Australian financial firms have to inform their clients about new dispute resolution body AFCA

All members of the new external dispute resolution body need to ensure their customers are aware they can bring a complaint to AFCA.

There are less than three months left until the Australian Financial Complaints Authority (AFCA) – a new external dispute resolution body for the Australian financial services firms, commences its work and starts accepting complaints. AFCA is poised to start receiving and resolving disputes from November 1, 2018.

Hence, there are some requirements that AFCA members have to comply with.

Importantly, firms need to ensure their customers are aware they can bring a complaint to AFCA. From September 21, 2018 until AFCA commences on 1 November 2018, AFCA members must provide contact details of both AFCA and the relevant predecessor dispute resolution scheme (such as the Financial Ombudsman Service) in their internal dispute resolution (IDR) response letters and ‘delay letters’.

By July 1, 2019, members must also include AFCA’s contact details in their Financial Services Guide or Credit Guide and in other relevant disclosure documents.

The firms have to ensure that their IDR final response letters and ‘delay letters’ issued on or after September 21, 2018 and before November 1, 2018 include references to both the relevant predecessor EDR scheme (which will be able to receive complaints only up until 31 October 2018) and AFCA (which will be able to receive complaints on and after 1 November 2018).

The firms also have to ensure that such letters issued on or after February 1, 2019 include references to AFCA but not the predecessor EDR schemes. Letters issued between November 1, 2018 and February 1, 2019 may continue to include references to both the predecessor EDR scheme and AFCA, provided it is clear that only AFCA can receive complaints after November 1, 2018.

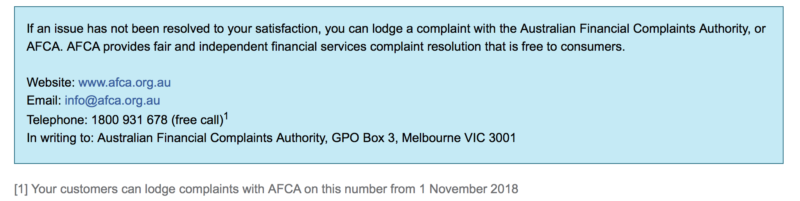

Below is an example of a recommended referring copy, as per AFCA’s website:

Regarding the two recent consultations – on the proposed Rules that will govern AFCA, and on the AFCA funding model, both have now closed. The AFCA Board has recently considered the feedback received and any further appropriate changes arising from the consultation. Following the Rules being submitted to ASIC for approval, the plan is to release the final Rules and details of the AFCA funding arrangements in September. The Rules and the funding model will commence on November 1, 2018.

The Rules concern topics such as the complaints AFCA can consider, the process it will follow to resolve complaints, remedies and compensation limits, reporting obligations, and the handling of systemic issues. AFCA received 34 submissions from industry organisations, consumer bodies and financial firms.

Let’s also note the recent AFCA funding model consultation. AFCA is required to ensure it has adequate funding to effectively manage the transition from the existing Ombudsman schemes and the Superannuation Complaints Tribunal, as well as its ongoing complaint resolution services. A total of 17 submissions from industry stakeholders have been received.