ASIC supports the development of a healthy digital advice market in Australia – takes a good look at social trading

For over two years, regulatory debate is centered on whether copy trading, social trading or digital advice via algorithmic systems constitutes regulatory oversight as financial advice. Leading the way once again, Australian regulator ASIC has come up with a full and detailed framework for digital advice, or robo-advice

Australian financial markets regulatory authority ASIC has today issued a full regulatory guide relating to systems that provide digital financial product advice to retail clients.

The potential regulation of automated trading systems, such as social trading platforms that automatically execute trades on behalf of traders that follow the trading patterns and signals provided by ‘trade leaders’, signal platforms and even Expert Advisors (EAs), has been on the agenda of many regulatory authorities recently, one of the first being Britain’s Financial Conduct Authority which, just over two years ago considered categorizing social trading and copy trading platforms as financial advisors.

ASIC states that digital advice, which is also known as robo-advice or automated advice, is the provision of automated financial product advice using algorithms and technology and without the direct involvement of a human adviser.

Today’s regulatory guide brings together some of the issues that persons providing digital advice to retail clients need to consider when operating in Australia—from the licensing stage (i.e. obtaining an Australian financial services (AFS) licence) through to the actual provision of advice.

ASIC recognizes that the provision of digital advice has grown rapidly in Australia since 2014, with a number of start-up Australian financial services (AFS) licensees and existing AFS licensees developing digital advice models.

ASIC supports the development of a healthy and robust digital advice market in Australia.

This regulatory guide brings together some of the issues that persons providing digital advice to retail clients need to consider when operating in Australia—from the licensing stage (i.e. obtaining an AFS licence) through to the actual provision of advice.

ASIC has spoken with a number of AFS licensees and their authorised representatives that provide digital advice to retail clients. The regulatory authority has also spoken with start-up financial technology (fintech) businesses that are considering whether to become an AFS licensee or an authorised representative of an AFS licensee.

From these discussions, ASIC’s perspective is that it has become clear that industry would benefit from additional guidance that deals specifically with digital advice.

ASIC states that communicating with clients is an important element of providing digital advice. Because there is no ‘natural person’ (i.e. human adviser) directly involved in providing the advice, it is especially important for digital advice providers to carefully consider their website design and digital communications and disclosure.

Providers should take a user-focused approach and put the client’s needs first when designing their communications and disclosure and ASIC recognizes that the digital advice environment is still evolving, and that what constitutes effective communication will vary across the different electronic devices used (i.e. it is highly context specific). For these reasons, ASIC encourages a culture of ongoing testing and enhancement.

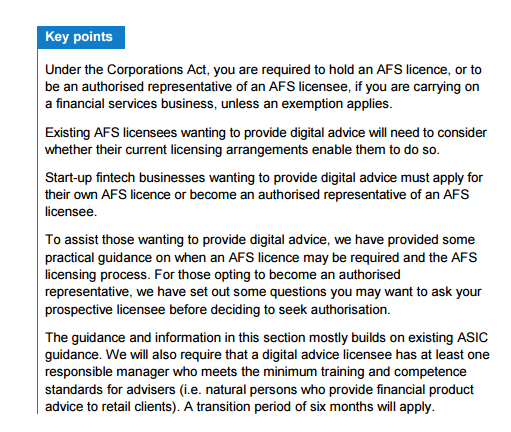

There are specific criteria which firms offering digital advice must hold a valid AFS license with ASIC.

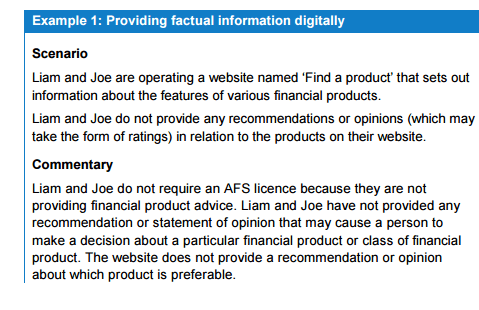

In this example, ASIC considers no AFS license to be necessary because according to ASIC, in scneario such as this, no financial product advice is being provided.

