Belgium’s FSMA sees continued activity of fraudulent online trading platforms

Months after the new ESMA rules aiming to bolster investor protection came into effect, fraudulent online trading platforms continue to target Belgian investors.

Whereas pan-European regulators like ESMA have been busy implementing measures that purport to bolster protection for retail investors, scammers continue to target victims via fraudulent online trading schemes. It appears that while regulated brokers face an increasing regulatory burden, fraudulent schemes keep operating undeterred by warnings and black lists.

Earlier today, Belgium’s Financial Services and Markets Authority (FSMA) said that fraudulent online trading schemes attract new victims. This happens in the face of the fact that the Belgian authorities were among the first to introduce a ban on the distribution of binary options, certain CFDs and Forex instruments back in the summer of 2016.

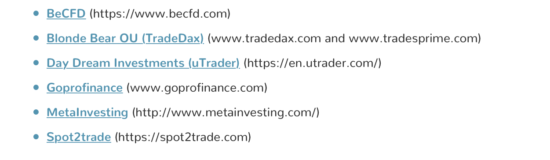

As per FSMA’s announcement, there are at least six new entities that have to be added to its “black list” of illicit entities offering binary options, FX and CFD trading. These are:

The warning is issued less than a week after the Belgian regulator updated its “black list” of cryptocurrency scams. The watchdog added 28 names to the growing list.

Let’s recall that, as per FSMA’s Annual Report for 2017, FSMA launched 241 investigations into illicit financial product offerings last year, with the number down from 273 in 2016.

In those cases where the authority is unable to terminate quickly the illicit activities, it informs the judicial authorities and issues warnings against the entity in question. In 2017, FSMA published 116 such warnings, concerning 99 firms. During these investigation, FSMA has found out that the fraudulent entities are often connected to other entities against which the regulator has earlier taken action.

Earlier this year, the Belgian regulator published data about consumer complaints, showing that it received 1,710 notifications from consumers about various financial matters in 2017, up 13% compared to 2016. Nearly half of the enquiries were questions or complaints relating to fraud and unlawful offers of financial products and services. There were 792 such messages in 2017, up by 45% compared to the previous year.

Most messages reporting fraud or unlawful offers concerned binary options, boiler rooms, pyramid schemes and ‘phishing’. New topics in 2017 included credit fraud, virtual currencies and fraud with investments in diamonds.