Australia’s Financial Ombudsman Service registers 14% Y/Y rise in derivatives & securities disputes in 2016/17

One of the problems is that most retail investors do not obtain personal financial advice before trading in CFDs, which were at the centre of 29% of all derivatives disputes in 2016/17.

The Australian Financial Ombudsman Service (FOS) has earlier today posted its Annual Review for the 2016-17 financial year (the year to June 30, 2017), with the data underlining the growth in disputes concerning various financial products, such as derivatives/hedging instruments, which include contracts for difference, foreign currencies, forwards, futures, options and swaps.

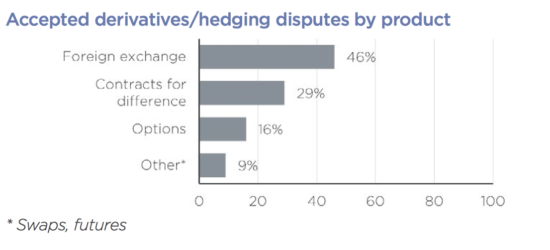

In 2016-17, FOS accepted 113 disputes about these products, accounting for 9% of investments and advice disputes. The most common issues in this category were Financial services provider (FSP) decision (35%), disclosure (17%) and service (12%). Nearly a half (46%) involved foreign exchange transactions, followed by CFDs (29%).

FOS saw a 14% increase in the total number of disputes involving securities and derivatives in the past year and noted the importance of understanding the risks associated with products like CFDs.

FOS saw a 14% increase in the total number of disputes involving securities and derivatives in the past year and noted the importance of understanding the risks associated with products like CFDs.

In its Regulatory Guide 227 (RG 227), the Australian Services & Investments Commission (ASIC) noted that the complexity and risk of CFDs means they are unlikely to be appropriate to meet the investment objectives, needs and risk profile of many retail investors. ‘The problem is exacerbated given most retail investors do not obtain personal financial advice before trading in CFDs,’ ASIC said. Several recent disputes have concerned whether the FSP undertook an inadequate assessment of a client’s suitability to open a trading account.

Also, FOS said in its report, online platforms trading in derivatives and hedging products are often based on unilateral client agreements that are drafted to give the FSP power to protect their interests by reversing or cancelling contracts, varying prices or correcting ‘errors’.

Several of the recent disputes that FOS had to handle were about the right of an FSP to rely on its terms and conditions to close out positions. Other disputes were about the FSP’s platform being unreliable, causing the applicant loss because they were unable to trade. In such disputes, FOS consider the FSP’s conduct and rights in the context of what is fair in the circumstances and not just strict adherence to the terms and conditions.

Australia’s dispute resolution framework is about to change, with FOS backing the establishment of a single external dispute resolution body to be called the Australian Financial Complaints Authority.