in a way that orders and positions executed on other apps in the Tradable Platform can be viewed and modified on the TradingView chart and vice versa.

How does Tradable position this particular charting app against its rivals from other FX software vendors as well as individual developers, and what is its unique value proposition?

TradingView has built in a community as part of their offering. This enables TradingView to support traders in a different way supporting traders looking to share and engage in trading ideas as the happen. It’s adds something different to a certain type of retail trader.

Tradable is aimed at the technologically advanced user, who wishes to code apps. An off-the-shelf charting feature is effectively plug and play. Which traders is this aimed at?

First the Tradable desktop platform is not only for the trader who has an ambition to code apps for themselves. Most of our users are traders who are looking for choice to support their particular way of trading. By personalizing the trading experience the traders can make certain aspects of their trading life smarter, more convenient and productive.