Belgium’s black list of cryptocurrency schemes keeps growing

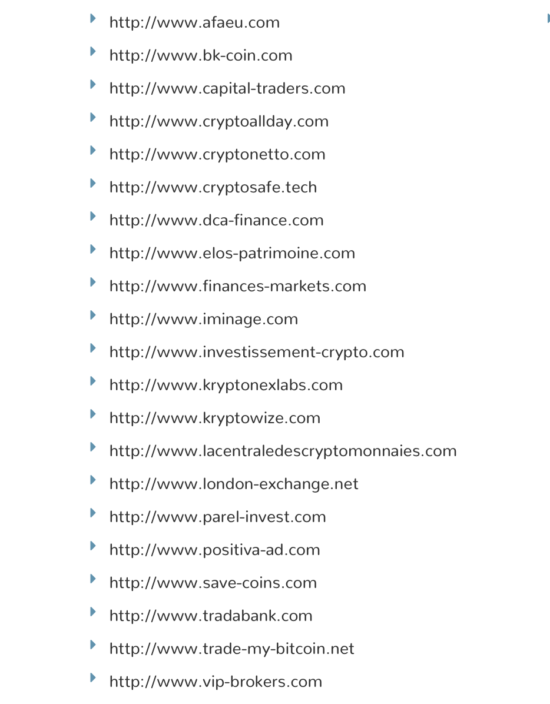

Belgium’s FSMA adds 21 new websites of suspected cryptocurrency scams to its black list.

In the face of numerous warnings concerning the risks associated with investments in crypto-assets, the number of fraudulent schemes related to cryptos is growing. Belgium’s Financial Services and Markets Authority (FSMA) has earlier today updated its “black list” of cryptocurrency schemes targeting Belgian investors.

There are 21 new additions to the list, taking the total number of entries to 99.

The regulator explains that cryptocurrency scammers often approach investors after they have expressed interest in an advertisement published on social media or other websites. Filling in a contact form with one’s email address and phone number typically results in getting a phone call from a salesperson, who provides some “explanations of cryptocurrencies” and directs investors to a certain website.

These types of swindlers are also very active on social media such as Facebook, which they use to promote their ‘investments’. The Belgian regulator warns investors to be careful about ‘liking’ a page.

Investors may also be contacted by phone without having taken any prior initiative themselves. This technique, known as ‘cold calling’, is widely used by investment fraudsters.

Once the fraudsters have investors’ contact details, they offer them an investment they claim is secure, easy and very lucrative. They try to inspire confidence by assuring investors that they do not need to be experts in cryptocurrencies in order to invest in them. They claim to have specialists who will manage investments for the investors. The formulas are various, the regulator notes. These may include proposals to purchase of cryptocurrencies, to open savings accounts based on cryptocurrencies, to enter into management agreements, participate in ICOs, etc.

Regardless of the type of the formula, the misleading promises are usually the same:

- a very high rate of return, often around 8% per month (or more);

- the possibility of withdrawing one’s money very easily and at any time;

- the funds deposited are guaranteed, which means that even if the market collapses, you will recover at least your initial investment, which makes this a very safe type of investment.

All these promises are worthless, however. If an offer is fraudulent, the promises that accompany it are also fraudulent, the FSMA says.

The Belgian regulator started publishing its “black list” of cryptocurrency platforms in February this year. Back then, the regulator explained that all such entities use the same ruse: they claim to offer the best (or one of the best) trading platform(s), enabling both beginners and professionals to trade in cryptocurrencies in a matter of seconds and with full confidence. Also, some of these platforms offer other financial products with cryptocurrencies as their underlying: savings accounts with supposedly guaranteed returns, servicing rights or derivative products such as CFDs.

Less than a month after Belgium, France also started compiling such a “black list”. The variety of such scams has been significant. In June this year, for instance, France’s AMF published a warning about an individual presenting himself as Stéphane Delaplace who claims to be working at the AMF and to be investigating a trading platform operating via www.union-crypto.com/. The regulator noted that it has no employee called Stéphane Delaplace. Furthermore, the trading platform in question is not authorized to provide services to French residents. The AMF sent the information associated with this case to the public prosecutor’s office.