ASIC approved 339 new AFS licenses in FY 2020-21

The financial watchdog also stated that it was able to finalise 50% of AFS licence applications within 93 days, 70% within 145 days and 90% within 251 days.

ASIC has revealed in its “Licensing and professional registration activities: 2021 update” that between July 2020 and June 2021, the financial watchdog in Australia has approved 339 new AFS licenses for financial services firms.

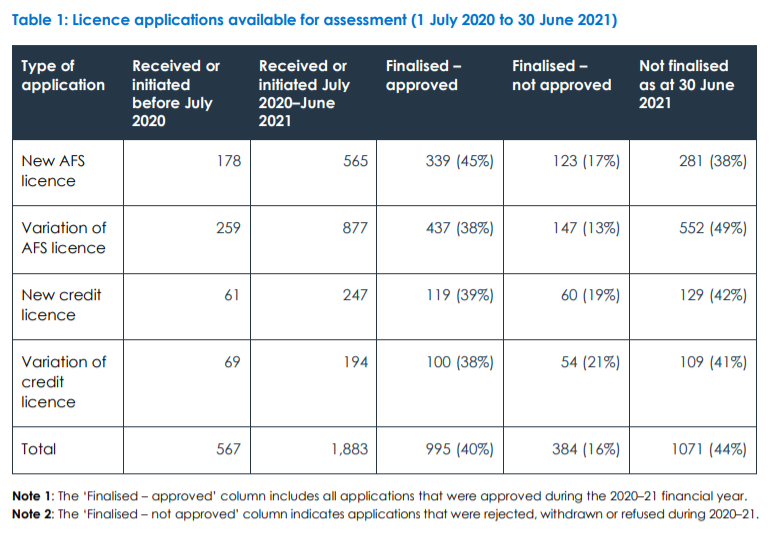

In that period, ASIC received 1,883 Australian financial services licence (AFSL) and Australian credit licence (ACL) applications. This is a significant increase from 1,346 of the previous year and can be explained by the licensing reforms relating to insurance claims handling and debt management services.

The regulator added that it approved 458 new AFSLs and ACLs (compared to 394 last year). Of those 458, only 339 refer to AFSLs. In the abovementioned period, ASIC stated that 741 new AFS licence applications were assessed, while 1,136 AFS licence variation applications were assessed.

The update further detailed additional regulatory outcomes on AFS licence applications:

– 651 additional regulatory outcomes achieved on approved applications (new and variation)

– 57% of additional regulatory outcomes involved the imposition of a responsible manager keyperson condition

– 21% of additional regulatory outcomes relate to granting authorisations that were different from those sought by the applicant

The financial watchdog also stated that it was able to finalise 50% of AFS licence applications within 93 days, 70% within 145 days and 90% within 251 days.

“As of 30 June 2021, we had received a total of 65 applications for a new AFS licence including claims handling authorisations and 236 variation applications from existing licensees to be covered for claims handling”, said the report.

The report also pointed to the new regime for foreign financial services providers (FFSPs): “Since 1 April 2020, foreign financial services providers (FFSPs) from certain jurisdictions seeking to provide financial services to only wholesale clients have been able to apply for an AFS licence under a streamlined licensing assessment process.

“In May 2021, the Government announced that it would consult on reforms to the regulatory regime for FFSPs. As a result, we have extended the transitional arrangements from 31 March 2022 to 31 March 2023 in relation to FFSPs that can rely on an exemption from having to hold an AFS licence.

“ASIC will continue to assess FFSP applications on a streamlined basis until any changes are made in response to the Government’s FFSP

reform proposals”.

ASIC’s licensing report is released annually to increase transparency and to provide guidance to licensees, registrants and prospective applicants about ASIC’s licensing and professional registration decision making, outlines factors ASIC considers when reviewing an application, why certain information is required, and what factors may increase the time taken to assess an application.