Become rich in 7 days with CopyOp and Anyoption? Yes, and I’m a hobgoblin

We plumb the depths of a false advertising campaign which sets out to dupe customers into a fraudulent binary options scheme by promising very high returns and using Apple Appstore to normalize the experience. The firm itself, operated by convicted fraudsters, is notorious. We approach CySec and receive a very interesting response

Meet Jeremy P., A self made millionaire using a “secret system” and part of a “New world of making fast profit”.

This “secret system” is very popular in the United States and I quote “The system was so popular, it could have turned the American working-class rich overnight.”

Whilst this is pure sarcasm at its best, we have to point out the malicious intent behind these wholesale ponzi schemes and this one happens to be just as blatant as the homeless man and his red Ferrari.

You, your mother, your sibling, your boss, a nurse, a plumber and just about anyone out there are the target.

We are talking about the dying binary options industry and the crooks that prey on the weak.

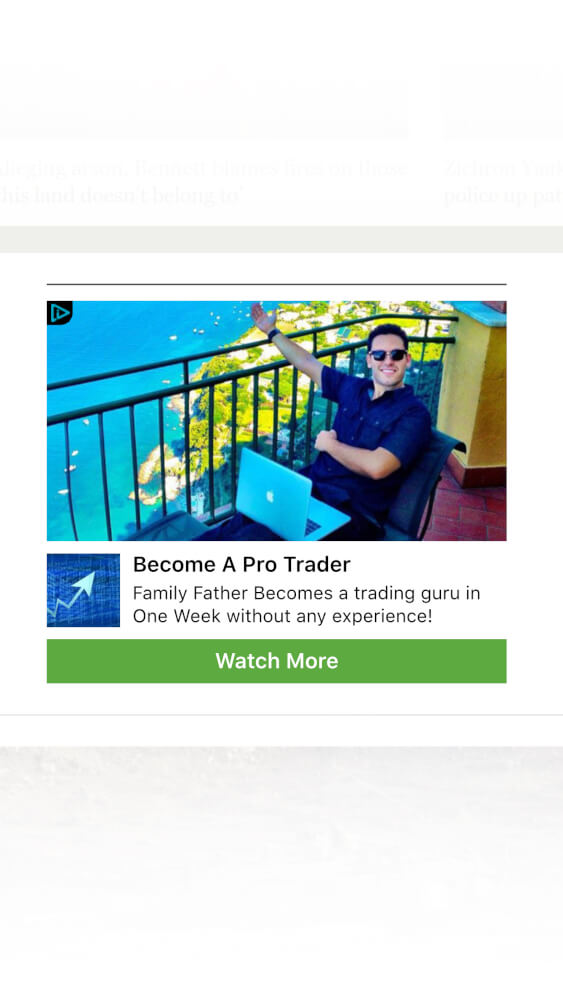

Browsing the web, an unsuspecting member of the public sees an advertisement. This is an actual example below.

The advertisement captures attention and the viewer often clicks through. This brings the viewer to what appears to be a news site. All looks clean, with well written bogus copy about some self made millionaire who has found the secret to success. It even reads like an investigative report where the reporter is on the payroll.

The article leads the now captivated reader through the steps it takes, highlighting the case of a one Mr. Jeremy P. from Birmingham, UK; who, it is claimed, made a whopping $50,000 in 7 days simply from doing… well nothing really, apart from using their secret system.

Clicking on the ‘register now’ link and it takes the reader to the Apple Appstore. Here in a familiar setting, most people are normally very comfortable downloading an app directly from the App store,therefore it normalizes it and often the user will go ahead to download this “secret system”.

Whilst I haven’t gone the extra mile, I can assure you that you will be prompted to sign up to Anyoption as the app itself is owned by Anyoption as the below screenshot proves.

Firstly, in which industries will anyone get away with such false advertising designed and carefully planned to mislead?

Secondly, how in the world would someone like Anyoption whom are regulated with CySec and supposedly operating within the financial services sector, get away with such blatantly false, misleading and malicious advertising?

Here are the facts:

The supposed image of Jeremy P- the self made millionaire from Birmingham is in fact a stock image from Shutterstock (https://www.shutterstock.com/g/nacroba). There is no such site as Investor’s Journal bar an old personal blog which has not been posted to since 2008 (definitely not your active journalist uncovering the truth).

The pass through or third party “news portal” splash page is actually one I have seen before many times with similar ad setups (tradingbinaryoption.com). Again, all WhoIS info is blocked / private thus no further information bar a domain parking page provided by GoDaddy.

Anyoption- naughty naughty naughty….

Looking at the full URL– it is clear the parking page is just a smokescreen to make the domain appear offline. The full link to the article shows this particular domain is not only in use but in use with intention by pros. It has a CDN (content delivery network) setup to serve pages / images and as seen in the past subdomains per “advertiser”.

Whilst we will refrain from linking tradingbinaryoption.com directly to Anyoption (we don’t want to “wind up” some defender of binary options crooks, usually in the form of a third-rate lawyer), I can assure you that Anyoption has indeed purchased this ad if they aren’t the direct owner of the domain itself.

This is not some “by accident” or “gosh, how’d that get there- must be posted by a third party” nonsense. This is intentional and a way to avoid regulatory requirements around advertising financial products.

It is worth bearing in mind that Anyoption, which is one of the largest binary options brands globally, is owned and operated by Shay Ben-Asulin, who was charged by the Securities and Exchange Commission in America in 2011 for participating in pump-and-dump schemes and for engaging in a fraudulent scheme to conceal the sales of millions of shares of their companies, netting him and his 7 accomplices $33 million, yet he went on to found a large binary options brand after this, continuing to satisfy his thirst for ripping people off.

What does Anyoption have to say about this?

FinanceFeeds contacted Anyoption for a comment and in order to gain their perspective on the rationale behind this, to which no comment was proffered.

Anyoption and CySec- what we know…..

FinanceFeeds approached CySec, the regulator which provides Anyoption with a license to peddle these services. Our findings with respect to this research was of great interest and with our further investigations bringing the following points to to light:

- Ouroboros Derivatives Trading Ltd (owner of the Anyoption brand) was identified as a high priority firm under CySEC’s Supervisory Action Plan on the financial binaries trading industry, launched in November 2015

- Follow in-depth on-site inspection of Ouroboros, CySEC found multiple failings, including instances that violating the legislation concerning:

- Providing investment advice without authorization

- Company’s executive directors commitment of sufficient time to perform his duties and adequate supervision of the Company’s services/activities

- Adequate and organized records of its business activities and internal organisation

- Complaints handling procedures

- Outsourced marketing activities, including sales & introducing brokers

- Terms and conditions of bonus promotions

- Fair, clear and not misleading marketing communications

- Client suitability requirements

As a result, CySEC issued a €235,000 fine on Ouroboros Derivatives Trading Ltd in March this year

Ouroboros is currently subject to an intense period of follow-up supervision to ensure it implements the necessary corrective measures required to treat the failings found in the inspection which resulted in the fine and CySEC doesn’t treat fines as an end-stop action and will not hesitate to use all the supervisory tools at its disposal, should there be persistent failings.

It is indeed apparent that the propagation of misleading information still prevails. Mind how you go !