Australians lose $13.3 million to investment scams in H1 2017

The highest number of reports was submitted by people who are 35-44 years of age, followed by those over 65 years of age, according to data by Scamwatch.

Australians continue to fall victim to various investment fraud schemes – the trend has been underlined by numbers provided by Scamwatch, which is run by the Australian Competition and Consumer Commission (ACCC).

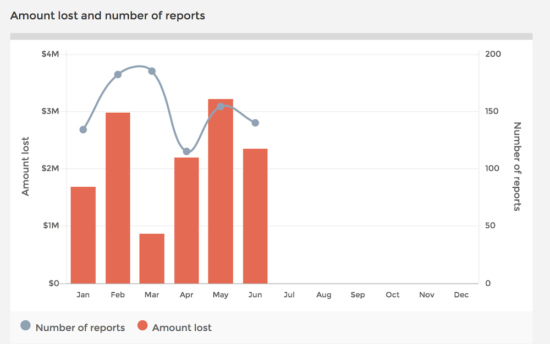

Scamwatch’s statistics for the first January-June 2017 period show that Australians lost $13,286,444 to investment scams in the period in question. The number of reports submitted to the ACCC during the six-month period was 910, with those between 35 and 44 years of age being the most active in reporting fraud, followed by people aged over 65.

In the six-month period, May was the month with the biggest losses reported by defrauded Australians – $3.21 million, followed by February – $2.98 million.

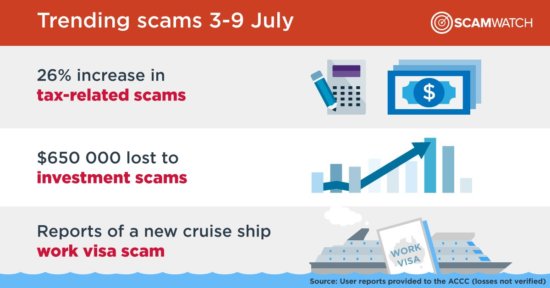

Let’s note that the trend seems to continue in July, as the first week of this month (July 3 – July 9) saw Australians lose $650,000 to fraudulent investment schemes.

The latest results are in tune with the findings in ACCC’s annual report on scam activity for 2016, which shows a rise of 47% in the number of scam reports in 2016 compared to 2015. Losses due to investment scams amounted to $23.6 million last year.

The numbers are not conclusive because many victims do not report their experiences. In 2016, the ACCC and the Australian Cybercrime Online Reporting Network (ACORN) got a total of 200,103 reports about scams. Losses reported to Scamwatch, ACORN and from other scam disruption programs total approximately $300 million.

Most of the losses due to cold calling related to offers of investment opportunities in binary options, the report noted.

The ACCC is pushing for putting an end to scams. Its Scam Disruption project continues, with more than 2,834 letters sent to potential scam victims in 2016. Of those people that got a letter, 74% stopped sending money within six weeks. Last year, the ACCC also started collaborating with financial institutions, telecommunication providers and Facebook to put in place better scam prevention systems to make it harder for scammers to access victims or receive money from them. This work is poised to continue in 2017.