Australia sees record losses due to investment fraud in August

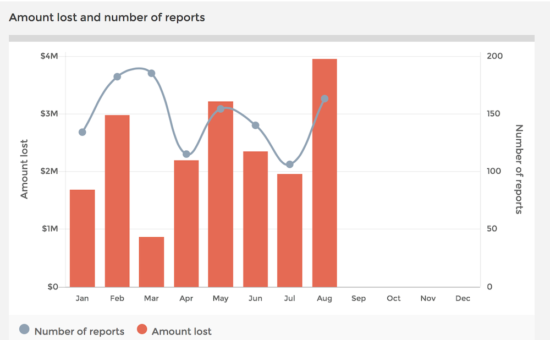

Australians reported more than $3.95 million lost due to investment scams in August, beating the previous record registered in November 2015.

August saw Australians report record losses due to fraudulent investment schemes, according to the latest data just provided by Scamwatch, a body operated by the Australian Competition and Consumer Commission (ACCC).

The total amount of money reported lost due to investment scams in Australia hit $3,951,804 last month, the highest number since such estimates began. August losses surpassed the previous record of $3.94 million in losses set in November 2015. ACCC received 163 reports about fraudulent investment schemes last month.

The biggest losses were suffered by people aged 55 – 64 years, they reported $1.24 million lost to such fraudulent schemes last month. The most active in reporting investment scams were those aged from 35 to 44 years.

The latest results are barely surprising as snapshots of data provided by Scamwatch on a weekly basis have indicated sharp rises in investment fraud losses in Australia. Jobs & investment losses exceeded $2 million in the week to August 20, 2017, to mention one example.

The biggest number of reports concerned scams conducted via phone, the so-called cold calling which has been identified as persistent problem by Australian authorities and consumer advocates. In its annual report on scam activity for 2016, the ACCC said cold calling investment scams resulted in the highest reported losses for phone based scams with $11.5 million lost based on 879 reports. Most of these reported losses related to offers of investment opportunities in binary options, as well as “the opportunity” to buy shares at lower than market rates.

The August losses due to investment fraud took the total for the year thus far to $19.2 million. The number of reports reached 1,179. The numbers are not conclusive as many investors do not report their losses.

In 2016, the ACCC and the Australian Cybercrime Online Reporting Network (ACORN) received a total of 200,103 reports about scams. Losses reported to Scamwatch, ACORN and from other scam disruption programs amount to approximately $300 million.