Australian losses due to investment fraud top $38.8m in 2018

The latest numbers from Scamwatch indicate a sharp rise in the losses due to investment scams in 2018 when compared to 2017 levels.

Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), has just published its latest data about scams, with the numbers pointing to a rise in the amount of losses reported by Australians in 2018 when compared to preceding years.

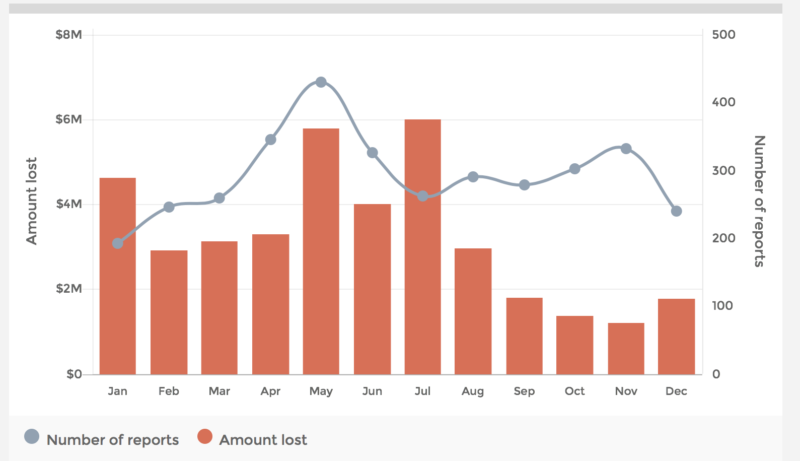

In 2018, Australians submitted a total of 3,508 reports about investment scams and reported losses amounted to $38.85 million. This compares to more than $31 million reported lost to investment scams in 2017.

The highest number of reports was submitted by those aged between 25 to 34 years, whereas those of 55 to 64 years of age were the ones to report the biggest amount of losses.

Last year, July was the month with the biggest amount of losses ($6 million).

The large majority of investment scams are still focused on traditional investment markets like stocks, real estate or commodities. For instance, scammers cold call victims claiming to be a stock broker or investment portfolio manager and offer a ‘hot tip’ or inside information on a stock or asset that is supposedly about to go up significantly in value. They will claim what they are offering is low-risk and will provide quick and high returns.

Two other types of investments where scams are prevalent are cryptocurrency trading and binary options. Cryptocurrency trading scams have grown significantly in the past 12 months and are now the second most common type of investment scam offer pushed on victims.

According to Scamwatch, the clearest warning sign that one may be dealing with an investment scammer is how they contact their potential victim and the promises they make. Any claims like ‘risk-free investment’, ‘low risk, high return’, ‘be a millionaire in three years’, or ‘get-rich quick’ signify that one is dealing with a scammer.