BGC Partners expects revenues for Q2 2020 to be below low-end of previously forecast range

Due to weaker industry volumes across rates and FX, BGC’s revenues for the second quarter of 2020 are now expected to be slightly below the low-end of the range of its previously stated outlook.

International brokerage and fintech company BGC Partners (NASDAQ:BGCP) has updated its outlook for the quarter ending June 30, 2020.

Amid weaker industry volumes across rates and foreign exchange, BGC’s revenues for the second quarter of 2020 are now expected to be slightly below the low-end of the range of its previously stated outlook, while its pre-tax Adjusted Earnings are anticipated to be slightly above the low-end of the range.

BGC’s margins benefited from its improved payout ratio related to its Fenics platform.

Back in May, when BGC reported its results for the first quarter of 2020, the company said its revenues, excluding its insurance brokerage business, increased by approximately 2% year-on-year for the first 21 trading days of the second quarter. This reflects mixed global industry volumes thus far in the quarter as well as continued dislocation for BGC’s brokers and their clients due to COVID-19. The Company’s guidance assumed that industry volumes and its non-insurance brokerage revenues are flat to down slightly year-on-year for May and June.

In addition, BGC said in May that it expects its insurance brokerage revenues to be relatively flat year-on year in the quarter, but to generate accelerating growth through the balance of the year. The company’s outlook includes the impact of its recent insurance brokerage hires who are incurring costs and are not yet generating meaningful revenue. But for this investment, the mid-point of the range for BGC’s pre-tax Adjusted Earnings outlook would have been up year-over-year.

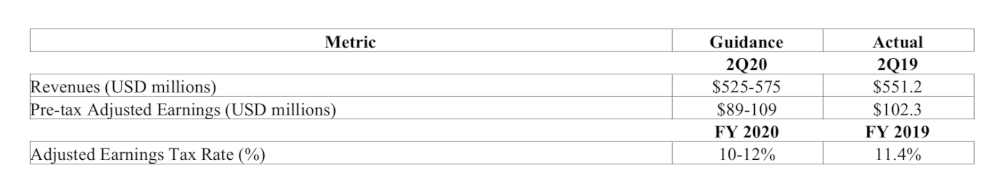

Below is the outlook chart from the report posted on May 5, 2020: