B2Broker Presents B2Core REST API v2.1 with New Features On Board

User management, KYC verification, and the creation of currency wallets are just a few of the new methods for back-office and front-office operations that are included in the new API.

A brand-new REST API 2.1 release was rolled out by B2Broker, leading professional provider of turnkey, technology, and liquidity solutions for Forex brokerages, crypto exchanges, and CFD companies. User management, KYC verification, and the creation of currency wallets are just a few of the new methods for back-office and front-office operations that are included in the new API. Brokers will be able to provide their clients with a better experience thanks to this increased flexibility and control over their business processes.

Back-Office API

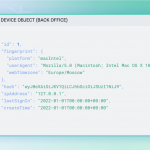

For the purpose of retrieving more user information, the team has expanded the back-office API. Now, the API may be used to obtain the user type (whether individual or corporate), phone number, address, and device print (IP address of the device, browser, operating system, and time zone). Organizations would benefit from this development since it will help them focus their marketing efforts and understand their customers better. The new information will also aid with fraud protection and customer service. As a consequence, all B2Core consumers will receive higher-quality service based on increased insight into customers’ behavior.

The team also included crucial tools for back-office user management, including ways to add, edit, and remove users. Due to its increased versatility and usability, this is a great addition for brokers who need to manage their back-office users. Furthermore, by using these methods, you will have more control over the data that is kept in the back-office and be able to get rid of unused users.

The new Rest API now offers ways to obtain the current exchange rates. The techniques are simple to use and provide quick access to the rates of several currencies. Furthermore, the integrity and dependability of the data made available by the API guarantee that users may make deliberate and confident financial decisions.

The main category of methods that emphasizes the most recent REST API upgrade is the KYC methods. With the use of these methods, handling all the verification functionality provided by B2Core is now simpler than before, as well as the front- and back-office systems. Utilizing these new KYC methods, admin users can completely tailor verification records, alter the level of verification, and manage the end-users overall verification.

Front-Office API

For front-office users, the API now enables the creation of currency wallets. This is an intriguing development since it gives these users new opportunities for platform interaction. For instance, they can now make wallets for several currencies and use them to more securely handle and store their money. The API also enables creating several wallets for one user, providing them with even more convenience and flexibility when it comes to managing their finances.

Conclusion

The new B2Core API v2.1 has the B2Broker team confident in further success! The team is sure that the inclusion of many new features and enhancements in this update will provide users an even better experience. In order to give you the most outstanding service possible, B2Broker is dedicated to doing everything within its power to make B2Core the most beneficial solution for your company.