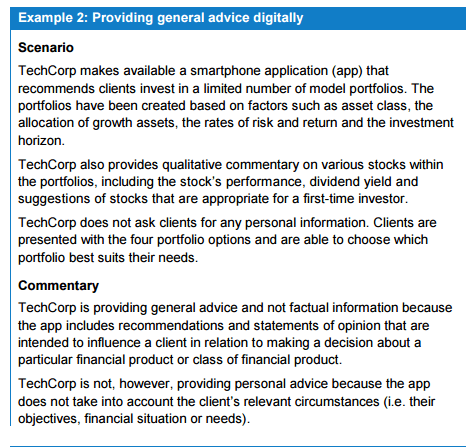

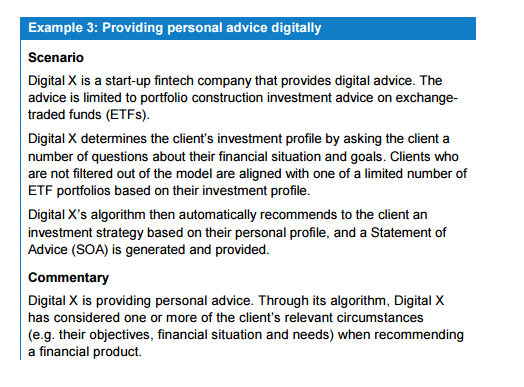

In these examples, the digital advice provider must hold an AFS licence because general advice or personal advice is being provided.

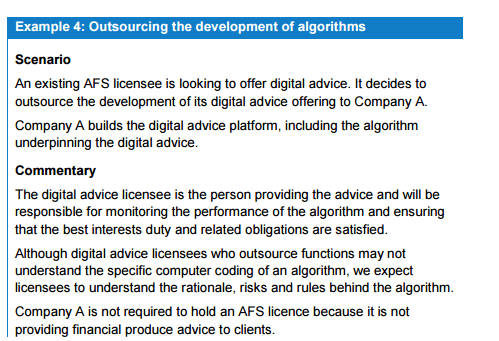

Outsourcing functions that relate to AFS licences

ASIC understands that many digital advice licensees may wish to outsource functions that relate to their digital advice business. Where functions are outsourced, the regulator expects that firms will have measures in place to ensure that due skill and care are taken in choosing suitable outsourced service providers; and that they can and will monitor the ongoing performance of outsourced service providers.

As a matter of good practice, digital advice licensees should discuss the requirements of this regulatory guide with any outsourced service providers involved in their digital advice business.

This example highlights that AFS licensees who outsource functions remain responsible for the financial services provided to clients.

Adequate risk management systems

ASIC stipulates that firms using such algorithmic copy trading or digital advice systems must have a general obligation to establish and maintain adequate risk management systems. ASIC expects comapnies to have a structured and systematic process for identifying, evaluating and managing risks

Monitoring and testing algorithms

As part of the obligatory risk management systems, firms should regularly monitor and test the algorithms that underpin the advice. The extent of those arrangements will depend on the nature, scale and complexity of each digital advice business.

ASIC expects firms to:

• Have appropriate system design documentation that clearly sets out the purpose, scope and design of the algorithms. Decision trees or decision rules should form part of this documentation, where relevant. A ‘decision tree’ uses a tree-like graph or model to display decisions and their possible consequences.

• Have a documented test strategy that explains the scope for testing of algorithms. This should include test plans, test cases, test results, defect resolution (if relevant), and final test results. ASIC expects robust testing of algorithms to occur before digital advice is first provided to a client, and on a regular basis after that.

• Have appropriate processes for managing any changes to an algorithm. This includes having security arrangements in place to monitor and prevent unauthorised access to the algorithm.

• Be able to control, monitor and keep records describing any changes made to algorithms over the past seven years. One way of doing this may be to store different versions of the algorithm electronically.

• Review and update algorithms whenever there are factors that may affect their currency (e.g. market changes and changes in the law).

• Have in place controls and processes to suspend the provision of advice if an error within an algorithm is detected and that error is likely to result in client loss and/or a breach of the Corporations Act.

• Have in place adequate resources, including human and technological resources, to monitor and supervise the performance of algorithms through an adequate and timely review of the advice provided.

• Have in place an appropriate internal sign-off process to ensure that the steps above have been followed.

This is a positive and interesting direction by ASIC, which addresses the ongoing question that surrounds whether digital advice constitutes actual financial advice and sets forth a sustainable framework for this sector to flourish. Once again, ASIC demonstrates its very modern approach to defining high quality regulatory strucutures that maintain customer security at the highest level whilst engendering next generation financial market infrastructure and its ability to grow.