Bank of America marks net income of $4bn in Q1 2020

For the three months ended March 31, 2020, reserve build of $3.6 billion is calculated as provision for credit losses of $4.8 billion less net charge-offs of $1.1 billion.

Bank of America has earlier today reported its financial results for the first quarter of 2020.

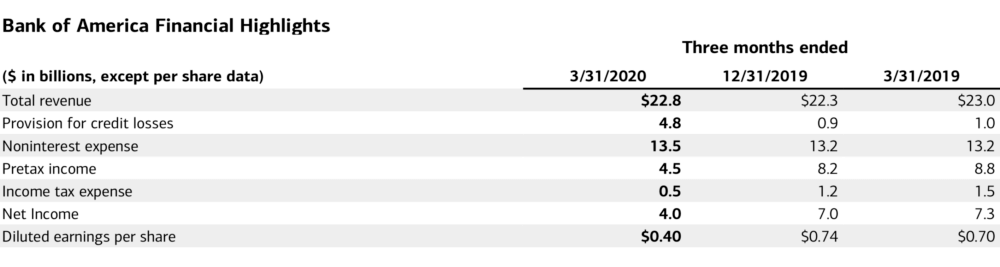

Bank of America registered net income of $4.0 billion, or $0.40 per diluted share, in the first the months of 2020. This includes higher provision expense for COVID-19 related reserve build. For the three months ended March 31, 2020, reserve build of $3.6 billion is calculated as provision for credit losses of $4.8 billion less net charge-offs of $1.1 billion.

Pre-tax income declined 48% from the year-ago quarter to $4.5 billion, whereas pretax, pre-provision income is down 5% to $9.3 billion.

Revenue, net of interest expense, decreased 1% from the same quarter a year ago to $22.8 billion.

Average loan and lease balances in the business segments rose $57 billion, or 6%, YoY to $954 billion.

Ending loan balances rose $68 billion, or 7%, since Q4-19 to $1.0 trillion, whereas average deposit balances rose $79.5 billion, or 6%, YoY to $1.4 trillion. Ending deposit balances marked a rise of $149 billion, or 10%, since Q4-19 to $1.6 trillion.

Common equity tier 1 (CET1) ratio declined slightly but remained strong at 10.8%

Chief Financial Officer Paul Donofrio commented:

“Ten years ago, we set out to transform our business and operate under the principles of responsible growth so we would be a source of strength in the next crisis. Our results this quarter reflect our progress: our strong earnings power allowed us to increase loan loss reserves while generating $4.0 billion in net income for shareholders. During the quarter, we suspended our buyback program to provide additional support to the economy. We also continued to invest in our people and our systems so we could deliver for consumers, small business owners and large corporate clients. We remain well-positioned to support our clients and deliver for all our stakeholders.”

Chairman and CEO Brian Moynihan said:

“We remain a source of strength – our customers trusted us with $149 billion in additional deposits since year-end, which enabled us to provide liquidity to people, small business owners and corporate clients. We received nearly a million requests for assistance and we announced a $100 million commitment to provide critical support to local communities. We are taking extraordinary steps to support our employees, clients and communities during this humanitarian crisis.”