Australia’s Financial Ombudsman Service receives record number of disputes in 2017/18

FOS received 43,684 disputes in 2017-18, up 11% from last year.

Australia’s Financial Ombudsman Service (FOS) received a record number of disputes in 2017-18, according to its Annual Review.

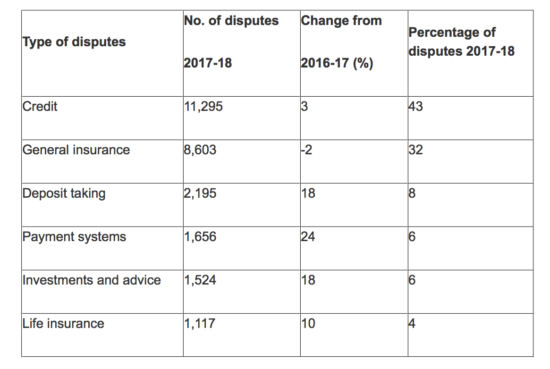

FOS received 43,684 disputes in 2017-18. This marks an 11% increase from last year, following a 16% increase from 2015-16.

The increase in 2017-18 reflects growing dispute numbers in all categories, especially later in the year. The unprecedented dispute numbers may be explained by increased awareness of FOS due to its community outreach activities over several years, attention on the sector brought about by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry and public debate about the future of external dispute resolution.

FOS accepted 22,962 disputes into Case Management in 2017-18, up 2% from the preceding year.

Across all these disputes, the main products in dispute were credit cards (15% of all disputes), home loans (10%) and motor vehicle – comprehensive insurance (10%). The main issues were denial of claim (8%), claim amount (7%) and failure to follow instructions/agreement (7%). Of all these disputes, banks were involved in 43%, general insurers 28% and credit providers 9%.

A key focus again has been on systemic issues. FOS identified and referred 306 possible systemic issues to financial firms for response and resolved 91 definite systemic issues. More than 295,000 customers were estimated to have been affected by the systemic issues we investigated.

This Annual Review is the last one for FOS. From November 1, 2018, a single financial services dispute resolution scheme, the Australian Financial Complaints Authority (AFCA), will begin receiving disputes. AFCA replaces FOS, the Credit and Investments Ombudsman (CIO) and Superannuation Complaints Tribunal (SCT).

Let’s recall that Australian financial services providers that work with retail clients have until September 21, 2018, to become members of AFCA. The membership is mandatory.

Last week, the Australian Securities and Investments Commission (ASIC) said it had approved AFCA’s Complaint Resolution Scheme Rules and the Terms of Reference of the AFCA Independent Assessor (IA).