Banks want to buyout or partner with FinTech startups, but concerns over data abuse rise

FinTech started brewing in the years following the financial crisis, the Dodd-Frank Act and other regulatory policy changes, skyrocketing since 2014 with total funding coming at $12.2 billion with added participation from the banking industry, coming to a total of $19.1 billion in 2015, in a bid to boost efficiency of the business. VC-Backed Fintech […]

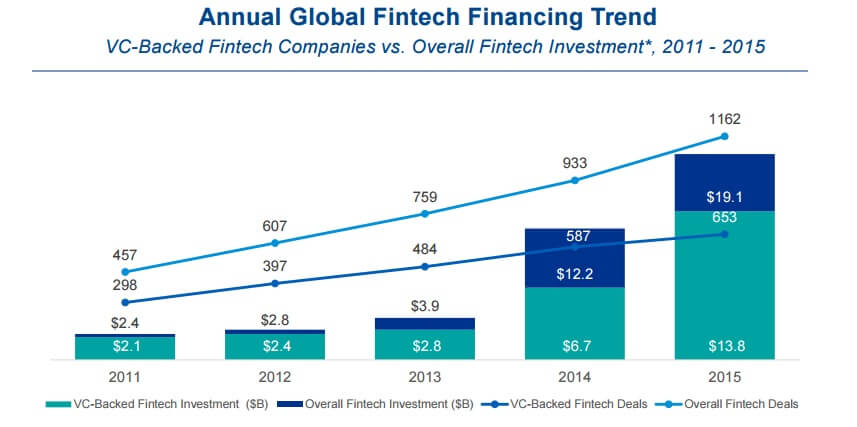

FinTech started brewing in the years following the financial crisis, the Dodd-Frank Act and other regulatory policy changes, skyrocketing since 2014 with total funding coming at $12.2 billion with added participation from the banking industry, coming to a total of $19.1 billion in 2015, in a bid to boost efficiency of the business. VC-Backed Fintech investment continues to lead funding, and saw a 106% growth from 2014 to 2015.

Source: KPMG

The strategy, however, is coming to a change. Instead of buying in as minority stakeholders in startups, big banks are now looking to partner with or buyout startups, making them part of the business.

Lending, payments, billing, personal finance, asset management, money transfer, remittance, digital currency, institutional tools, equity crowdfunding, insurance, p2p, RegTech, Artificial Intelligence, Big Data, Virtual Reality, cloud applications, are some of the areas – many intersecting – where FinTech is disrupting the financial industry.

Big banks have been diversifying their allocation, investing in almost every FinTech area, given their broad position in the financial sector, from investment banking and insurance to retail banking, etc.

While consolidation is the keyword of the year among competitors, startup buyouts are in fashion as consulting firms have been calling for a serious adoption of FinTech if traditional banks don’t want to lose further market share to entrants.

A $275 million deal saw Ally Financial buying online brokerage TradeKing Group earlier this month, and BlackRock acquired online investment firm Future Advisor for $150 million in August 2015. Texas-based online retirement planning service Honest Dollar was sold to Goldman Sachs.

Finnish banking startup Holvi was bought by Spanish bank BBVA in March, and BNP Paribas stroke a partnership deal with SmartAngels just recently, as reported by FinanceFeeds.

A pressured banking sector sees benefits to partnering up with startups as way to avoid potential M&A costs, while promoting efficiency in their processes, but integrate and monetize some of the startups, such as marketplace platforms for unsecured lending, has been a challenge with an increased pain: risk of data spills. JP Morgan Chase CEO Jamie Dimon complained about it this month, saying that some third-party apps take more data than needed for their own economic benefit.

That kind of abnormal behavior could endanger the confidence that the financial sector puts in FinTech startups, leading to reduced real-time access to customers’ bank accounts, where mobile banking and finance management apps are heavily dependent on, and could also affect next funding and partnering moves.