Well capitalized FX brokers are high risk, yet retail borrowers with no job and no money are not? So say Britain’s banks

Well capitalized FX brokerage or PoP and want credit from a large bank to operate a brokerage? No chance. Got no money, no job and want a 95% mortgage? No problem.

Here in Britain, some of the world’s largest banks split their business between the Tier 1 interbank electronic trading business, six banks in Canary Wharf handling 49% of all global interbank liquidity for the entire FX market.

Among those banks, some are British by origin, and some are European or North American, yet their Canary Wharf operations that handle FX order flow are intrinsically British business units. Citigroup, the world’s largest FX dealer by order flow, may have its roots in Chicago and New York, however it processes 16.1% of the world’s FX business via its Docklands location in Canary Wharf, London.

The largest British banks in terms of interbank FX order flow are Barclays (via the BARX platform), with 8.11% of the global market share, HSBC with 5.4%, RBS with 3.38% and Standard Chartered with 2.4%. OK, Standard Chartered is South African, but it is a completely British venture from historic times until now.

These are the very same banks that exposed themselves to vast unrepayable loans to retail customers, including credit cards, unsecured borrowing and perhaps even more remarkably, allowing retail customers to make their own declarations about their earnings and existing assets, which often were wildly exaggerated, meaning that mortgages were granted to those who could not afford to meet the commitments, ultimately contributing to the collapse and government acquisition of many major British banks.

Some 8 years have passed since the dark days of the bank runs and the credit crunch, however an investigation by FinanceFeeds demonstrates that the banks are shunning well capitalized FX brokerages and restricting prime of prime relationships even to firms with massive capital bases and highly complex risk management policies in place, yet the very same banks are making a return to offering 95% loan-to-value mortgages to retail consumers with no savings and no real proof of income or collateral to guarantee the repayment.

Added to this, the banks are not even profiting from this very much, as the interest rates are so low that they are almost negligible.

In the FX brokerage business, one of the most difficult professions is to head a division of a liquidity provider or prime brokerage in a capacity which requires forging and maintaining relationships with banks. The butting of heads over where to dispatch order flow plus the continual metaphorical grilling that the bank desks give prime brokerages with regard to which flow was offset against what, with a watchful eye on risk all the time.

Companies in London with capital bases of over $500 million and market capitalization figures running into the billions are the bete noire of banks, yet anybody can walk into a retail high street branch of the same bank and walk out with a mortgage secured on a house whose value may go down, not just up, having self-declared a fictitious income and having committed very little personal capital toward the transaction.

Local branches of HSBC and Barclays have set up stands in the front of their entrance halls, with a friendly and polite sales person proactively approaching retail customers who enter the branches to conduct counter transactions to see if they can sell them a mortgage with only 5% downpayment and no ‘bureaucracy.’

However, if you are the head of PB relationships at a large brokerage, you are likely to be butting heads with the risk management teams of the very same banks to get orders processed.

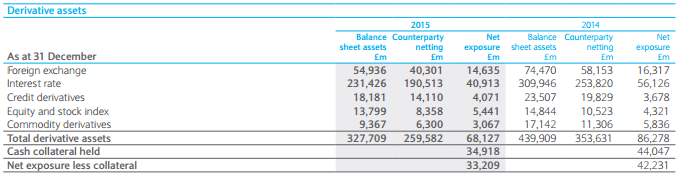

Derivative asset exposures at Barclays in 2015 were £295 billion, which was lower than reported if netting was permitted for assets and liabilities with the same counterparty, or for which Barclays holds cash collateral.

Similarly, derivative liabilities for 2015 stood at £295 billion. In addition, non-cash collateral of £7 billion was held in respect of derivative assets. Barclays also received collateral from clients in support of over the counter derivative transactions.

This is the same bank that began offering a 100% mortgage to retail customers in May this year (!!).

UK household debt is among the highest in the world, despite the flourishing economy and London’s towering financial prowess.

The Office of Budgetary Responsibility has made a forecast that by 2019, household debt in the UK will be 182% of household income, which is not sustainable, yet the same banks that are restricting credit to very conservative, risk-aware and highly experienced prime brokerages and FX firms with huge capital bases.

Credit readily available to those without capital, and restricted to those with capital

Want a bank account with a large overdraft facility, a credit card and a 95% mortgage but you have no savings and no capital? No problem.

Want a bank account to store operational capital for an FX brokerage, no credit at all, and are prepared to deposit £2 million, plus a segregated client money account? The computer says no.

FinanceFeeds spoke to one particular FX brokerage CEO who recently explained that one day, the bank simply closed his company’s account, with no warning, making it impossible to draw money and operate the business. It then took a few days to move to another bank, with lots of reluctance from the bank staff, meanwhile making the operational aspect of the business very difficult indeed. His words were “I will never forgive them.”

All the while, the same banks are profiting from the order flow sent to their interbank FX divisions via aggregated liquidity feeds from the very same brokerages that they are bearing down upon, plus the interbank FX and electronic trading businesses of the banks are far more profitable than the retail banking divisions.

Indeed, many banks are centralizing the retail divisions as having high street branches is no longer a viable business in many cases, yet the FX business makes up a substantial share of their revenues, without having to have a network of physical branches which cater for low-value transactions and vast call centers to support customers.

Banks quietly reintroduced the ‘liar loan’ – a derogatory term used for self-certification mortgages, in January and have now begun pushing them hard.

If you buy a brand new house, it is possible to ask the construction company to pay the 5% downpayment, and then take 95% from the bank, with almost no questions asked.

Whilst quid pro quo has indeed given way to quid pro no quo. Unless of course you have no money and no job, yet want to borrow from a bank.