Australians report $61.6m lost due to investment scams in 2019

During 2019, Australians submitted 4,986 reports about investment scams at the Australian Competition and Consumer Commission.

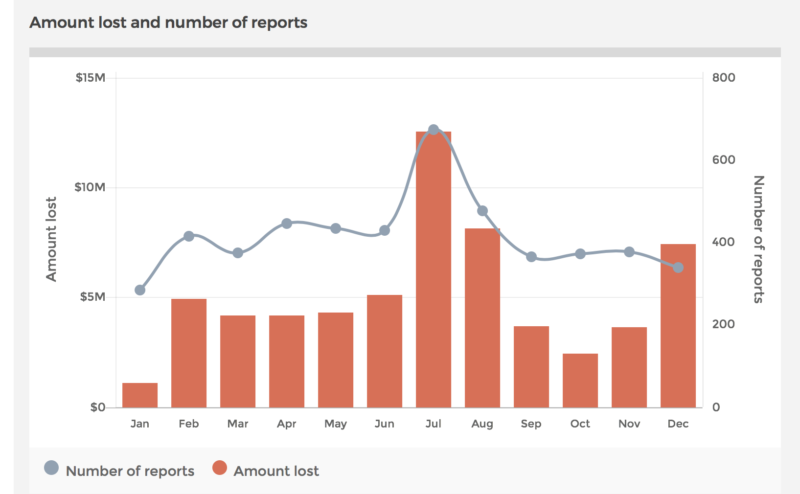

The latest data from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), reveals that Australians reported more than $61.6 million in losses due to fraudulent investment schemes for 2019. This marks a steep rise from a year earlier, when Australians reported $38.8 million in such losses.

The month with the biggest losses in 2019 was July, followed by August and December. The number of reports for the entire 2019 was 4,986, with those from 25 to 34 years of age being most active in complaining about investment fraud.

Speaking of scams, let’s note that the raging bushfires have led to a rise in fundraising fraud cases.

There are currently a wide range of appeals raising funds for people and animals affected by the bushfires. Unfortunately, some of these are scams.

People can make a report on the Scamwatch website. The ACCC has also set up a dedicated phone number for the public to report bushfire related scams. People can call 1300 795 995 to report these scams.

Scamwatch warns that scammers are pretending to be legitimate well-known charities, creating their own charity names, and impersonating people negatively impacted by the bushfires. They are cold-calling, direct messaging and creating fake websites and pages on social media to raise funds.

The public is advised not to donate via fundraising pages on platforms that do not verify the legitimacy of the fundraiser or that do not guarantee your money will be returned if the page is determined to be fraudulent.

In case of uncertainty, donation should be made via an established charity.

If you are donating to an established charity or not-for-profit organisation, ensure it is registered and that you are on its official website by searching the Australia Charities and Not-for-profits Commission Charity Register.