Australia is an FX industry benchmark: FinanceFeeds Sydney Cup hosts the absolute top level senior FX executives

From publicly listed electronic trading giants to the major interbank dealers, and from board level executives from the world’s prime of prime brokerages along with institutional technology leaders, the FinanceFeeds Sydney Cup brought together the very leaders which preside over the most important components of the global business. Here is a full insight into the gathering of the elite in one of the most important regions for this industry in the world

Modernity, fastidious business ethics, and a finely honed understanding of the entire spectrum that the electronic trading sector of the financial services business encompasses, Australia’s senior level talent is a fine example indeed.

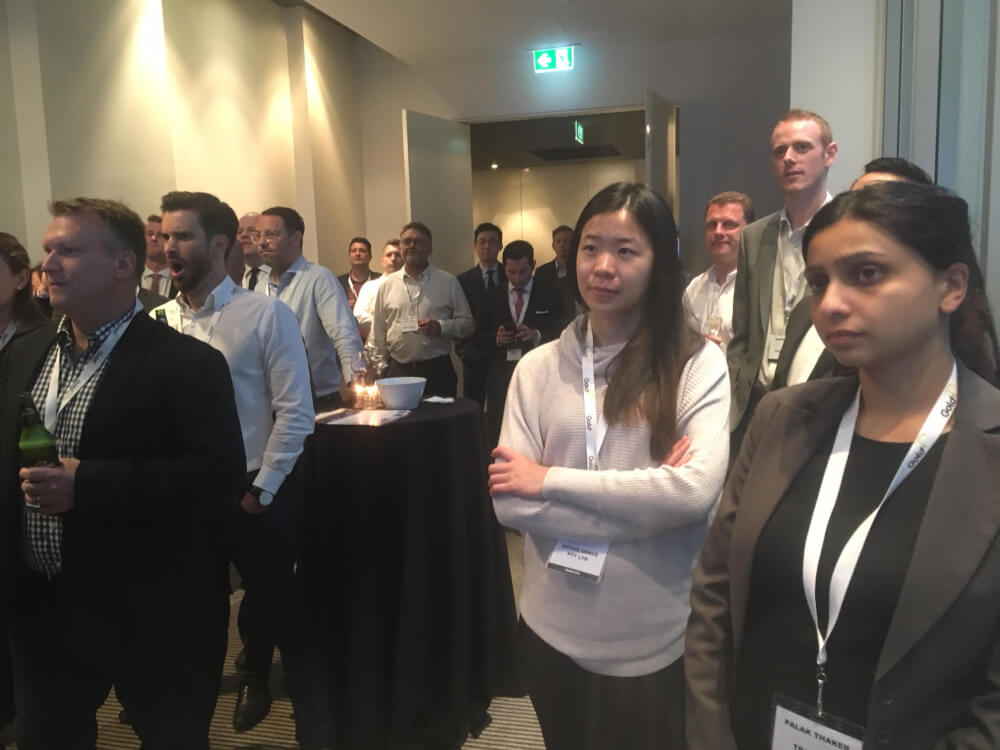

Today, here in Sydney, Australia’s financial and technological capital, FinanceFeeds hosted over 60 senior executives from across the institutional, technological and retail brokerage industry at the third Sydney Cup FX industry networking event, in conjunction with FX brokerage integration and software specialist Gold-i.

Attending the event is one aspect of importance, as such a platform for the high quality firms that are very well established in Sydney and form the very well organized electronic financial markets sector in Australia, however the combination of Australia’s position as a very highly respected business center between the all-important Asia Pacific region and the West stands it out as the most important retail FX center in the world.

Represented were senior executives from CMC Markets, Invast Global, Saxo Bank, oneZero, TRAction FinTech, CMC Markets, ISPrime, Thomson Reuters, CQG, IG Group, IC Markets, OANDA Corporation, Charter Prime, XTD, Rakuten Securities, FXCM Pro, along with some of the ancillary service providers that have a majority market share in Australia and the APAC region including licensing consultancies and boutique financial technology service providers.

