Bank of England confirms implementation of SONIA reforms

SONIA now captures a broader scope of overnight unsecured deposits, by including bilaterally negotiated transactions alongside brokered transactions.

In line with previously announced plans, the Bank of England today confirmed the implementation of its reforms to the SONIA interest rate benchmark.

The Bank’s goal in reforming the Sterling Overnight Index Average (SONIA) is to strengthen a benchmark which is considered crucial for the sterling financial markets. Previously, the benchmark was based on a market for brokered deposits which has limited transaction volumes. It now captures a broader scope of overnight unsecured deposits, by including bilaterally negotiated transactions alongside brokered transactions. Volumes underlying the rate based on the new methodology now average around £50 billion daily, over three times larger than those underlying SONIA previously, the Bank said.

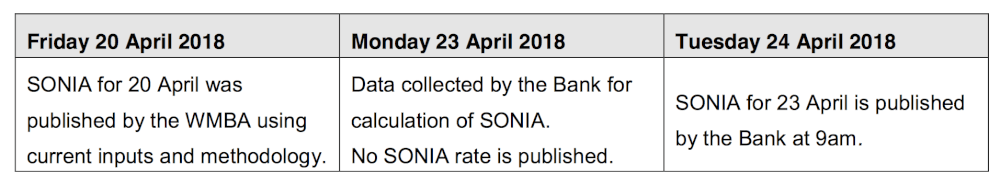

In addition to the methodological changes, the publication time of SONIA has been moved. As a result, the SONIA rate for a given London business day is now published at 09:00 on the following London business day. As previously guided, the SONIA rate for today will be calculated by the Bank using the reformed methodology and published at 09:00 tomorrow. No data will be published today.

About a year ago the Bank said it would promote SONIA’s use as an alternative to sterling LIBOR, which has been plagued by a multitude of scandals over the past few years. In the UK, the Financial Conduct Authority is overseeing the reform of Libor (including sterling Libor), whereas the Bank of England is overseeing the development of sterling RFRs.

Chris Salmon, Bank of England Executive Director for Markets, said back then: “Work must now begin on planning for the widespread adoption of SONIA, in consultation with a broader set of market participants. This will lead to more effective interest rate hedging markets for end-users, while minimising opportunities for misconduct.”

In November 2017, the UK Financial Conduct Authority (FCA) published a statement on LIBOR panels. The panel banks have agreed to support LIBOR until the end of 2021, but there are some changes to the panels. The FCA said that there will be two amendments to individual panel compositions. Societe Generale will cease submissions to the US Dollar panel and Credit Agricole Corporate and Investment Bank will cease submissions to the Japanese Yen panel. Both banks will keep submitting to all other panels to which they contribute at present.

All of the 20 panel banks have provided their support and the FCA does not expect to see any further changes to the LIBOR panels.