B2Broker Expands Into Europe with B2Prime, a CySEC-Regulated Multi-Asset Liquidity Provider

B2Broker, a major technology and liquidity provider in the Forex/CFDs and Cryptocurrency sectors, has announced that it has broadened its worldwide reach through B2Prime, a Cyprus-based financial institution registered and supervised by the CySEC, to enter the heavily EU-regulated Forex/CFDs market.

Following the completion of the relevant legal processes for the change of ownership, B2Broker now has a stake in B2Prime. Artur Azizov, the Founder and CEO of B2Broker Group, and Evgenia Mikulyak, the co-founder of B2Broker Group, are the new proprietors of B2Prime. B2Prime’s new CEO is Nick Chrysochos. This decision reaffirms the group’s commitment to providing global investment services through a liquidity provider licensed by one of the world’s most prestigious financial markets regulators.

About B2Prime

B2Prime is a regulated worldwide Prime of Prime (PoP) Multi-Asset Liquidity Provider that serves professional and institutional clients across the capital markets. Its primary investing offerings are leveraged derivative CFDs (Forex, metals, commodities, shares, indices, and cryptocurrencies).

B2Broker Group of Companies

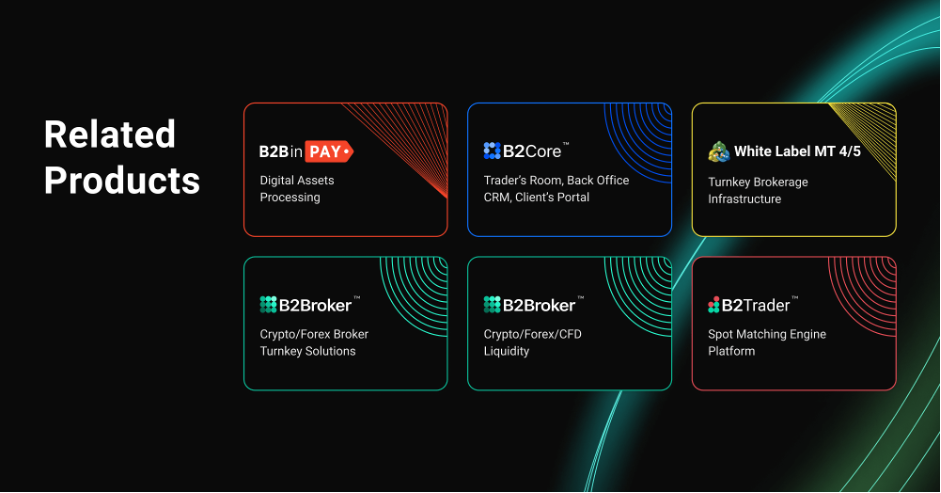

B2Broker is a worldwide brand with a strong B2B reputation. It is one of the most prestigious technologies and liquidity providers for crypto and Forex brokers, crypto exchanges, and other financial services firms. Crypto/Forex/CFD liquidity, Crypto/Forex Broker turnkey solutions, crypto payment processing (B2BinPay), MT4/5 white label solutions, B2Core (Trader’s Room), B2Trader (Matching Engine), and liquidity on over 800 trading instruments across the entire spectrum of assets are among the services offered by the company.

B2Broker, based in Moscow, has ten offices in eight locations spanning Russia, Europe, Asia, the Middle East, and North Africa. B2Broker has a total of seven licenses, including the FCA, AEMI, and the Central Bank of Russia, allowing it to serve clients in more than 50 countries and provide Forex liquidity distribution as well as a variety of additional services to the Forex, Crypto, and Securities sectors. The group of companies has built a massive portfolio of well-known global financial services clients to expand corporate representation and exposure across the world.

What Does It Mean for Clients?

Cyprus’ financial regulator, CySEC, establishes a regulatory framework within which the country’s licensed financial services firms must operate. As a CySEC-regulated broker, B2Prime is bound by the most stringent financial market regulatory norms, including capital adequacy requirements, customer money segregation, and company operations transparency.

Clients from the EU, the United Kingdom, and many other third-country jurisdictions can now be safely onboarded under EU MiFID II regulatory norms. Through an EU financial services brokerage license, B2Broker may now expand its footprint in the European Union and give customers the chance to experience the organization’s comprehensive product and service offering while setting itself on an expedited global growth path.

“We are thrilled that B2Prime has received CySEC clearance,” said Arthur Azizov, CEO of the B2Broker group of companies. “We now can provide institutional-grade liquidity to clients in over 30 countries thanks to the license. Meanwhile, our clients will be able to enjoy increased security, confident in the knowledge that they are backed by a world-leading, multi-regulated technology and liquidity provider. We believe that now that we have received CySEC approval to provide our investment liquidity services, we will be able to position ourselves as one of the strongest and most trusted organizations in the industry, allowing our clients to feel at peace when trading with us.”

“My ambition is to make B2Prime one of the most stable and reputable financial services organizations in the Forex industry, with a high level of service offering being our main emphasis,” Evgeniya Mykulyak, B2Prime’s owner and Executive Director, stated. “I’m excited to learn about the numerous new prospects in Europe that are accessible to us, as well as to welcome new clients on board. The development of additional trading platforms for connection and the continuous expansion of our Prime of Prime liquidity services will be part of our efforts. We are already establishing a solid liquidity provision network in the European market and have formed agreements with key Prime Brokers. We also intend to join several exchanges, establishing B2Prime as a prominent participant in the financial services business.”

“With Artur Azizov’s long experience and solid credentials in the Forex and Crypto space, and Evgeniya Mykulyak’s deep industry know-how and clear vision for the company, we will be able to provide advanced, cutting-edge technology so that our clients can trade with the confidence of knowing that their trading activities are managed by a reputable firm that adheres to the most stringent regulatory standards of CySEC,” B2Prime CEO Nick Chrysochos added.

Final Thoughts

B2Prime has already begun accepting new clients and can link brokers to 115 Forex pairs, 22 Crypto CFD pairs, Spot Metals, Indices, and Spot Energies through the OneZero, MT5, and PrimeXM platforms.

B2Broker’s most recent license acquisition is part of the company’s larger strategic aim to have a presence in all major jurisdictions, to become a worldwide liquidity provider. The company’s continued success and expansion are reflected in the start of commercial operations in Cyprus. It will continue to deliver some of the market’s most excellent liquidity and trading services.