Beware! The patent trolls are swamping the FX industry. FinanceFeeds investigation

Via extensive research conducted in conjunction with senior FX industry executives in the technology, integration and platform sectors, FinanceFeeds has concluded that there is currently a serious thorn in the side of the business that is currently expanding its scope, and of which all companies should be aware. What is a patent troll? What is […]

Via extensive research conducted in conjunction with senior FX industry executives in the technology, integration and platform sectors, FinanceFeeds has concluded that there is currently a serious thorn in the side of the business that is currently expanding its scope, and of which all companies should be aware.

What is a patent troll?

What is being referred to here is an entity which is commonly known as a ‘patent troll.’

A patent troll is a person or company that attempts to enforce patent rights against accused infringers far beyond the patent’s actual value or contribution to all information that has been made available to the public in any form before a given date that might be relevant to a patent’s claims of originality.

This is becoming a rapidly increasing, and already quite serious issue for platform vendors, ancillary software providers, integrators and liquidity bridge providers, signal providers, analytics companies and electronic trading software and automation firms.

Patent trolling has been less of a problem in Europe than in the U.S. because Europe has a ‘loser pays costs’ regime, however this has not stopped patent trolls approaching certain British FX technology companies and effectively ambushing them, requiring serious litigation in order to be able to put a stop to their activities.

Rather unbelievably, some companies have previously engaged in lawsuits regarding patent trolling, one of which is North American online trading platform software company ThinkorSwim, headquartered in Chicago, Illinois.

ThinkorSwim is a very long established company, owned by TD Ameritrade, and was founded by Tom Sosnoff in 1999, and according to FinanceFeeds sources, which are senior level American FX industry technology executives, ThinkorSwim is actually licensing some patent troll material in which any company with a revenue of over $10 million gets approached automatically.

ThinkorSwim provides services including thinkDesktop, webBasedTrading, thinkAnywhere, thinkMobile, thinkMicro, and paperMoney, and the ActiveTrader component of such products to provide access to exchanges in Chicago, including the Chicago Board Options Exchange (CBOE).

Five years ago, Trading Technologies sued ThinkorSwim and its owner, TD Ameritrade, alongside six other companies for infringement of patent in the Northern District of Illinois.

The case was closed in September 2015, five years after it was filed.

Trading Technologies sued ThinkorSwim for four patent infringements relating to:

Click Based Trading with Intuitive Grid Display of Market Depth – Patent issued August 3, 2004

User Interface for an Electronic Trading System – Patent issued May 1, 2007

With the lawsuit, Trading Technologies included original material in the form of the patent documentation.

In this particular case, in May last year, a federal judge issued an order staying Trading Technologies’ litigious battle against infringers in seven cases while the U.S. Patent and Trademark Office undertakes a broad review of patent claims.

Trading Technologies objected to the order, however responding to the objection, Judge Virginia Kendall stated that as a result of the Patent Office’s structure, reasoning and determinations will necessarily affect how the court views the remaining claims, and that the court concluded that a stay of the consolidated cases is most efficient for the parties, best conserves judicial resources and avoids piecemeal litigation.

A stay, by definition, is a suspension of a case or a suspension of a particular proceeding within a case which means that after five years, and the legal costs associated with this case, no outcome has been reached. The objections were subsequently completely dismissed by the court.

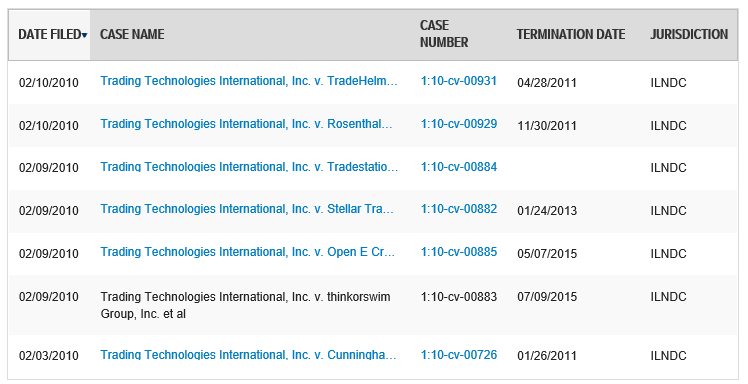

This is just one particular outcome within the several cases at Illinois Northern District court (ILNDC) filed by Trading Technologies, listed here:

This practice has raised its presence yet again this year, as patent trolling increases

On one hand, there are firms willing to invest substantial sums in litigation in order to preserve their patents, however there are other circumstances in which innovators may see patents as an obstacle.

