B2Trader Now Offers 100×100 Order Book with Up to 100 Currency Pairs

B2Broker is excited to introduce the newest edition of B2Trader, the matching engine built for cryptocurrency exchanges, market makers, spot brokers, and MTF brokers

B2Broker is excited to introduce the newest edition of B2Trader, the matching engine built for cryptocurrency exchanges, market makers, spot brokers, and MTF brokers. With this version, we have increased the number of pairs accommodated to 100 while still maintaining the same order book depth. If you’re a trader, this upgrade will enable you to place larger orders and have a more smooth trading experience in general. If you are a broker, you will be able to offer your clients a more sophisticated trading platform that can handle larger trade sizes. By making this improvement, B2Broker is again demonstrating its commitment to providing the best possible service to all its customers.

Improved Matching Engine With More Trade Pairings

With our update, B2Trader can now handle 100 pairs of any instrument with a market depth of 100×100 — an increase from the 61 trading pairs the engine could previously handle. Roughly doubling the engine’s effectiveness, this update offers users a wider variety of trading instruments and more possibilities to profit.

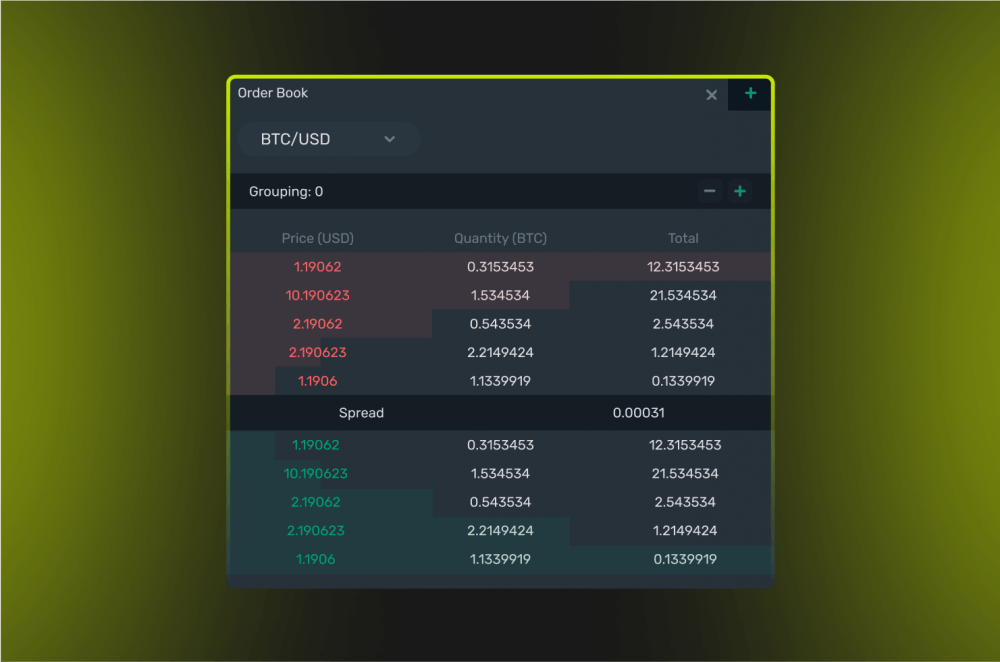

When viewing an order book for a particular asset, market depth tells you how many orders are there at each price level. Because the market depth is 100/100, you will see the top 100 buyers and sellers. In other words, traders will be more willing to place bigger orders because they know there is enough liquidity to cover them.

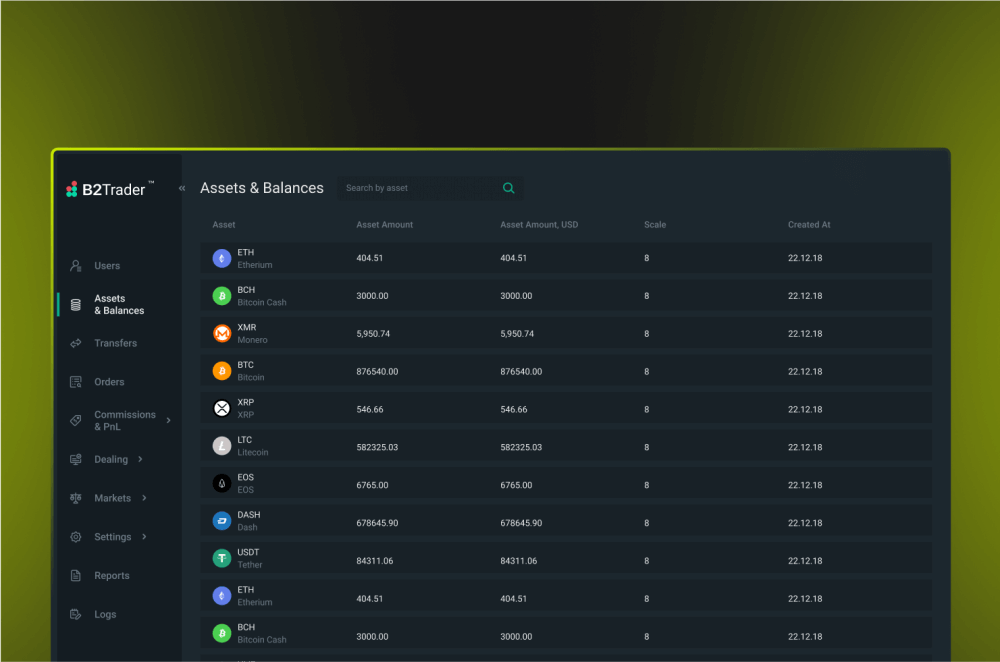

When it comes to adding new trading instruments to your platform, you have two choices. The first option is to import the B2Trader markets into your cabinet using the admin control panel. The second choice is to select preferred markets from the drop-down menu and fill out the checklist. Once your exchange is in maintenance mode, the B2Trader staff will add the requested assets.

Closing Thoughts

The team at B2Broker is constantly on the lookout for methods to improve the company’s quality of services, and we are dedicated to making huge improvements at all times. Our recent upgrade is a big step in the right direction for us, as our goal has always been to provide our users with the best experience possible. Our company believes that the new update will be helpful to our clients and enable B2Trader to become the most popular platform for all their trading needs. We hope that you enjoy the new additions and find them extremely useful. If you haven’t already tried B2Trader, it’s time to get started! Also, B2Trader will continue to improve and expand in the future, so keep an eye out for more updates in the near future. If there are any issues or concerns, please do not hesitate to contact us anytime.