Bank of America adds more features to AI-driven virtual assistant Erica

Credit card bill reminders and Spend Path are among the new functionalities added to Erica.

Erica, Bank of America’s AI-based virtual assistant, continues to gain popularity among the bank’s clients and to get additional functionalities. Bank of America has announced the introduction of Erica® Insights – a raft of features, allowing clients to better manage their spending habits, track their credit rating and monitor their subscriptions.

Erica’s initial insights will include:

Erica’s initial insights will include:

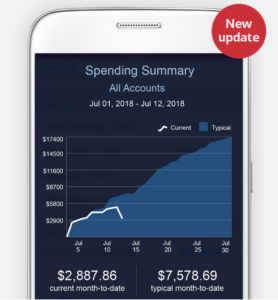

- Spend Path: Provides a weekly snapshot of month-to-date spending.

- FICO® Score Tracker: Helps to track important month-to-month changes to FICO® scores.

- Subscription Monitor: Flags upcoming recurring charges.

- Credit card bill reminders: Sends alerts for upcoming Bank of America credit card payments due.

Aditya Bhasin, head of Consumer, Small Business and Wealth Management Technology for Bank of America, explains:

“Since the launch, we’ve integrated more than 200,000 different ways for clients to ask financial questions and expanded Erica’s conversational knowledge. We are introducing this new suite of more complex capabilities based on insights, behaviors and real-time feedback from millions of Erica users.”

Launched earlier this year, Erica employs the latest technology in AI, predictive analytics and natural language to help clients better meet their financial needs. Erica recently surpassed more than 3.6 million users and has assisted with more than 12 million client requests to date. When seeking Erica’s assistance, 43% of users are interacting via text, closely followed by tap (32%) and voice recognition (25%).

Bank of America continues to add updates and features to Erica based on client feedback.

Let’s note that when Bank of America published its financial results for the third quarter of 2018, it reported continued growth in digital usage at the consumer banking segment. The segment marked 25.9 million active mobile banking users, up 10% from the equivalent quarter in 2017, whereas digital sales climbed and now account for 23% of all Consumer Banking sales. Mobile channel usage is up 17% from the year-ago quarter.

Brian Moynihan, Chairman and Chief Executive Officer, commented the robust results for the third quarter of 2018, noting the bank’s “high-tech, high-touch approach continues to drive both client satisfaction and efficiencies”.