BGC Partners continues to explore shift to more simple corporate structure

If the company determines to execute such a conversion, it would be subject to the approval of the Board of Directors and relevant committees.

International brokerage and fintech company BGC Partners (NASDAQ:BGCP) has earlier today reported its financial results for the first quarter of 2020, providing an update on a possible corporation conversion.

As FinanceFeeds has reported, in February this year, Howard W. Lutnick, Chairman and Chief Executive Officer of BGC, indicated that BGC Partners may convert the partnership into a corporation.

Today, the company said it continues to explore a possible conversion of its UP-C partnership (Umbrella Partnership/C-Corporation Structure) structure into a more simple corporate structure. If the company determines to execute such a conversion, it would be subject to the approval of the Board of Directors, relevant committees, and be completed no earlier than year-end 2020.

Any such transaction would be subject to tax, accounting, regulatory, and other considerations and approvals.

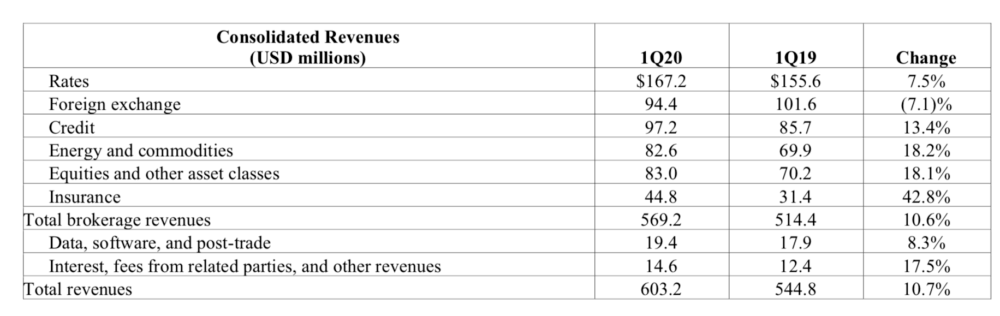

Regarding the results for the first quarter of 2020, BGC’s GAAP results were negatively impacted by various non-cash, non-operating items leading to a net loss of $5 million. In the first quarter of 2019, BGC’s GAAP results benefitted from non-operating gains of $42 million primarily related to a divestiture and fair value adjustments of investments. Excluding these non-operating items from both quarters, the delta in pre-tax GAAP earnings would have improved by approximately $47.0 million in the first quarter of 2020.

First quarter 2020 pre-tax GAAP earnings also reflect restructuring charges of $22.7 million that were not recorded a year earlier, as well as a $30.1 million year-on-year increase in equity-based compensation and allocations of net income to limited partnership units and FPUs. The latter two items together totalled $52.7 million.

In addition, the year-over-year change in Adjusted EBITDA would have improved by approximately $69.7 million in the first quarter of 2020 but for the GAAP non-operating gain of $42.0 million and GAAP non-operating loss of $5.0 million in the first quarters of 2019 and 2020, respectively, as well as the GAAP restructuring charges of $22.7 million in the first quarter of 2020.

Overall industry volumes have historically been seasonally strongest in the first calendar quarter of the year, sequentially slower in each of the next two quarters, and slowest in the fourth calendar quarter. BGC’s energy and commodities, credit and equities businesses experienced strong double-digit growth. Although the company’s overall foreign exchange revenues declined, Fenics fully electronic foreign exchange volumes and revenues increased year-on-year by double digit percentages, as the market continues to embrace electronic execution in this asset class and as BGC’s fully electronic foreign exchange offerings gained further market share.

In addition, the Company’s first quarter 2020 total revenues would have been more than $10 million higher, but for the relative strengthening of the U.S. Dollar.

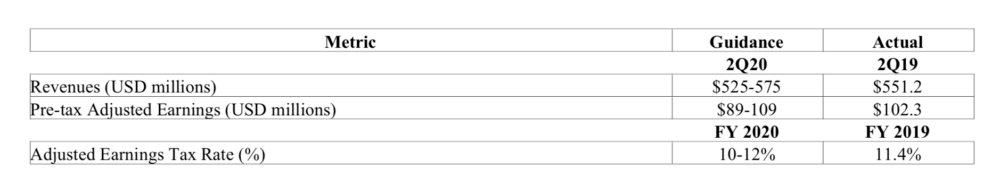

BGC’s revenues, excluding its insurance brokerage business, increased by approximately 2% year-on-year for the first 21 trading days of the second quarter. This reflects mixed global industry volumes thus far in the quarter as well as continued dislocation for BGC’s brokers and their clients due to COVID-19. The Company’s guidance assumes that industry volumes and its non-insurance brokerage revenues are flat to down slightly year-on-year for May and June.

In addition, BGC expects its insurance brokerage revenues to be relatively flat year-on year in the quarter, but to generate accelerating growth through the balance of the year. The Company’s outlook includes the impact of its recent insurance brokerage hires who are incurring costs and are not yet generating meaningful revenue. But for this investment, the mid-point of the range for BGC’s pre-tax Adjusted Earnings outlook would have been up year-over-year.