Bank of England warns firms keep writing new Libor contracts despite pending discontinuance

In particular, in loan markets, Libor-linked lending continues to dominate, according to a piece of analysis prepared by the Bank of England.

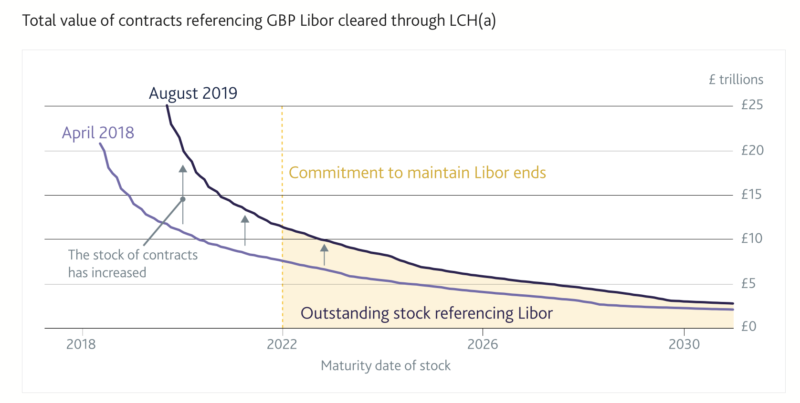

The Bank of England (BoE) has earlier today published an analytical piece regarding the preparedness of markets for the end of Libor. The contents of the article resemble that of a similar piece of research posted by the BoE in June 2018 when it warned that market participants keep accumulating Libor-linked sterling derivatives for periods after 2021.

Today, the Bank said that, as Libor is poised to be discontinued after end-2021, the use of alternative interest rate benchmarks is steadily increasing. However, use of Libor remains widespread, and this poses risks to market stability.

Users of Libor are expected to prepare by transitioning to alternative, more robust benchmarks, such as overnight risk-free rates.

In sterling markets, the primary alternative is SONIA, which is published by the Bank of England and based on an average of over £40 billion of transactions each day. This supports a well-established and growing derivatives market, and has rapidly become the benchmark of choice for floating rate bonds over the last year.

Let’s recall that, in June 2019, Dave Ramsden, Deputy Governor for Markets & Banking at the Bank of England, voiced a somewhat upbeat stance about the process of moving away from Libor. He said there had been real progress in establishing SONIA as the successor to sterling Libor. In the preceding six months there had been a number of positive developments in the sterling cash market, he noted. For instance, SONIA linked floating rate note (FRN) issuance dominated sterling floating rate financials issuance and there was clear momentum towards using the compounded SONIA rate across bond markets.

Today, BoE said that, despite the progress in establishing alternative reference rates and in building these new markets, much more work is needed to complete the transition, as many new contracts maturing beyond 2021 continue to reference Libor.

In particular, in loan markets, Libor-linked lending continues to dominate, the Bank warns. And many new long-dated derivative contracts also continue to reference Libor, with steady growth in the stock of cleared sterling Libor swap contracts maturing beyond 2021.

The Bank notes that firms now have to focus on shifting new business from Libor to alternative rates, and should put in place a clear transition plan to mitigate their legacy risk from older contracts. Firms are expected to be able to run their business without Libor from the end of 2021, so it is not in their interests to continue to increase exposures to Libor, or to have a large stock of legacy contracts that will become subject to significant legal uncertainty beyond that point, the Bank said.