ASIC outlines strategic priorities for next four years: product, ESG, retirement, technology

“The plan identifies work we have underway to address a number of emerging trends and important law reforms that are reshaping the financial system, including digitally enabled misconduct, emerging technologies, climate risks and an ageing population.”

The Australian Securities and Investment Commission has outlined its strategic priorities for the next four years and its plan of action for the year ahead in its Corporate Plan.

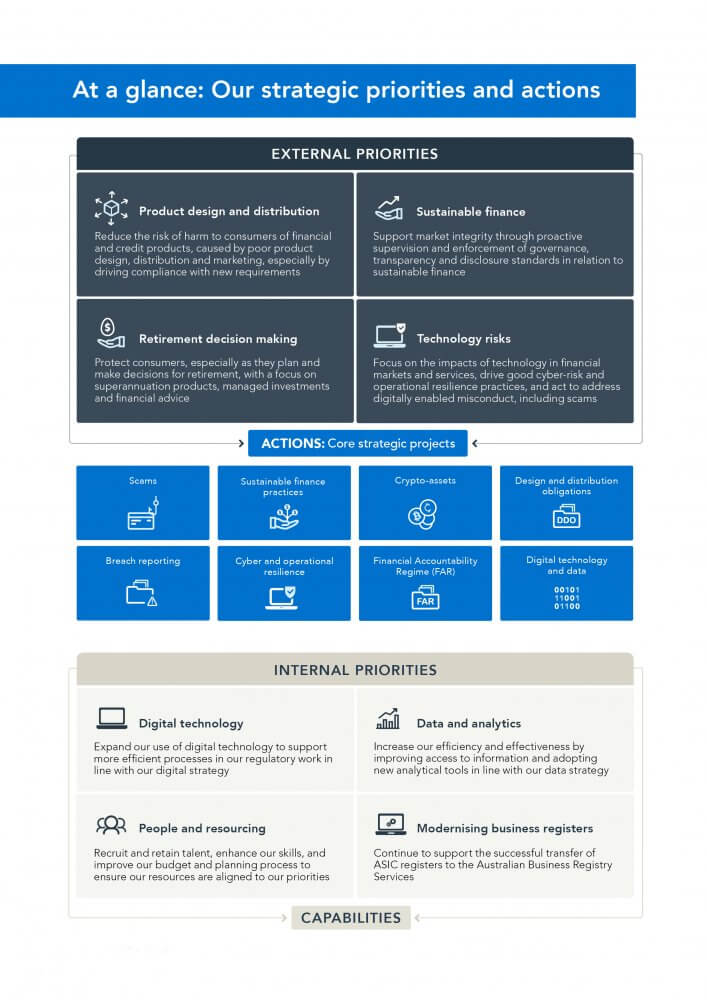

The plan also highlights key aspects of ASIC’s internal change program in line with four internal strategic priorities, including a move toward being a leading digitally enabled and data-informed regulator.

The financial watchdog has developed core strategic projects, focused on sustainable finance practices, crypto-assets, scams, cyber and operational resilience, breach reporting, design, and distribution obligations that will support the strategic priorities. These projects are subject to the passage of legislation, the Financial Accountability Regime, before being executed.

Below are ASIC’s four external strategic priorities:

- Product design and distribution: Reduce the risk of harm to consumers of financial and credit products, caused by poor product design, distribution and marketing, especially by driving compliance with new requirements;

- Sustainable finance: Support market integrity through proactive supervision and enforcement of governance, transparency and disclosure standards in relation to sustainable finance;

- Retirement decision making: Protect consumers, especially as they plan and make decisions for retirement, with a focus on superannuation products, managed investments and financial advice;

- Technology risks: Focus on the impacts of technology in financial markets and services, drive good cyber-risk and operational resilience practices, and act to address digitally enabled misconduct, including scams.

ASIC Chair Joe Longo said: “The plan identifies work we have underway to address a number of emerging trends and important law reforms that are reshaping the financial system, including digitally enabled misconduct, emerging technologies, climate risks and an ageing population. ASIC will take strong and targeted enforcement action to protect consumers and investors and to maintain trust and integrity in the financial system.

“ASIC is looking to the longer term and planning over the next four years. But we’ve seen that scenarios can change quickly. We remain alert to changes and developments in our operating and regulatory environment, and we will continue to make rapid, strategic decisions to adapt where needed. When we do so, it will be transparent.”