One senior figure with substantial experience in software licensing told FinanceFeeds this week “My opinion is that software patents stifle innovation, I don’t think they’ll exist in the US for much longer and I don’t think many of them are valid.”

This actually points to a similar mindset of that held by the court in the aforementioned case, albeit viewed from a different perspective.

Today, FinanceFeeds spoke to an FX technology provider which had been the subject of a target by patent trolls recently. The company managed to fend them off but explained that it was similar to an ‘ambush’ and was not easy to deal with at all.

Another FX technology vendor explained “My experience of IP trolls was in the context of the US. The primary issue is that in the USA it is risk free to claim patent infringment because the burden of proof is with the defendant, and the defendant cannot claim costs, even if it is a spurious claim. It is only when it goes to court that the troll is at risk of incurring meaningful costs.”

“It is never the intention of the troll to take the matter to court because then they too will incur significant costs (each side would need to spend on average $2million) so it is typically settled on a commercial basis with a license of the patent and a mutual agreement not to sue in the future” he said.

The technology vendor continued

“In a case where the troll is a competitor to the defendant, the competitor often tries to use the settlement as a negative sales tactic in the market, for example, the defendant is “using our technology”. Of course the defendant never gets access to any technology in the license arrangement but only has the right not to be sued for using the methods in the patent. So the distinction between licensing of the patent versus licensing of technology is very important.”

“On the positive side, if you are being sued, congratulations! It means that you have achieved some level of success and that the other party now considers you a threat or worthwhile to sue.”

“I don’t believe that any technology entrepreneur build tech with the intention of breaching patents and never have. My advice if faced with the situation is to minimize the cost and interaction of lawyers as the cost of the lawyers can exceed the value of the settlement. Take the case to the court steps as it is only then that the troll is at risk of incurring costs and their bluff is called” he concluded.

Three FX companies sued for patent infringement – cases dismissed

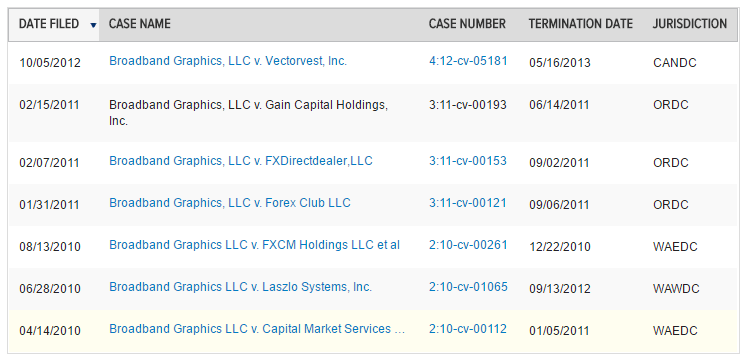

During 2011 and 2012, Broadband Graphics LLC sued a series of companies for Wilful Patent Infringement, three of which were FX companies GAIN Capital, Forex Club and FXDD.

The patents concerned were directed to cell-based end user interfaces in which display container cells are automatically shifted and/or downsized to make room for the creation of other display container cells.

In the complaints, Broadband Graphics alleged that the Rumus trading platform software which belongs to Forex Club LLC, the MTXtreme trading platform software that belongs to FXDD, and the FOREXTrader PRO software of GAIN Capital Group infringe the ’765 and ’947 patents owned by Broadband Graphics.

Forex Club and FXDD subsequently filed answers and counterclaims denying infringement and alleging that the ’765 and ’947 patents are invalid.

Broadband Graphics then answered Forex Club’s and FXDD’s counterclaims in which Broadband Graphics reaffirmed its position that the ’765 and ’947 patents are valid and infringed by Forex Club’s and FXDD’s products. Gain Capital did not yet file an answer, however Broadband Graphics in mid 2011 filed an amended complaint against GAIN Capital.

Today, FinanceFeeds spoke to Lubomir Kaneti, COO of FXDD who explained “I have some experience in this area. There was an entity a while ago chasing FX companies who have proprietary platforms for an alleged violation of some early windows resizing patent. It was a bit of a hassle, but we had competent defence team and they did a very good job.”

All of these cases were closed without outcome.

Whilst it is clear that this is becoming an increasingly troubling matter for our innovative and sophisticated industry, with many FX firms and technology providers having committed extensive resources into the development of their innovative products, only to find themselves being the target of litigation by those who only mean harm, it is worth being very vigilant.

Such is the sensitivity of this subject that many companies that approached FinanceFeeds to explain the gravity of this preferred to remain anonymous.

In this case, the usual caveat emptor becomes cavendum sit amet.

Featured photograph: US Patent and Trademark Office, Alexandra, Virginia. Copyright Coolceasar.