ASIC reminds Australian Financial Services licensees to file their reports on time

Limited AFS licensees and body corporate AFS licensees that are not disclosing entities have to lodge certain reports by October 31, 2019.

The Australian Securities & Investments Commission (ASIC) today issued a reminder to all Australian Financial Services (AFS) licensees to submit their annual financial statements and auditor reports by the due date as required under the Corporations Act 2001.

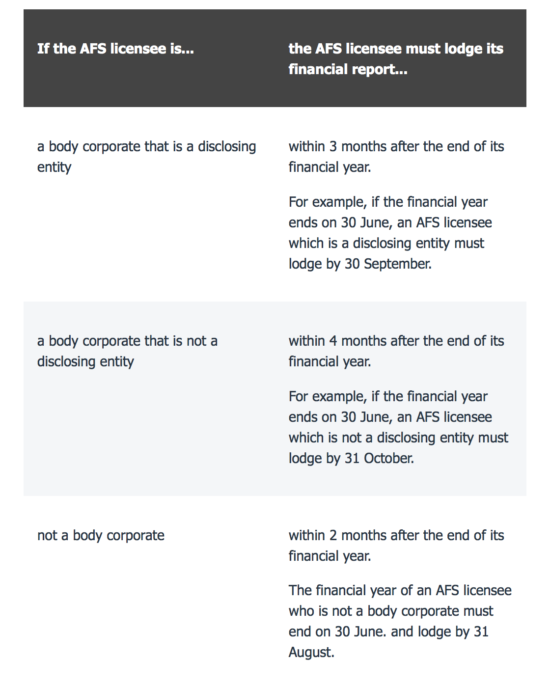

ASIC explains that body corporate AFS licensees that are not disclosing entities, and have a financial year ending 30 June, are required to lodge their financial accounts by October 31, 2019. Limited AFS licensees that do not deal with client money must file an annual compliance certificate along with a profit and loss statement and a balance sheet each financial year, also by October 31, 2019.

AFS licensees that fail to meet their obligations before the due date risk regulatory consequences.

The regulator explains that it has previously contacted a number of AFS licensees that have not complied with their annual financial reporting obligations. In some cases, ASIC has taken action to ensure compliance with the law. Since October 2016, the regulator has suspended nine AFS licences and cancelled 22 AFS licences over firms’ failure to lodge their annual financial statements and auditor reports.

A recent example is the cancellation of the AFS license of Melbourne-based financial services provider, Golden Financial Group Pty Ltd. The cancellation followed a period of suspension from March 18, 2019. The regulator was concerned that Golden Financial was not complying with its general licensee obligations. The firm failed to file its annual financial reports and did not have membership of an external dispute resolution system.