Beeks Financial Cloud posts solid metrics for H1 FY2019

The gross profit increased 43% year on year during the six months to end-December 2018 to £1.7 million.

Cloud computing and connectivity provider for financial markets Beeks Financial Cloud Group PLC (LON:BKS) has earlier today published its financial results for the first half of FY 2019, that is for the six months to end-December 2018.

The metrics are overall quite robust, with group revenues up 36% year on year to £3.5 million (H1 2018: £2.57m), on the back of continued organic growth. Annualised Committed Monthly Recurring Revenues (ACMRR) increased by 26% to £7.45 million (H1 2018: £5.93m).

Gross profit earned increased 43% to £1.7 million (H1 2018: £1.20m) and the Group saw an increase in gross margins from 47% to 49% as a result of the previous investments made in capacity now becoming revenue generating. In comparison to FY 2018, gross margins are lower, impacted by the expansion into two new data centres in London InterXion and Singapore. The company target is to reach a monthly breakeven level within 12 months of new territories coming live so these areas are anticipated to become more profitable as it moves into the second part of the year.

Earnings before interest, tax, depreciation, amortisation and exceptional costs (EBITDA) increased by 49% to £0.94 million in H1 FY 2019 (H1 2018: £0.63m) with underlying EBITDA margins increasing to 27% (H1 2018: 25%).

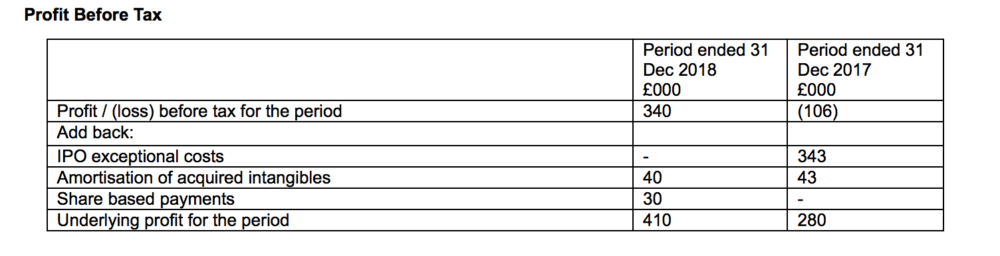

Reported profit before tax increased to £0.34 million (H1 2018: loss £0.11m) as a result of increased sales and improved margins as well as no exceptional costs during the period.

There has also been an increase in Administrative expenses excluding IPO exceptional costs of 45% to £1.30m (H1 2018: £0.90m) due to an increase in staff numbers. Professional fees such as audit and advisory, legal as well as the mandatory compliance costs of being an AIM listed public company have increased by £0.11 million as the comparative period last year only had one month of these costs following the Company’s listing in November 2017.

Beeks’s principal objective is to grow its institutional customer base in the markets for automated trading. Financial institutions around the world are looking to increase their customer offerings and require sophisticated cloud-based technology platforms to do so. Growth is set to be achieved through the entry into new geographies, further development of Group offerings across the asset classes, and the continued evolution of its self-service web portal.

The Group says it has made its first strides into the Tier 1 institutional space with one significant win and other opportunities identified. This was its goal and a key reason for the IPO.

Let’s note that the institutional customer numbers using the platform grew from 192 at June 30, 2018 to 210 at December 31, 2018, and the average entry level new institutional customer contract has increased to £1,825 per month from £900 per month when compared to the same period last year. Institutional revenue, which continues to be Beeks’ focus, now represents almost 90% of total revenue.

Beeks notes its strategic focus on Asia has driven an increase in revenues and it will look to replicate this initial success in South America in the second half of the year.