Australians report record losses due to investment scams in November 2017

November 2017 saw a record-high for losses to investment scams in Australia, according to the latest data from Scamwatch.

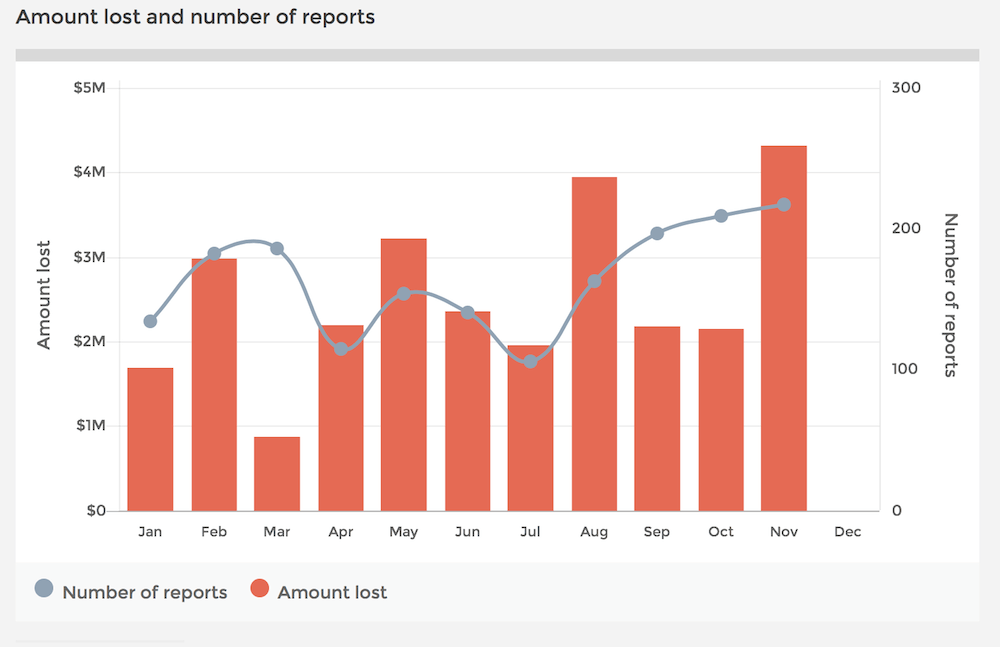

Australians reported losses of $4,321,946 due to investment scams in November 2017, according to the latest data from Scamwatch, the body run by the Australian Competition and Consumer Commission (ACCC). This is roughly two times higher than the amount lost to such fraudulent schemes in October 2017 and is the highest amount of losses reported since the start of such measurements in early 2015.

The biggest losses were suffered by people aged over 65, followed by those between 35 and 44 years of age. The residents of Victoria and New South Wales were most active in reporting investment fraud last month. The total number of such reports reached 217, with approximately half of the reports coming from Victoria and New South Wales.

Since the start of 2017, Australians have reported more than $27.8 million lost to investment schemes, with a total of 1803 reports submitted in the first 11 months of 2017.

Scamwatch has recently warned of a rising number of Bitcoin-related scams. The organization received a total of 77 reports about Bitcoin-related scams in the week to October 29, 2017, with the number up 126% from the previous week. A typical example of such a scam is an SMS saying that a person has a certain number of Bitcoins in his/her account and then asking the potential victim to check (log into) the account.

The numbers from Scamwatch were released shortly after the Australian Communications and Media Authority (ACMA) also voiced its concerns about the increased number of fraudulent schemes involving cryptocurrencies. ACMA warned the public of scams targeting people who use crypto currencies like Bitcoin and Ethereum. In particular, the authority noted a number of fake Blockchain URLs and a Bitcoin survey that are indeed scams that aim to collect personal information.