Australia and the FX leverage laws: Full report on current legal and consultative status

We talk to lawyers, FX industry executives, compliance managers and academics in Australia and North America to look at how the current stance on leveraged FX and CFD products is following last week’s proposals on retail products by ASIC

Last week, FinanceFeeds provided a unique and detailed report into the proposed new rulings by the Australian Securities and Investment Commission (ASIC) which pertain to how the esteemed regulatory authority wishes to revise the method by which CFDs are sold to retail customers, and how they are traded.

With our senior FX industry connections among some of Sydney’s most well respected FX brokerages, it has been possible for FinanceFeeds to research this matter in detail and provide comprehensive insight from a regulatory and brokerage perspective.

During interaction with Australian FX industry leaders over the past two years and certainly since the implementation of MiFID II in Europe, FinanceFeeds has been able to glean from opinion among senior executives that ASIC may potentially follow suit in terms of restructuring the means by which OTC trades are executed, reported and sold to retail customers, many of whom considered that leverage restrictions would be part of that remit.

Indeed, the speculation was correct and last week ASIC released a very detailed proposal in which the regulator demonstrates its clear intention to restrict the methods by which OTC CFDs are sold.

FinanceFeeds perspective on this is that if ASIC was to make structural changes as mandated by its proposals to the method by which retail brokerages can offer CFDs, the essence of their proposal is not that bad and can be pragmatically navigated around by the high quality retail FX environment that exists in Australia in order to achieve sustainability.

In order to gain background, it is recommended to read FinanceFeeds report from last week on this, which can be read here.

Since then, FinanceFeeds has made substantial investigation into how the proposals are being processed by FX industry stakeholders, lawyers, lawmakers and compliance officers in the event that ASIC may implement these rulings.

This morning, FinanceFeeds spoke to a senior FX industry compliance consultant who operates his business on behalf of large multinational banks, commodities firms and brokerages. He referred us to a study that was initially carried out in Cambridge, Massachusetts by academics Rawley Z. Heimer and Alp Simsek of the US National Bureau of Economic Research, which is a think tank that nestles in the same community as private Ivy League institutions including Brandeis and Harvard universities.

This research was initially written in 2017 and focused on the effects of the use of leverage in global OTC derivatives, however since ASIC has been issuing its proposals, the two academics have made revisions to their study, based on exactly these proposals.

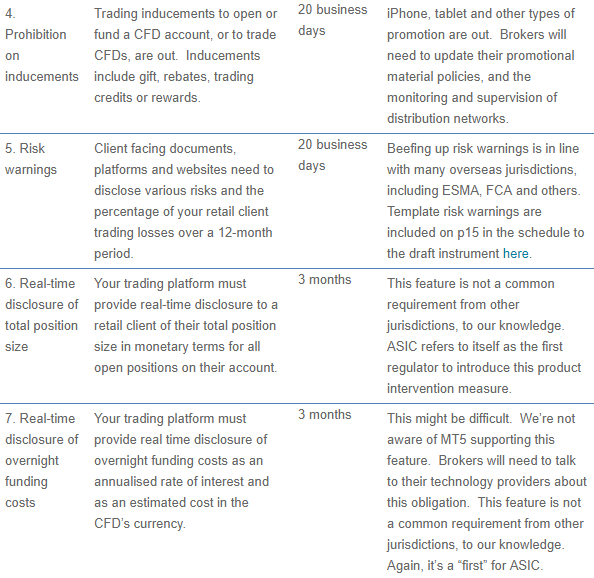

This particular study’s latest research begins very early in what is an extremely comprehensive works, and last week was amended to show that, bearing in mind regulations in US restrict retail clients to 50:1 leverage in FX and market participation reduced from 30 margin brokers to 4 in 2011 which has since dwindled to just three, retail customers saved 40% on equity, had a 23% reduction in turnover, a 25% reduction in broker surplus equity and no discernible reduction in spreads.

The compliance consultant that referred to this said “This was a win/win situation for many retail customers especially if they were novice traders, but the loser in that case was the FX margin brokers. Of course, Australia has around 65 FX margin brokers and leverage may well go down to somewhere between 20:1 – 30:1, so maybe the landscape for broker here will be affected but the large firms will simply follow the path of the ones that stayed in America such as your reference last week to Interactive Brokers, or will attract a different client who will put more margin capital in and carry on trading with less risk, as happened in Japan.”

