Australians report nearly $1m lost due to investment scams in Jan 2019

Although the amount is substantial, it marks a drop from the preceding months.

Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), has just published its latest data about scams, with the numbers pointing to a drop in the losses due to investment scams in the first month of 2019.

The data reveal that Australians reported losses of $926,401 due to investment fraud in January 2019. This is lower than the amount of $1.77 million reported lost due to such schemes in December 2018.

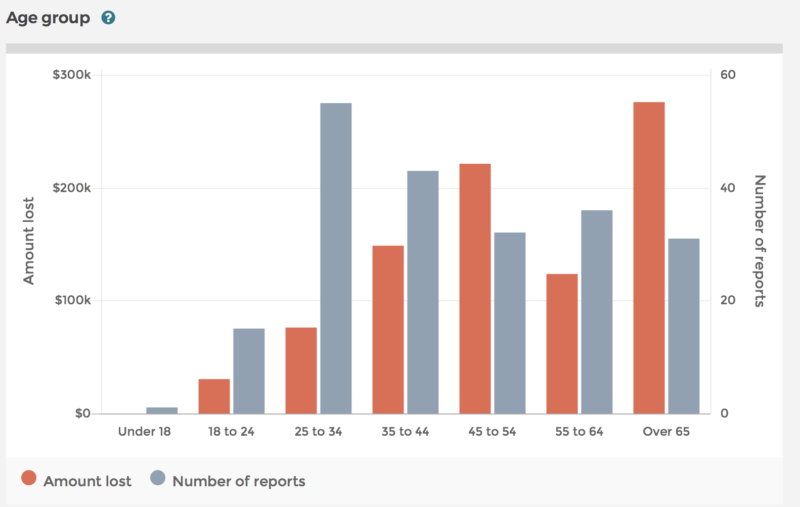

Those above 65 years of age reported the biggest losses, whereas those from 25 to 34 years of age were the most active in reporting investment fraud.

In 2018, Australians submitted a total of 3,508 reports about investment scams and reported losses amounted to $38.85 million. This compares to more than $31 million reported lost to investment scams in 2017. Last year, July was the month with the biggest amount of losses ($6 million).

The large majority of investment scams are still focused on traditional investment markets like stocks, real estate or commodities. For instance, scammers cold call victims claiming to be a stock broker or investment portfolio manager and offer a ‘hot tip’ or inside information on a stock or asset that is supposedly about to go up significantly in value. They will claim what they are offering is low-risk and will provide quick and high returns.

Two other types of investments where scams are prevalent are cryptocurrency trading and binary options. Cryptocurrency trading scams have grown significantly in the past 12 months and are now the second most common type of investment scam offer pushed on victims.

According to Scamwatch, the clearest warning sign that one may be dealing with an investment scammer is how they contact their potential victim and the promises they make. Any claims like ‘risk-free investment’, ‘low risk, high return’, ‘be a millionaire in three years’, or ‘get-rich quick’ signify that one is dealing with a scammer.