Australians lose $3.29m to investment scams in April 2018

This takes the amount lost by Australians due to investment scams since the start of this year to approximately $16.04 million.

After the decline in the losses due to investment scams reported by Australians in March 2018, April saw another pick-up in the amount lost as a result of such fraud, according to the latest data provided by Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC).

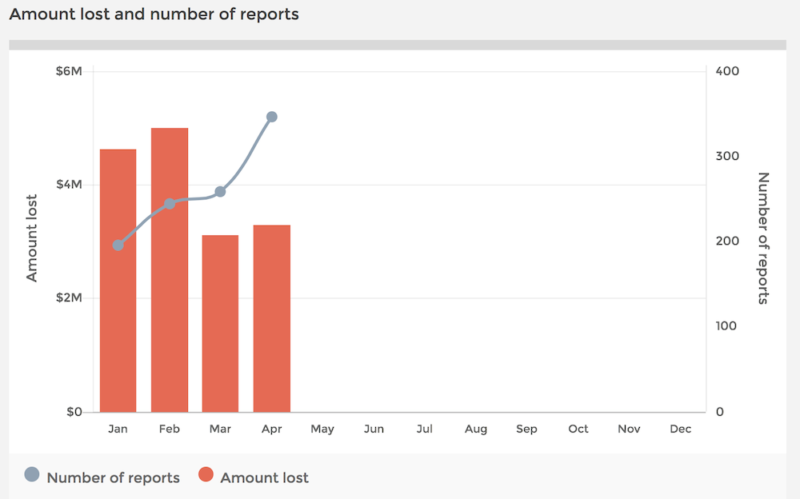

Australians reported losses of $3.29 million due to investment scams for April 2018, with 346 reports about such fraud submitted. This marks a slight increase compared to the $3.11 million lost in March 2018.

The people who suffered the biggest losses were those aged from 45 to 54, whereas those from 35 to 44 years of age were the most active ones to report investment fraud.

This takes the amount lost by Australians due to investment scams since the start of this year to approximately $16.04 million. The total number of reports about such fraud reached 1,043 in the first four months of 2018. The losses for the first quarter of 2018 reached $12.75 million, with January and February seeing particularly high levels of fraudulent activities.

A type of investment fraud that is currently gathering pace in Australia involves cryptocurrencies. Earlier this year Consumer Affairs Victoria, a business unit of the Department of Justice & Regulation, within the Victorian government, voiced its concerns about Bitcoin scams. Victoria’s consumer regulator said it had received reports of people being defrauded through fake Bitcoin websites. The average amount lost is not that large – around $300, but the body sees this type of fraud as worrisome.

In the meantime, the Australian authorities continue to remind cryptocurrency exchange platforms that they are now subject to new regulatory requirements and need to register with AUSTRAC. The registration of such a business with AUSTRAC, however, does not constitute endorsement.