Indeed it did, FinanceFeeds has many times made the point that Japanese brokers reduced margin in 2011 and despite the speculation that overseas and offshore firms would suddenly receive a deluge of Japanese traders – something they all wanted because of the massive volumes traded on retail brokerages in Japan – however this did not happen and Japan’s big three, GMO Click, DMM Securities and MONEX carried on from strength to strength often trading over $1 trillion per month in notional volume post leverage restriction.

This may happen in Australia, as clients of Australian brokers in the APAC region fully appreciate the quality of the firms, their leadership and the regulatory and business structure in Australia which is among the best in the world.

At the same time as this study came to light, commercial and financial services law company Holley Nethercote issued a notice to many compliance directors in Australia, stating that it is to hold a forum on September 5 regarding ASIC’s Product Intervention Consultation.

The law firm told its clients “After years of speculation, product intervention in the CFDs sector has come to Australia. As Australian lawyers acting for a large portion of the industry, product intervention has been a key topic of interest in Australia since 6 December 2016 when the FCA made its announcement to impose the restrictions on the sector. This was followed by an IOSCO paper that same month, along with the Australian government’s proposal to introduce design, distribution and product intervention laws.”

“Earlier this year, the design, distribution and product intervention laws came into effect. ASIC was given the legislative power to issue a product intervention order for individual businesses, or broader, market-wide sectors. ASIC issued its first consultation paper on 26 June 2019, concluding on 7 August 2019. That first consultation asked for feedback on how it should use its powers. Without publicly commenting on the feedback or publishing its final guidance, ASIC then issued, days later on 22 August 2019, consultation about using its new powers to impose ESMA-style restrictions on the Australian CFDs and Binary Options Sector.”

There will be an update on what the Australian Retail OTC Derivative Association is currently doing in light of ASIC’s proposed product intervention, and during the forum on September 5, the firm will be running a live, anonymous phone-based poll on the day in which questions can be sent to the firm by brokers if they want Holley Nethercote to survey participants with a particular question.

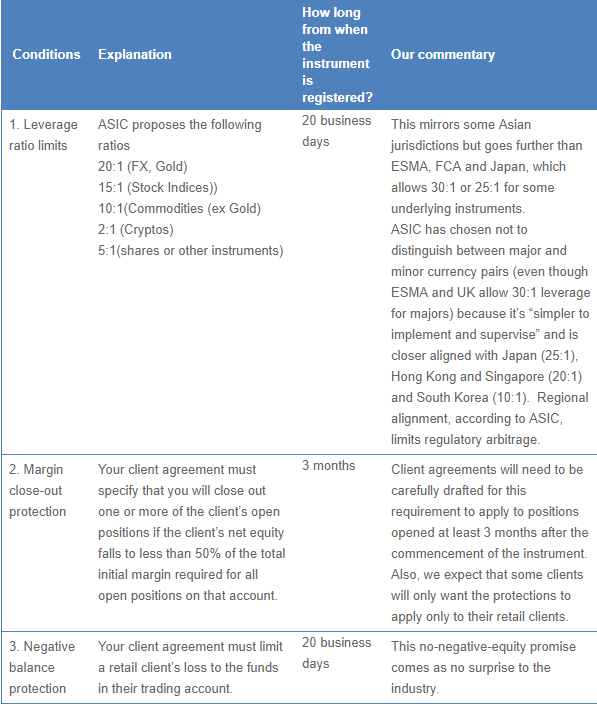

Commentary by Holley Nethercote is as follows:

Looking at this and comparing it to studies made on leverage which have now been revisited by senior executives within Australia’s FX industry, there is a lot of positive dialog between regulator and broker.

The abstract area of study focused around the provision of leverage to retail traders, and if it actually improves market quality or facilitates socially inefficient speculation that enriches financial intermediaries.