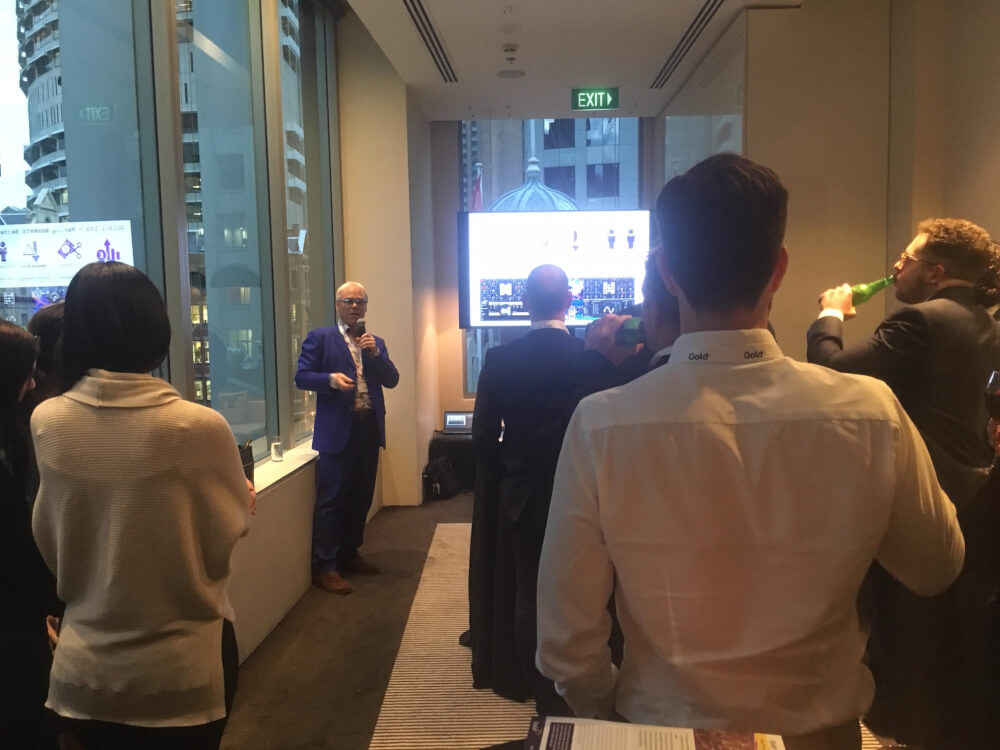

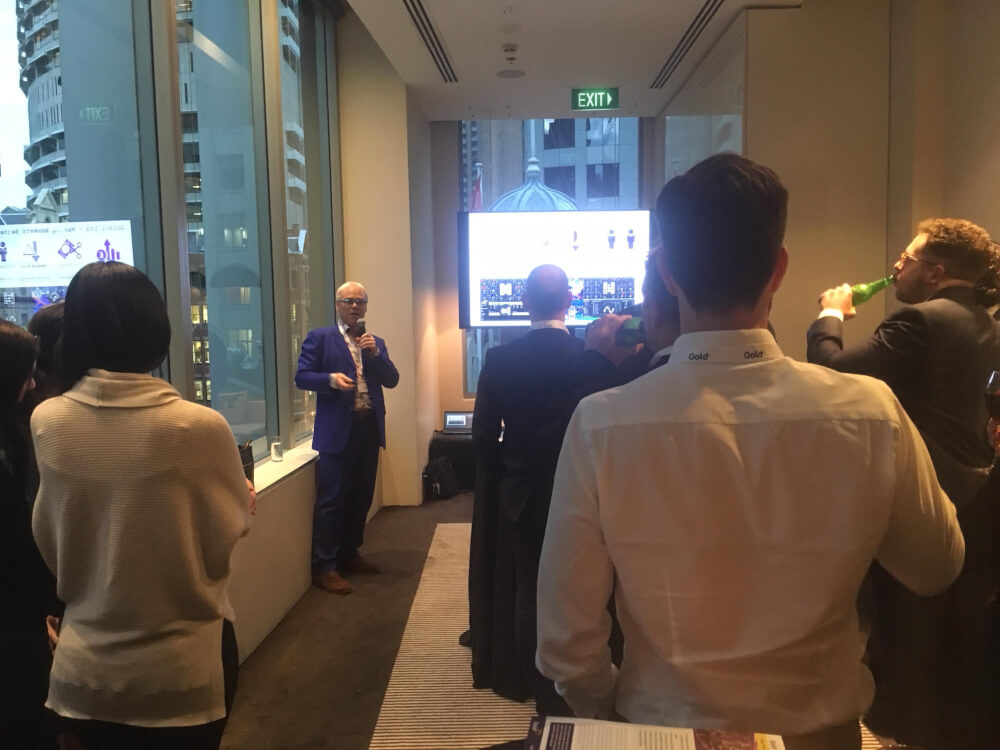

In keeping with FinanceFeeds’ ideology of linking the very senior level executives with each other and ensuring that absolutely relevant business can be conducted in a charismatic and corporate community style environment, following a welcome address by FinanceFeeds CEO Andrew Saks-McLeod, the Sydney Cup event was preceded by a highly informative and entertaining keynote speech delivered by Tom Higgins, CEO of Gold-i, who explained in great detail how the history of money, dating back 6000 years ago to its origins as weights carved from metal, became centrally issued as notes which eventually carried specific values, and likened the method by which currency evolved to the origins of today’s cryptocurrency revolution.

Mr. Higgins detailed Gold-i’s new Crypto Switch technology, and explained how this exemplifies the technology-driven aspect of incorporating cryptocurrency into a brokerage platform, providing a full insight as to how to consider cryptocurrencies in today’s market, as well as look at them as a commodity that should be part of the technological topography of the financial services industry.

Sydney is a very important region for the FX industry. It is the high quality bridge between the APAC region and the West, and embodies some of the most well organized and knowledgeable companies in the world.

FinanceFeeds will see you all again on in March 2018 for the next Sydney Cup FX Industry Networking Event at The Establishment.

Meanwhile, here is a full montage of this evening’s event. See you all again next year in Sydney!