BGC Partners updates its outlook for Q4 2019

The revised guidance reflects a backdrop of generally lower industry volumes.

International brokerage and fintech company BGC Partners (NASDAQ:BGCP) has announced that it has updated its outlook for the quarter ending December 31, 2019.

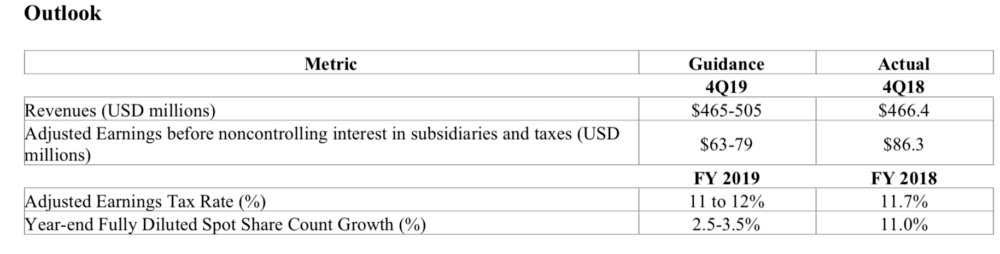

Against a backdrop of generally lower industry volumes, BGC’s revenues and pre-tax Adjusted Earnings for the fourth quarter of 2019 are now expected to be between the low- and the mid-point of the range of its previously stated guidance. This outlook was contained in BGC’s financial results reported on October 24, 2019.

For the third quarter of 2019, the company reported revenues of $521 million, up 14.4% from a year earlier, whereas GAAP income from continuing operations dropped massive 86% to $8.7 million. Post-tax adjusted earnings rose 2.6% from a year earlier to $77.3 million.

Back in October, when the previous guidance was issued, Howard W. Lutnick, Chairman and Chief Executive Officer of BGC, commented:

“We continue to study restructuring our partnership into a corporation, which would simplify BGC’s organization. We will provide an update on this analysis before the end of the year, although any action we may take will not occur until next year.”

On December 18, 2019, Mr Lutnick said:

“We expect to submit a proposal to restructure our partnership into a corporation and simplify our organizational structure to BGC’s Board of Directors and relevant committees by the end of the first quarter of 2020. Upon their review and assuming their approval, our objective is to be positioned to execute the plan by the end of the third quarter of 2020.”