BGC Partners says likely to perform better than expected in Q1 2020

March has been highly volatile, with significant volumes across numerous global instruments, BGC says.

International brokerage and fintech company BGC Partners (NASDAQ:BGCP) has provided an operational and outlook update.

Due to the enormous effort on the part of its employees and clients, BGC believes that it is likely to perform better than it had expected when it provided its previous outlook. March has been highly volatile, with significant volumes across numerous global instruments, BGC explains.

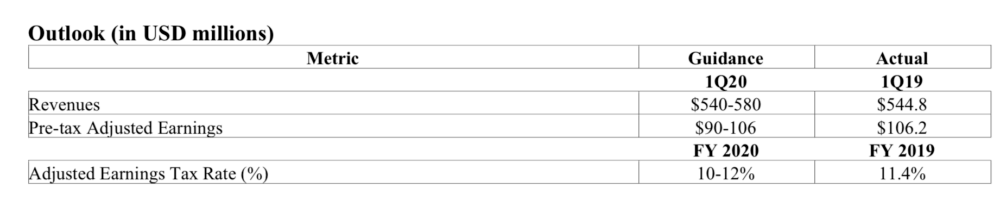

The company’s initial outlook was contained in BGC’s financial report issued on February 6, 2020. According to the initial forecasts, revenues for the first quarter of 2020 were set to be around $540-580 million, whereas Pre-tax Adjusted Earnings were expected to be approximately $90-106 million.

BGC believes that its balance sheet and liquidity remain strong. Nonetheless, BGC has drawn down an aggregate of $230 million from its revolving credit facility since December 31, 2019, for a total of $300 million outstanding. The company increased this borrowing in order to preserve financial flexibility given current uncertainty in the global markets resulting from the COVID-19 pandemic.

BGC notes that it has no meaningful debt maturities due until 2021. The proceeds from the revolving credit facility may be used for general corporate purposes.

Given the ongoing macroeconomic uncertainty, after consultations with its Board of Directors, BGC expects to reduce its quarterly dividend to one cent per common share. According to the company, this will allow management to prioritize near-term financial flexibility and bolster its financial position in these uncertain times.

The Board of Directors plans to review the company’s quarterly cash dividend policy as developments warrant at a future time. Additionally, BGC Holdings, L.P. also expects to reduce its distributions of income from the operations of BGC’s businesses to its partners.