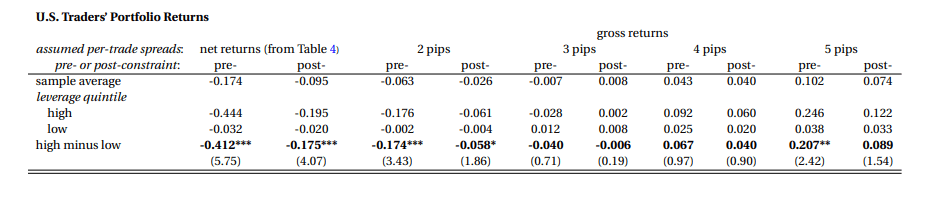

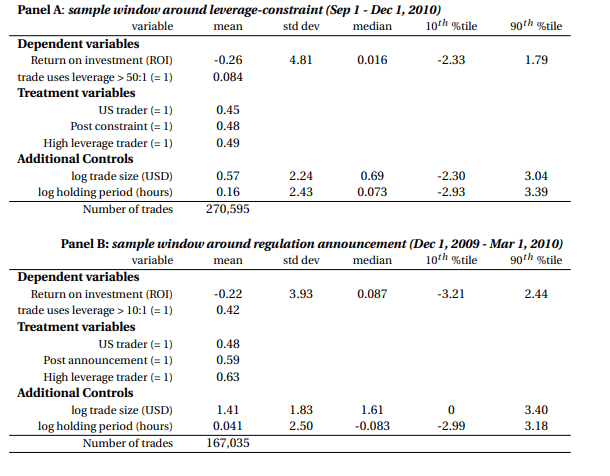

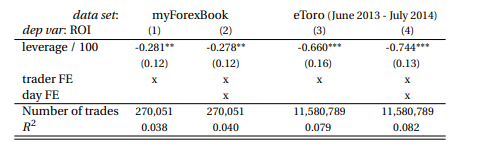

Using three unique data sets and a difference-in-differences approach, the US academics documented that the leverage-constraint reduces trading volume by 23%, alleviates high-leverage traders’ losses by 40%, and reduces brokerages’ operating capital by 25%. Yet, the policy does not affect the relative bid-ask prices charged by the brokerages. These results suggest the policy improves belief-neutral social welfare without reducing market liquidity.

A distinguishing feature of the forex market is that a significant number of brokerages have clients from around the world. However, there is no centralized, worldwide regulatory authority. Brokerages must comply with domestic regulations in each country that they operate. This requires brokerages to segment their clientele according to country of origin.

Verification of a client’s home country is done using government-issued documentation, such as a passport, and a link to a domestic bank account from which to withdraw and deposit funds. Consequently, it would be challenging and costly for a retail client to search for a preferred regulatory regime.

Therefore, the structure of the market is beneficial to this research, because it is possible to compare regulated U.S. traders to their lightly regulated European counterparts while accounting for brokerage features that may otherwise vary across countries.

This infers that ASIC’s attempt to ensure all brokers only operate with Australian customers emulates that of the US regulators NFA and CFTC, largely due to not only a lack of globally aligned regulation that allows countries to work together on the same regulatory principle, but also to prevent Australian brokers keeping client funds in non-Australian bank accounts.

ASIC wants to ensure that all funds are kept within Australia and therefore margin capital and client assets can be audited in the same way that they are in the US.

The report, rather interestingly, referred to how affiliate sites work in relation to leveraged trading.

Indeed, in the past, FinanceFeeds has stated that affiliate sites and social trading (which is a type of affiliate designed for retention and longer term trading) are at a conflict of interest with traders and cause a triangle of conflict between IB, affiliate, broker and trader as the entire relationship is based on zeroing accounts and splitting losses or commissions.

This study, however, looks at leverage interests via affiliates, taking myfxbook as an example. “Traders that use myForexBook are plausibly representative of traders in this market. First, we compare myForexBook traders to a second account-level data set—a year’s worth of transactions on one of the world’s largest forex brokerages” says the study.

“Both myfxbook traders and traders from this comparison data set have worse returns when they trade with leverage, which suggests that the relationship of interest between leverage and traders’ returns is unlikely to be biased by sample selection. Second, trading volume in the myForexBook data set strongly covaries (a Pearson’s correlation coefficient equal to 41%) with reductions in brokerages’ aggregate retail forex obligations, using data from CFTC reports. This provides evidence that, though myfxbook’s traders self-select into a social networking environment, these traders are a fair representation of the typical retail forex trader.”

“We are also confident that lessons from our tests on the leverage of retail forex traders extend to retail traders more broadly. Not only is the worldwide market for retail forex large, but the structure of the market is increasinglysimilar to modern-day active retail trading in equities markets.”

“Both markets are primarily served by online brokerages, and are increasingly accessible to clients that do not have much initial capital and are seeking low, or even zero-commissions (e.g., Robinhood Markets, Inc.). More concretely, Heimer (2016) provides evidence that the behaviors of myForexBook traders are similar to the behaviors of retail stock traders on a large discount brokerage that has been extensively studied by many financial markets data analysts across the US and have been published.

This is effectively a long-standing dialog regarding leverage, and it appears that Australia’s quality firms are established enough – some of them are among the largest and most well capitalized retail FX brokers in the world – to be able to work closely with good quality guidance and data to adhere to the rulings and prosper.

All data courtesy of National Bureau of Economic Research, Cambridge, Massachusetts.