Australia registers 60% M/M jump in investment fraud losses in January 2018

Australians reported $4.63 million in losses as a result of fraudulent investment schemes in January 2018, up nearly 60% from December 2017.

The latest numbers from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), have just been released, with investment fraud continuing to result in growing harm for investors.

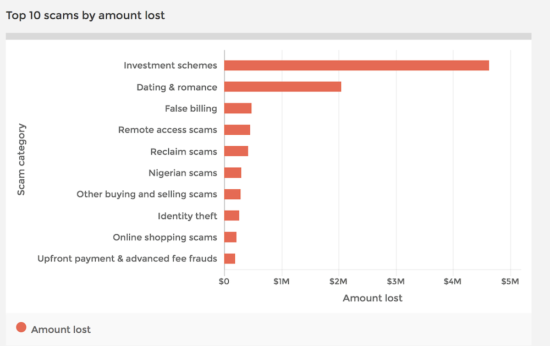

Australians report having lost a total of $10,692,438 to various scams in January 2018, with investment schemes being at the top of fraudulent activities costing money to Australians last month.

The amount reported lost as a result of investment fraud topped $4.63 million in January 2018, up 60% from the $2.9 million reported lost to such fraud in December 2017 and up massive 172% from the $1.7 million reported lost in January 2017.

There has been somewhat of a change in the profile of people actively reporting investment fraud. Whereas these are typically elderly people, last month the biggest number of reports was submitted by people aged 25-34, whereas the biggest amount lost was reported by those aged 45-54.

Australians reported losses of more than $31.15 million due to investment scams in 2017, according to Scamwatch. The losses mark a 32% rise from the losses of $23.63 million reported by Australians hit by investment fraud in 2016. Investment schemes dominated the landscape of most widespread scams in Australia in December 2017.

Overall, during 2017, Australians submitted 1,978 reports concerning investment fraud. November was a record-setting month last year with respect to amount lost as a result of such fraudulent activities – $4,321,946, followed by August ($3.95 million).

While Bitcoin-related scams are on the rise, the Australian Securities & Investments Commission (ASIC) has become the latest regulator to act against illicit trading activities related to cryptocurrencies. Earlier today, ASIC said it had obtained interim injunctions in the Federal Court of Australia against AGM Markets, OT Markets and Ozifin. The regulator warns the public not to deal with any of these entities in relation to trading in margin FX contracts for difference (CFDs) and bitcoin CFDs.