Australians report more than A$30m lost due to investment scams in H1 2020

The latest Scamwatch data show that 3,115 reports about fraudulent investment schemes have been submitted since the start of 2020.

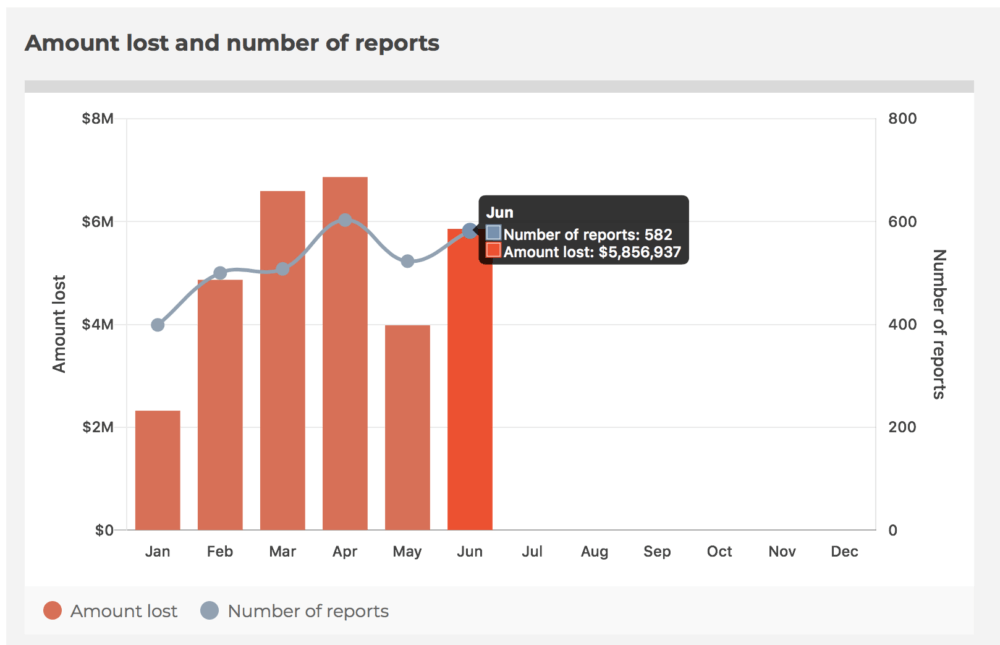

Australians reported A$30,490,348 in losses due to investment scams in the first six months of 2020, according to the latest data provided by Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC).

A total of 3,115 reports about fraudulent investment schemes were submitted in the January-June 2020 period, with those most active in lodging reports being from 35 to 44 years of age. Elderly people (those above 65 years of age) suffered the biggest losses as a result of the activities of investment fraudsters.

Among the first six months of 2020, April was the month with the biggest losses reported ($6.87 million), followed by March ($6.59 million) and June ($5.86 million).

Investment scams remain at the top of all fraudulent schemes targeting Australians, according to amount of money lost followed by dating & romance scams, and threats to life & arrest.

Let’s recall that Australians reported more than $61.6 million in losses due to fraudulent investment schemes in 2019. This marks a steep rise from a year earlier, when Australians reported $38.8 million in such losses.

The month with the biggest losses in 2019 was July, followed by August and December. The number of reports for the entire 2019 was 4,986, with those from 25 to 34 years of age being most active in complaining about investment fraud.