B2Broker Integrates Match-Trader Solution to Expands Its White Label Liquidity Offering

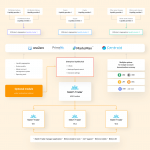

A global provider of technology and liquidity for the FX and cryptocurrency markets, B2Broker recently announced the extension of its white label liquidity offering by merging with Match-Trader.

Through this new integration, customers will have access to a full white label solution, fiercely competitive advertisements, and ready-made B2Core connectivity. After integrating cTrader in 2022, the integration of Match-Trader is simply the most recent in a string of developments by B2Broker. This connection demonstrates B2Broker’s dedication to offering its clients a comprehensive and flexible service.

Match-Trader White Label Model

Match-Trader is a comprehensive suite of services that B2Broker offers to its brokers and clients through white label model. With this latest offering, brokers are able to consolidate all essential technology into a single package, which allows them to save substantially on operating costs. In addition to B2BinPay (crypto payment processing) and B2Core (CRM system) technologies, it also offers access to B2Broker’s Prime of Prime liquidity pool.

Featuring an impressive range of features and services, Match-Trader makes online trading simple and convenient. Aside from round-the-clock server support and 24×7 technical support, you’ll also have access to dedicated account managers, who can assist you in navigating the brokerage world. White label packages also include training sessions to ensure your staff is fully acquainted with the technology.

With Match-Trader white label, businesses are able to benefit from competitive trading commissions and favorable volume charges. Additionally, no setup fees are charged, and the platform configuration is free. Customers are required to make a minimum three-month liquidity fee as their first investment. It’s even more attractive because, in addition to the regular monthly minimum liquidity and connectivity obligations, these customers can avail of a grace period of one calendar month plus the remaining days from the time of set-up.

Integration of B2Core and Match-Trader

Additionally, B2Broker provides a ready integration of Match-Trader with B2Core as part of its white label offerings. According to the B2Core ecosystem, Match-Trader will function in a similar manner to other platforms. Brokers may offer their consumers the same high-quality experience, enabling them to open or manage their accounts in the trader’s room with instant access to the platform.

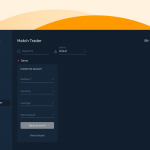

With Match-Trader, you can create a margin trading account pretty easily through B2Core. It is first important to create a user account for each of your trading accounts in order for them to be linked together. Match-Trader can be linked to your margin trading account once you have created your user account.

With the recent addition of the Match-Trader section in the Platforms tab, the B2Core team is promising a wide range of exciting features and capabilities. Users are able to experiment with different trading strategies in real time by creating both demo and live accounts. Further, deposits, withdrawals, transfers, and internal transfers are now possible through the platform. Furthermore, the dedicated Match-Trader terminal can now be downloaded directly from the website, making it easier for users to access the platform.

Verdict

Through the integration of B2Broker with Match-Trader, brokers are able to offer their customers an online trading experience that is both comprehensive and exciting. Designed for businesses that want to take advantage of advanced technology, this package provides business owners with powerful tools at their fingertips. An array of new opportunities will be opened up when Match-Trader is integrated into IB programming. In addition to delivering user-friendly functionality, Match-Trader’s integration with IB should enable traders to access a wide range of professional grade options, regardless of project size or complexity, that will meet their trading needs.

Furthermore, Match-Traders will be integrated with B2Core mobile shortly, allowing brokers to offer both platforms to their clients. Watch for these game-changing products in the near future!