Australians’ losses to investment scams exceed $15 million in first 7 months of 2017

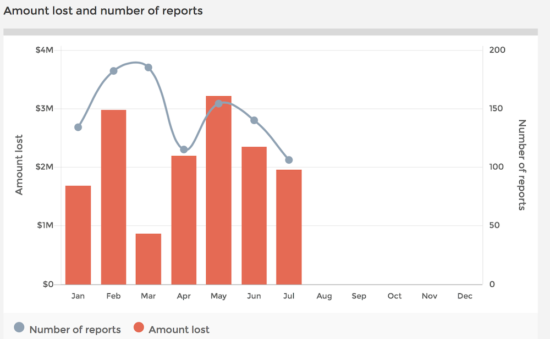

Australians report having lost $15,246,831 due to investment fraud in the January-July 2017 period, with the number of reports exceeding 1,000.

The amount lost by Australians due to fraudulent investment schemes has reached $15,246,831 in the first seven months of 2017, according to the latest numbers by Scamwatch, a body run by the Australian Competition and Consumer Commission (ACCC).

The amount lost in the January-July period reflects 1,016 reports submitted to ACCC, with the biggest losses suffered by those aged 55 to 64 years.

The amount lost to this type of fraudulent schemes in July was $1,960,387. The seventh month of this year did not see grand losses compared to May and June 2017, when Australians said they lost $3.21 million and $2.35 million, respectively. Moreover, the number of reports also fell to 106.

However, the numbers are not conclusive because many victims choose not to report their experiences.

In 2016, the ACCC and the Australian Cybercrime Online Reporting Network (ACORN) received a total of 200,103 reports about scams. Losses reported to Scamwatch, ACORN and from other scam disruption programs amount to approximately $300 million.

The biggest part of the losses due to cold calling in 2016 related to offers of investment opportunities in binary options, according to ACCC’s annual report on scam activity for 2016.

The numbers for the January-June 2017 period have shown that that Australians lost more than AU$13 million to investment scams in the first half of this year. The number of reports submitted to the ACCC during the six-month period was 910, with those between 35 and 44 years of age being the most active in reporting fraud, followed by people aged over 65.

The data for the first days of August are not encouraging either, as Australians reported having lost AU$750,000 to jobs & investment scams in the week from July 31, 2017 to August 6, 2017. Although this is not the highest weekly amount of losses due to such fraudulent activities, Scamwatch notes that the rise in such losses compared to the previous week is 128%.